Double Swing

- Experts

- Dmitriy Bukarev

- Versione: 1.0

- Attivazioni: 6

The Expert Advisor's operating algorithm is based on a priori known truth 'The price does not stand still'. We add math and logic to this truth and receive an Expert Advisor, which allows catching almost all the movements in the market. When an order is opened, a breakout Stop order of a larger volume is set instead of Stop Loss. If the price reaches this order, another pending Stop order of a larger volume is placed. This approach is called Swing or Pendulum Swing.

Double Swing uses this approach, but uses two grids of orders instead of one. The second grid is used for additional earnings, while the price is within the first grid of orders. Once the first grid reaches the profit level, the second grid starts working as the first one. At the beginning, the Expert Advisor places two opposite pending limit orders. The distance between the orders and the price is adjustable in input parameters, so you can set them on any levels. As soon as the price reaches one of these orders, the opposite limit order is deleted, and a pending Stop order is placed instead of the Stop Loss level. Additionally, a Limit order of the second grid is placed instead of Take Profit.

Recommendations on Usage

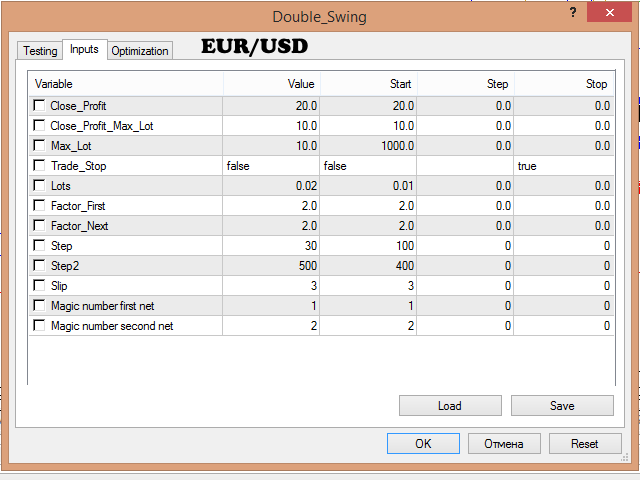

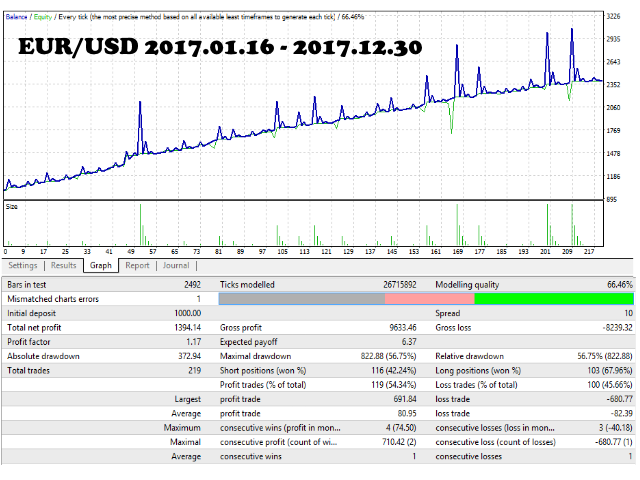

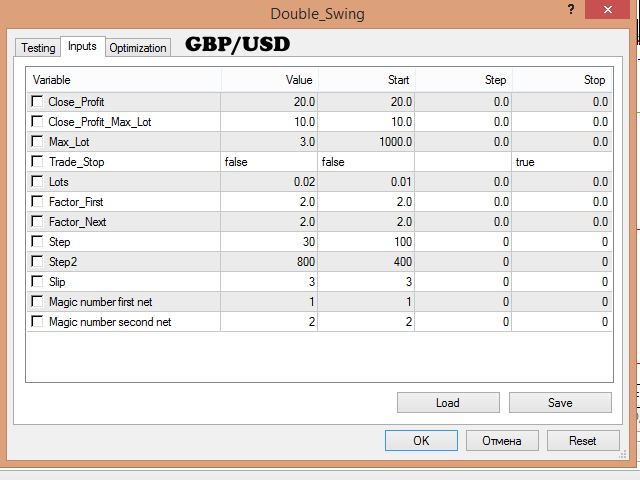

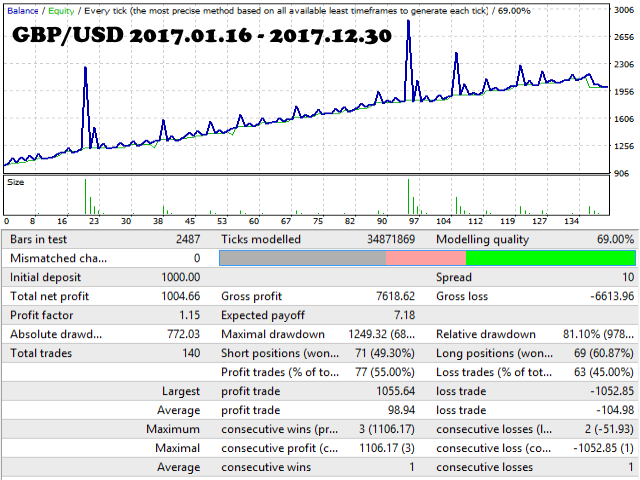

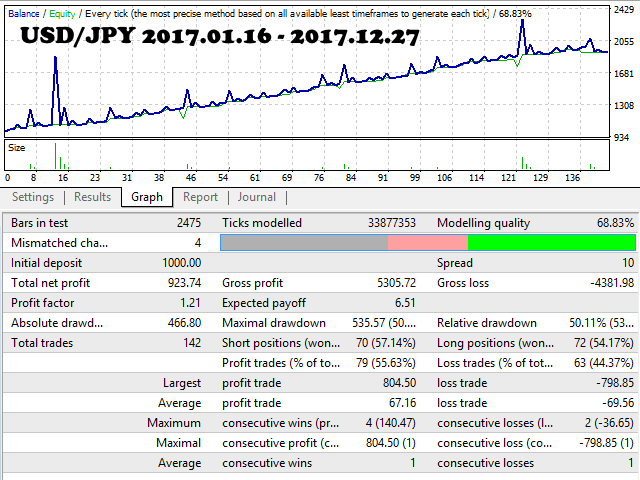

- Testing the EA on large time periods does not make sense, because volatility is constantly changing, and this is the main parameter for the operation of the Expert Advisor. The screenshots show an example of the EA operation and settings for 2017 - it run on different currency pairs. Thus I want to show that the EA can work with some parameters for a year and show good profitability. When selecting parameters, test the EA on the last 2-3 months of the selected currency pair and choose the Step2 parameter based on the currency pair volatility.

