Signal Bands

- Indicatori

- Aleksey Ivanov

- Versione: 3.0

- Aggiornato: 30 giugno 2020

- Attivazioni: 5

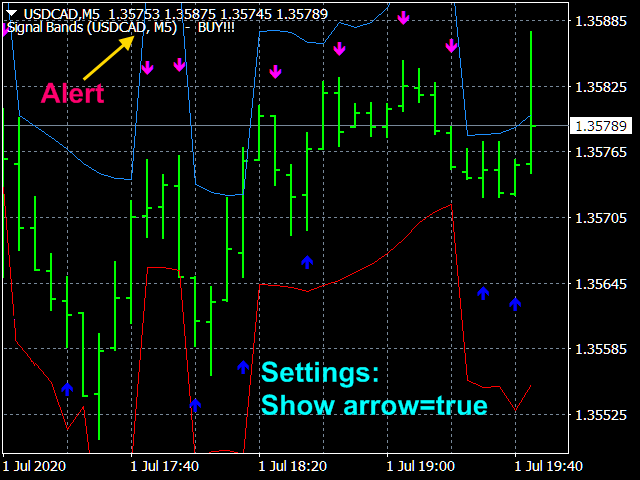

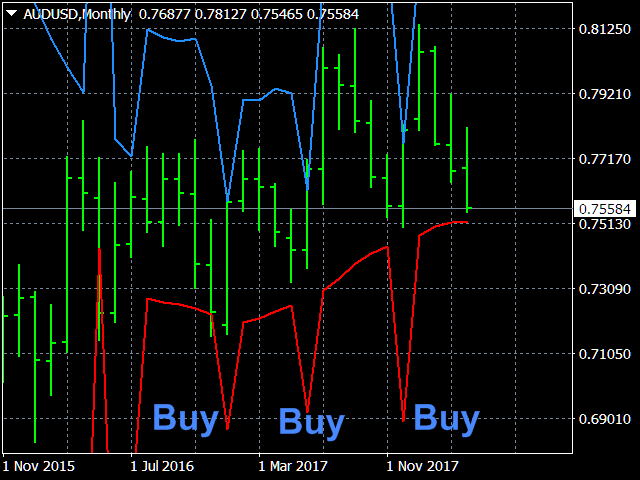

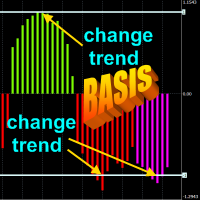

Signal Bands is a sensitive and convenient indicator, which performs deep statistical processing of information. It allows to see on one chart (1) the price trend, (2) the clear price channel and (3) latent signs of trend change. The indicator can be used on charts of any periods, but it is especially useful for scalping due to its high sensitivity to the current market state.

The functions of the indicator:

- First, the Signal Bands indicator draws channels into which all price fluctuations exactly fit, so with default parameters, the price will never exceed the limits of this channel (except for the occurrence of very high peaks of signal information).

- Sharp movements on channel lines (sharp peaks) indicate a change in price direction. Signals provided by such sharp peaks are often leading, i.e. they occur about 1-2 bars before the beginning of price reversal. A sharp downward peak at the bottom line of the channel down is the criterion for the reversal of the price upwards. Conversely, the sharp upward peak of the upper channel line precedes the downward price reversal.

The signals of the Signal Bands indicator are algorithmically formed based on the analysis of the current density of the price probability, which is subject to a strong asymmetry before the very moment of price direction change due to short-term price surges (which might be aiming at hitting the StopLoss of most traders) in the direction opposite to its new movement.

The indicator readings are extremely simple and do not require special explanations. Blue arrows pointing up are a buy signal, red arrows pointing down are a sell signal.

The Signal Bandsindicator can be used both for trading according to scalper strategies, and when using long-term trading strategies. The indicator has all types of alerts. The indicator does not redraw.

Indicator Settings

- Price type. Values: Close price, Open price (default), High price, Low price, Median price ((high + low)/2), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

- The averaging method. Values: Simple (default), Exponential, Smoothed, Linear weighted.

- The averaging period - averaging period. Integer. Default is 20.

- Channel width factor - channel width factor. The real number Default is 1.0.

- The factor of sensibility . - Coefficient of sensitivity to price surges. The real number. Values from 2.0 to 6.0. Default is 4.0.

- Show one branch? - Show one branch? Values: true - one branch, false - two branches.

- Show arrow ? (only in the mode of one branch) - Show signals with arrows. Values: true (default), false.

- Line & arrow thickness. Values: any positive integer (1 default).

- The Signal method - Type of trading alert. Values: No (default), Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.