Sensitive Signal

- Indicatori

- Aleksey Ivanov

- Versione: 7.0

- Aggiornato: 3 novembre 2021

- Attivazioni: 5

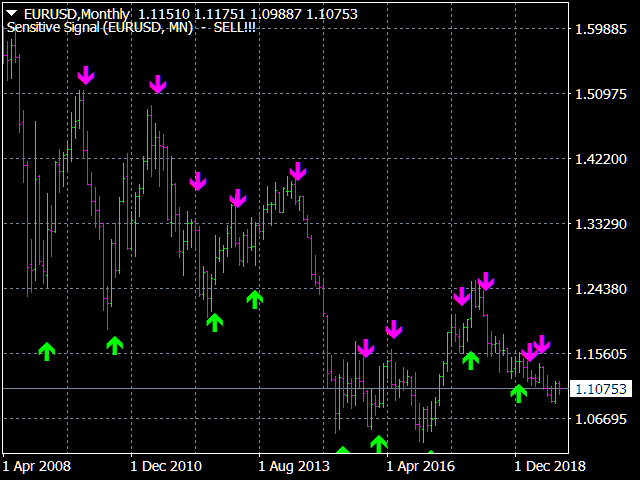

The Sensitive Signal ( SS) indicator, using the filtering methods (which includes cluster multicurrency analysis) developed by the author, allows, with a high degree of probability, to establish the beginning of the true (filtered from interference - random price walks) trend movement. It is clear that such an indicator is very effective for trading on the currency exchange, where signals are highly distorted by random noise. The filtration developed by the author is carried out in several iterations and reveals the true trajectory of the regular price movement (more precisely, the most likely curve of such movement) and draws it.

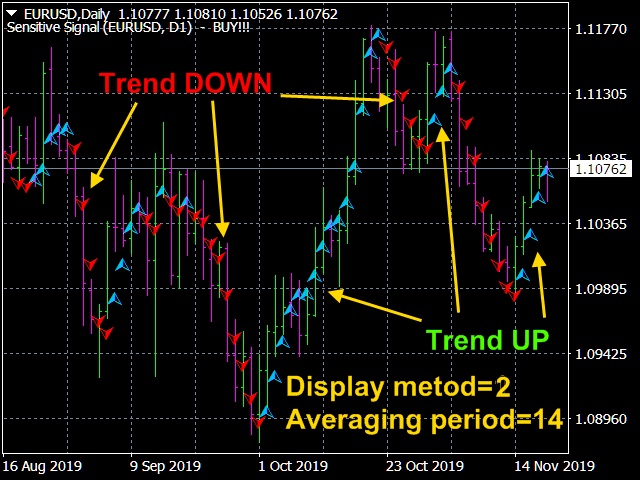

Indicator readings are visual, extremely simple and do not require comments. Blue triangles are located on the uptrend of the regular component of the price movement, red triangles - on the downward. Accordingly, entry points for Buy are where the blue triangles appear immediately behind the red triangles, and for Sell, the opposite. The level of sensitivity of the indicator is adjusted by setting « Select sensitivity level». At the same time, you need to understand that increasing the sensitivity level not only reduces the signal delay (which, in fact, is small for all levels), but increases the probability of issuing a false signal.

Possible moments of a change in the direction of price movement are also marked by arrows, which are never redrawn under any circumstances.

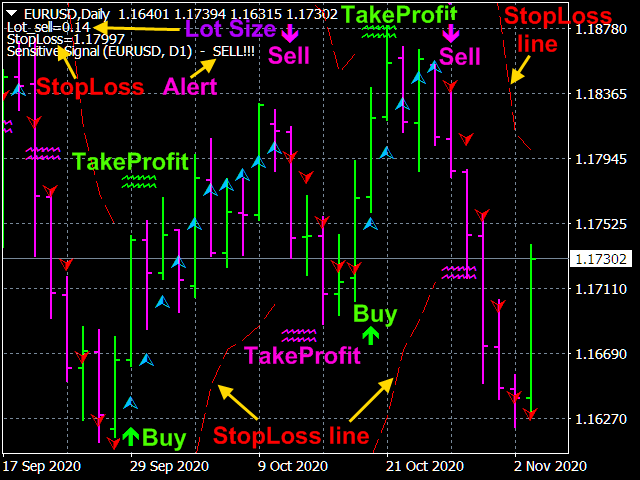

The indicator calculates and displays the StopLoss position lines, calculated based on the current distributions of the price probability and the selected level of probability of closing an order by StopLossas far as the trend reversal. The indicator also considers TakeProfit as the most probable value reached by the price after the signal.

The indicator also has a built-in money management function, in which you can calculate the lot size based on the accepted risk level, the size of the deposit and the StopLoss position.

Indicator settings.

- Price type - applied price. Values: Close price, Open price, High price, Low price, Median price ((high + low)/2 - default), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

- The averaging method - averaging method. Values: Simple, Exponential (default), Smoothed, Linear weighted.

- The averaging period - averaging period. Values: any integer (14 default).

- Select sensitivity level - sensitivity level of the Indicator. Values: Low, Middle (default) and High.

- Dimensions of markers – Dimensions of the markers. Values: any integer (2 default).

- The display method - Values: Show trend arrows and show change trend arrows (default), Show only trend arrows, Show only change trend arrows.

- Show StopLoss and TakeProfit lines? Values : true (default)? false.

- Trend UP arrow color= DeepSkyBlue

- Trend DOWN arrow color=Red

- Down arrow color=Magenta

- Up arrow color=Lime

- Signal Identification Method - Values: By the last two bars (default), By closed candle, By closed candle and by the previous for it bar.

- The Signal method - Type of trading signal alert. Values: No, Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.

- The probability of triggering StopLoss P_sl - The probability of closing an order by StopLoss before the trend reversal. Any real number between 0 and 1 (0.05 default).

- Calculate the lot size from the risk, deposit and P_sl ? – Calculate lot size based on risk, deposit and probability of order closing by StopLoss? Values: true, false (default).

- Allowable losses in % from Free Margin - (2% default).

Great indicator to use for confirmation of bias and/or exits, under correct settings and time frame, can be adjusted very well to precisely fit your strategy, in what ever market it is that you trade.