- Try to choose parameters so that the maximum open lot for these 2-3 months of operation was as small as possible.

- Use Money Management, but not in its traditional sense! EA parameters can be selected so that EA will show a profit of 100-400% per month, but the risk will be great in this case. So the optimal way is the following: Suppose we have 1000$. Deposit 100$ and launch the EA. This approach provides you with 10 attempts, so the possibility of having profit is higher, provided that you properly choose parameters and adjust them from time to time, because volatility changes.

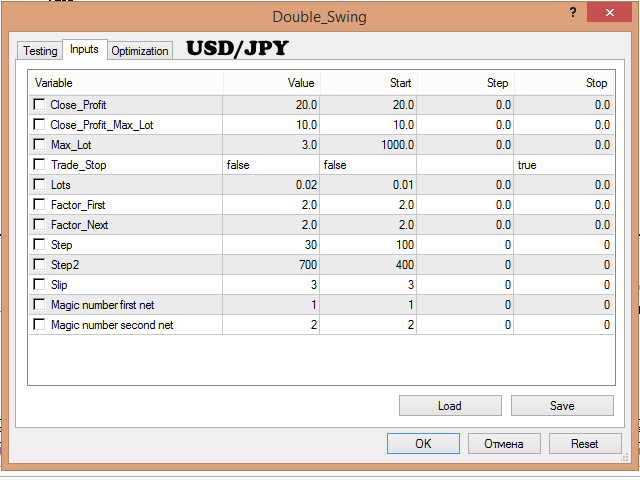

Program Parameters

- Close_Profit - when profit reaches Close_Profit1 in the deposit currency, all orders are closed if they have not reached the maximum lot yet

- Close_Profit_Max_Lot - when profit reaches Close_Profit2 in the deposit currency, all orders are closed if they have reached the maximum lot

- Max_Lot - the maximum allowable lot; if the volume of the next order is greater than Max_Lot, then this order will not be placed

- Trade_Stop - set to false by default - in this mode two grids of orders infinitely flow into one another; if true the second grid of orders will not be opened, and the first grid is closed upon reaching Close_Profit1. For a normal operation use false. When you need to complete the EA operation, change the parameter value to true.

- Lots - initial lot

- Factor_First - lot multiplier for the first pending order

- Factor_Next - lot multiplier for next orders

- Step - distance between the price and the order (at which initial pending limit orders are placed) in points

- Step2 - distance between orders (at which further pending orders are placed) in points

- Slip - slippage

- Magic number first net - a unique identifier for the first grid (not recommended to change)

- Magic number second net - a unique identifier for the second grid (not recommended to change)

L'utente non ha lasciato alcun commento sulla valutazione.