MACD Divergence on MT5

- Indicatori

- KEENBASE SOFTWARE SOLUTIONS

- Versione: 1.1

- Aggiornato: 25 marzo 2022

- Attivazioni: 5

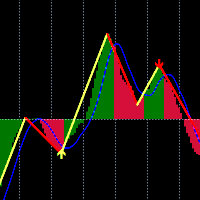

KT MACD Divergence shows the regular and hidden divergences build between the price and oscillator. If your trading strategy anticipates

the trend reversal, you can include the MACD regular divergence to speculate the potential turning points. And if your trading strategy

based on the trend continuation, MACD hidden divergence would be a good fit.

Limitations of KT MACD Divergence

Using the macd divergence as a standalone entry signal can be a risky affair. Every divergence can't be interpreted as a reversal signal. For better results, try to combine it with price action and other speculation methods.

Features

- Marks regular and hidden divergences between the price and oscillator.

- Unsymmetrical divergences are discarded for better accuracy and lesser clutter.

- Support trading strategies for trend reversal and trend continuation.

- Fully compatible with embedding in Expert Advisor.

- Can be used for entries as well as for exits.

- All Metatrader alerts are available.

What is a Divergence exactly?

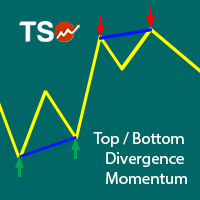

Generally speaking, if the price is making higher highs, then oscillator should also be making higher highs. If the price is making lower lows, then oscillator should also be making lower lows. When this normal behavior is not followed, that means the price and oscillator are diverging from each other. There are two types of divergence:

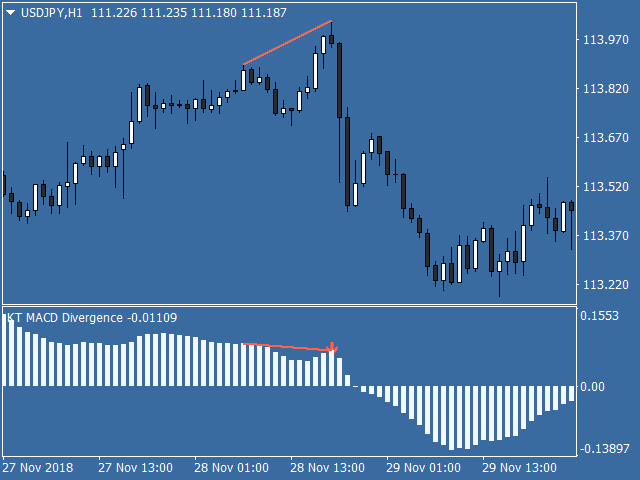

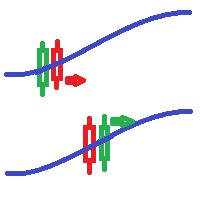

Regular Divergence

- Regular Bullish Divergence: When the price is making lower lows, but the oscillator is making higher lows.

- Regular Bearish Divergence: When the price is making higher highs, but the oscillator is making lower highs.

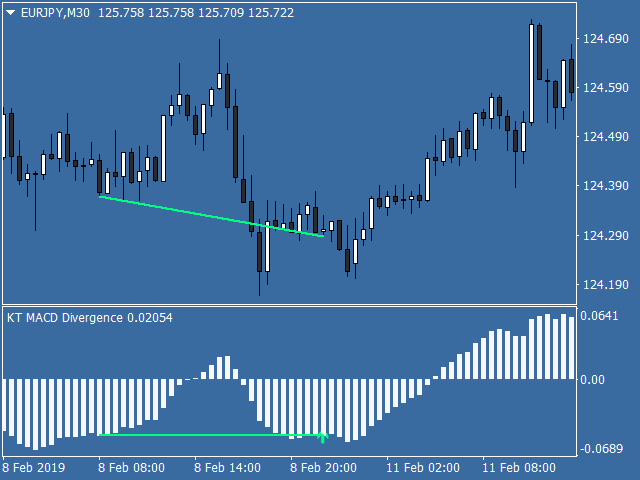

Hidden Divergence

- Hidden Bullish Divergence: If the price is making higher lows, but the oscillator is making lower lows.

- Hidden Bearish Divergence: If the price is making the lower highs, but the oscillator is making higher highs.