TSO Fibonacci Chains MT5

- Indicatori

- Dionisis Nikolopoulos

- Versione: 3.2

- Aggiornato: 15 settembre 2020

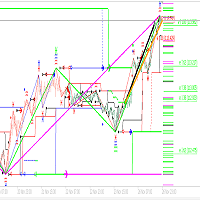

- Attivazioni: 10

Fibonacci retracement is a method of technical analysis for determining support and resistance levels. The TSO Fibonacci Chains Indicator is different from a simple Fibonacci Retracements indicator in that it provides the targets for each retracement level. In other words, there is an Extension Level (D) for every Retracement Level (C). In addition, if an Extension Level is reached, then a new Fibonacci setup is created automatically. These consecutive Fibonacci setups create a chain that reveals very useful information about an asset and it helps to make better trading decisions.

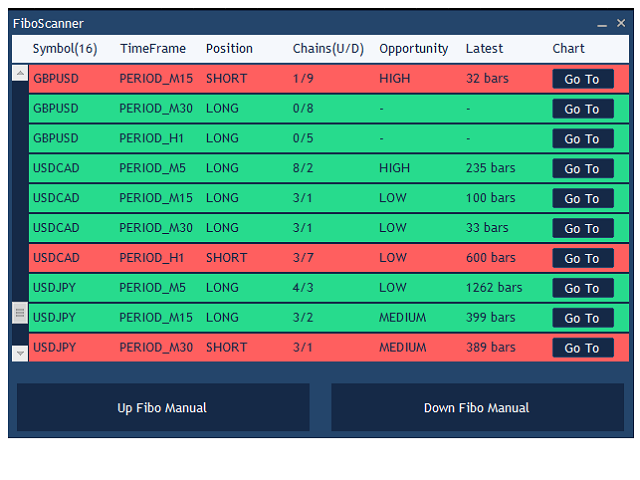

SCANNER is included. Now with Fibonacci Scanner you can find trading opportunities and trading setups easily and faster.

How it works:

- The indicator scans the whole graph to detect points of highest and lowest price level.

- It then starts calculating Fibonacci chains up until today.

- On the graph, only the latest Uptrend and Downtrend Fibonacci chains are shown

Fibonacci Levels:

- Α: Low (Uptrend) / High (Downtrend)

- B: High (Uptrend) / Low (Downtrend)

- C: Retracement (always at the lowest LOW (uptrend) or highest HIGH (downtrend) within the A-B range)

- D: Extension (Target)

C Retracement Levels and D Extension Levels:

- 38.2% - > 1.618%

- 50.0% - > 1.618%

- 61.8% - > 1.618%

- 78.6% - > 1.270%

- 86.0% - > 1.180%

Fibonacci calculation

- When the A, B and C levels have been formed followed by a HIGH/LOW* at the corresponding D Level, then the current Fibonacci block is considered complete and a new block is started.

- The A and B levels of the new Fibonacci block are based on the previous block, i.e. Α_new = C_old and B_new = D_old. This way, a chain of consecutive Fibonacci blocks is formed, with the last block being the active one.

- The chain is broken when the price moves below (uptrend) or above (downtrend) the A level of the last Fibonacci block.

*a HIGH/LOW occurs when the third (middle) candle out of 5 consecutive candles has a higher/lower HIGH/LOW than the two candles before and after it.

Strategies

- First two steps for any strategy

- Locate the latest valid (containing at least 2 complete Fibonacci blocks) uptrend and downtrend Fibonacci chains.

- Select the one that is dominant, i.e. the direction (uptrend or downtrend) that contains the most completed Fibonacci blocks in its latest chain.

- Conservative

- For the dominant chain find previous support/resistance levels close to the C levels (61.8%, 78.6% and 86.0%)*

- Wait for a LOW/HIGH to be created on these levels (if the Uptrend or Downtrend Fibonacci chain is dominant respectively)

- If the above criteria are met, enter using an entry strategy such as a candlestick pattern, a trend line break, a crossing moving average (e.g. 5-period and 10-period MAs) etc.

- The safest level for the Stop Loss is a few pips above (downtrend) or below (uptrend) the A level of the last Fibonacci block. The Take Profit should be placed at the corresponding D level.

- Stop Loss and Take Profit can also be set as in step 3 of the Aggressive Strategy.

- Aggressive

- For the dominant chain, wait for a C LOW/HIGH (Uptrend/Downtrend Fibonacci chain respectively) to be formed at any Fibonacci Level.

- If the above criteria are met, enter using an entry strategy such as a candlestick pattern, a trend line break, a crossing moving average (e.g. 5-period and 10-period MAs) etc.

- Place the Stop Loss a few pips above the current LOW (uptrend) or below the current HIGH (downtrend) and a Take Profit at the corresponding D Extension level or at a distances 2-3 times larger than the stop loss (Risk/Reward Ratio 1:2 or 1:3)

- If the above criteria are met more than once, create additional positions with Stop Loss and Take Profit levels as described in step 3.

- In case a position is closed due to the price level reaching the Stop Loss, open the same position again if the same criteria are met again.

- Very Aggressive

- For the dominant chain, place pending orders at multiple Fibonacci Levels (e.g. 61.8%, 78.6% and 86.0%).

- Place the Stop Loss a few pips above (downtrend) or below (uptrend) the A level of the latest Fibonacci block. The Take Profit should be placed at the corresponding D level (1.270%).

- Follow this procedure for every new Fibonacci created.