MMM Fibonacci Retracement

- Experts

- Andre Tavares

- Versione: 1.1

- Aggiornato: 30 luglio 2018

- Attivazioni: 10

The EA Strategy:

This EA strategy is based on Fibonacci Retracement Calculations to produce it's own signals and trade automatically. It was built for those traders who loves and trust Fibonacci Retracement Levels. In finance, Fibonacci retracement is a method of technical analysis for determining support and resistance levels. They are named after their use of the Fibonacci sequence. Fibonacci retracement is based on the idea that markets will retrace a predictable portion of a move, after which they will continue to move in the original direction. It uses the standard retracement levels: 50%, 33%, 38.2%, 61.8%.

It protects your money because it is provided with:

- trailing stop loss to protect your profit. Once your order has a positive profit, it sets SL at a certain distance in order to keep a positive profit;

- Spread value limit to prevent opening an order at a high Spread value. Usually brokers uses variable Spread values;

- minimum equity percentage to limit your risks. You may limit your investments and restrict it to a certain percentage of your money;

- Stop Out level to close all your pending orders after reaching a certain equity percentage low level. Some brokers do not do it automatically.

- limits the number of pending orders. This way you will not bankrupt your account with too many pending orders.

- Bad Time to Trade where you define the hours the EA should not trade (order open time).

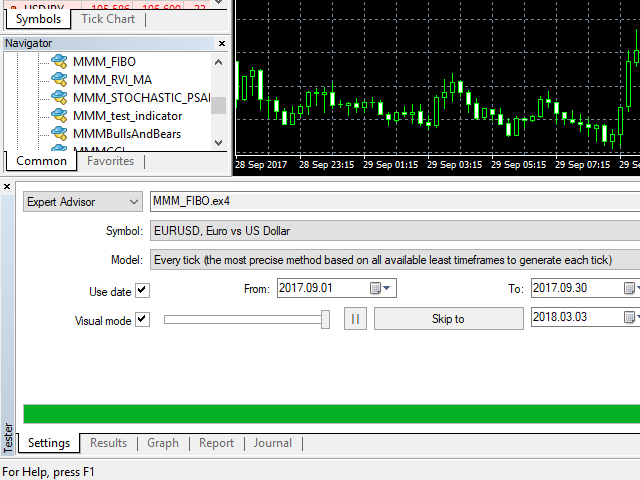

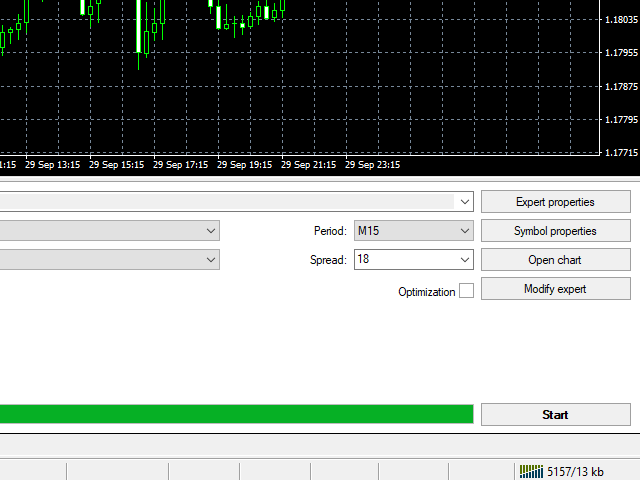

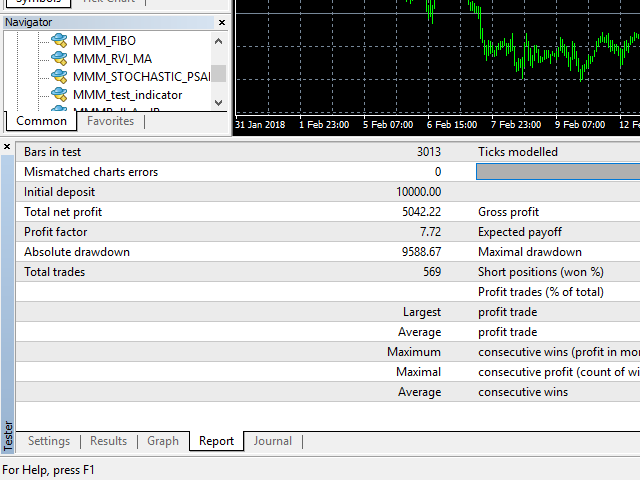

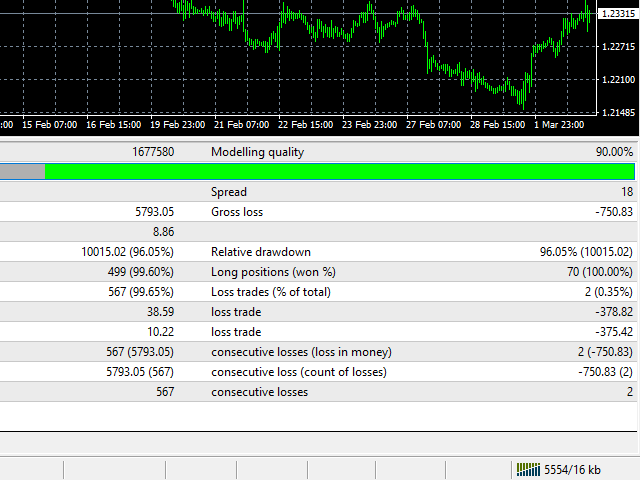

Attention! The default input values are already optimized for EURUSD at time frame M15 and spread = 18. Always use the strategy tester optimization to set the best values for your assets and time frame. It is very important and strongly recommended for successfull trading. So let's do it right by optimizing the input values as your needs.

General Inputs

- Closes orders with any profit of value over in currency: closes any order after reaching profit define in currency value;

- Take profit (order profit ceiling): traditional take profit (pips);

- Stop loss (loss limit): traditional stop loss (pips);

- Lots volume to trade: the lots volume to be traded;

- Trailing stop loss: trailing sto loss distance. If input an invalid distance, the minimum distance allowed by market will be used. Disabled if = 0 (ZERO);

- Orders expiration time in minutes: define the expiration time after order age reaches the minutes defined here (closes the pending expired orders). Disabled if = 0 (ZERO);

- Maximum number of simultaneous orders: limits the number of pending orders;

- Minimum equity percentage to allow opening new orders: defines the equity minimum percentage to open new orders;

- Maximum Spread allowed for operations: limits the spread value to open new orders;

- Magic Number: identifies the orders opened and administrated by this EA;

Bad time to trade inputs:

- Defines the starting hour the EA will not trade (0..23h): defines the start hour of bad time to trade (hours only). Disabled if = -1;

- Defines the ending hour the EA will not trade (0..23h): defines the end hour of bad time to trade (hours only). Disabled if = -1;

Lot Size Variance Inputs:

- Double Lots on Gain: doubles the lot volume to trade. Some people love it. Disabled if = false.

- Maximum Lot Size Allowed: defines a maximum limit the lots volume may Increase. If limit reached, the size goes back the the minimum volume allowed by Market.

Indicator's inputs:

Number of bars to calculate fibonacci levels: defines the number of bars to check the highest and lowest prices and calculate the fibonacci levels.

Account Security input:

- Equity Percentage to STOP OUT: defines the equity lowest level percentage to close all pending orders. Disabled if = 0 (ZERO).

Bad Day to trade

- Defines the Bad Day to trade: defines the day of the week the EA should not trade.