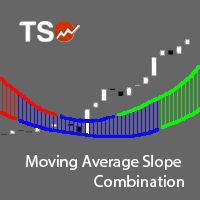

TSO Moving Average Slope Combination

- Indicatori

- Dionisis Nikolopoulos

- Versione: 2.0

- Aggiornato: 23 dicembre 2020

- Attivazioni: 10

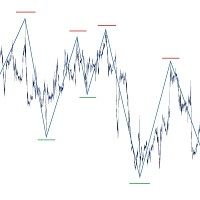

The Moving Average Slope (MAS) is calculated by detecting the moving average level n-periods ago and comparing it with the current moving average level. This way, the trend of the moving average can be drawn on the moving average line. This indicator allows to compare the slopes of two moving averages (fast and slow) to cancel out noise and provide better quality entry and exit signals

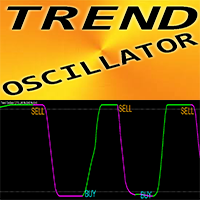

SCANNER is included. Now with Scanner you can find trading opportunities and setups easily and faster.

Features

- Observe uptrends and downtrends at a glance.

- Supports Multiple Moving Average Methods.

- Add second MA (of different period/type) to confirm signals.

- The indicator is non-repainting.

- Can be used as part of an EA. (see For EA Developers)

Supported Moving Average Methods

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- Smoothed Moving Average (SMA)

- Linear Weighted Moving Average (SMMA)

- Double Exponential Moving Average (DEMA)

- Triple Exponential Moving Average (TEMA)

- Fractal Adaptive Moving Average (FAMA)

- Adaptive Moving Average (AMA)

- Variable Index Dynamic Average (VIDYA)

Slope Calculation

- The slope is calculated by subtracting the price of the moving average n periods ago from the current price of the moving average.

- The slope is then classified (upwards, downwards, horizontal) and color-coded (green, red, blue) based on the average true range (ATR) n-periods back.

- If the current price of the moving average is higher than the price of the moving average n-periods back by more than the ATR n-periods back, the slope is considered positive (green).

- If |MAPrice(current) > Price(n-periods)| and |Price(current)-Price(n-periods)| > |ATR(n-periods)|, then Slope > 0

- If the current price of the moving average is lower than the price of the moving average n-periods back by more than the ATR n-periods back, the slope is considered negative (red).

- If |Price(current) < Price(n-periods)| and |Price(current)-Price(n-periods)| > |ATR(n-periods)|, then Slope < 0

- If the current price of the moving average is higher or lower than the price of the moving average n-periods back but their distance is less than the ATR n-periods back, the slope is considered horizontal (blue).

- If |Price(current) - Price(n-periods)| < |ATR(n-periods)|, then Slope = 0

Inputs

- Fast / Slow Moving Average Method: The method used to calculate the MA. Select 'Disable' in one of the two inputs to turn it off and use a single MA.

- Period: The period of the MA.

- Shift: The number of periods to shift the MA.

- Applied Price: The candlestick price level to be used for MA calculations.

- Slope: The number (n) of periods to look back for slope calculation.

- ATR Period: The Average True Range period to be used for slope classification.

- Fast EMA Period [ONLY FOR ADAPTIVE MA]: The period of the fast EMA in the Adaptive Moving Average calculation. This input is used only if 'Adaptive Moving Average' has been selected as the MA Method. Otherwise, this input is irrelevant.

- Slow EMA Period [ONLY FOR ADAPTIVE MA]: The period of the slow EMA in the Adaptive Moving Average calculation. This input is used only if 'Adaptive Moving Average' has been selected as the MA Method. Otherwise, this input is irrelevant.

- CMO Period [ONLY FOR VIDYA]: The period of the Chande Momentum Oscillator (CMO) used in the Variable Index Dynamic Average calculation. This input is used only if 'Variable Index Dynamic Average' has been selected as the MA Method. Otherwise, this input is irrelevant.

For EA Developers

- Fast MA Color: Buffer = 1

- Green = 0

- Red = 1

- Blue = 2

- Slow MA Color: Buffer = 3

- Green = 0

- Red = 1

- Blue = 2

- Vertical Lines' Color: Buffer = 6

- Green = 0

- Red = 1

- Blue = 2

- Vertical Lines' Length (pips): Buffer = 7