FFx Universal Strength Meter PRO MT5

- Indicatori

- Eric Venturi-Bloxs

- Versione: 1.1

- Aggiornato: 8 aprile 2020

- Attivazioni: 5

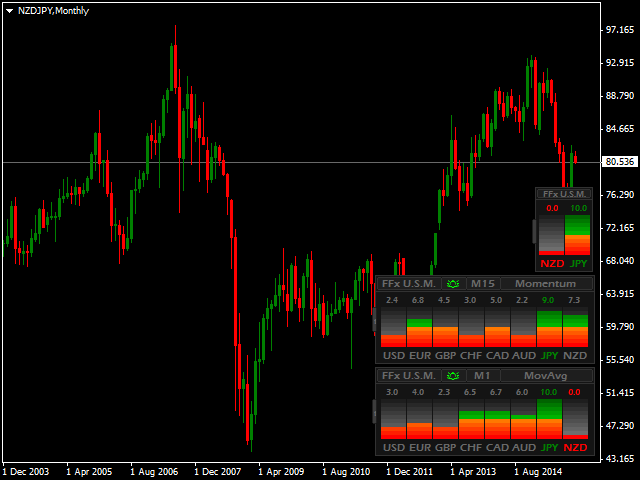

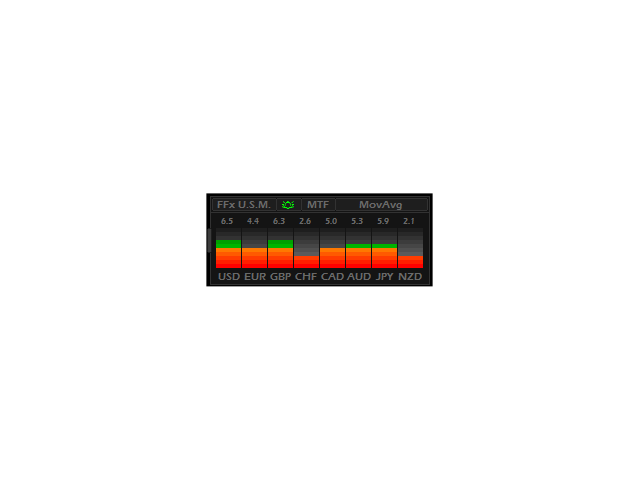

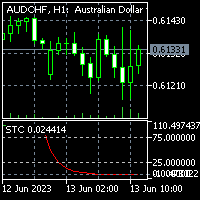

FFx Universal Strength Meter PRO is more than a basic strength meter. Instead of limiting the calculation to price, it can be based on any of the 19 integrated strength modes + 9 timeframes. With the FFx USM, you are able to define any period for any combination of timeframes. For example, you can set the dashboard for the last 10 candles for M15-H1-H4… Full flexibility!

Very easy to interpret... It gives a great idea about which currency is weak and which is strong, so you can find the best pairs to be traded in good confidence.

Example: If EUR is strong and USD is weak, then you can look for long entries on your EURUSD chart.

It also includes an alert when specific currencies reach strong or weak levels.

User Inputs

- Dashboard ID: set here a different number for each instance applied on the same chart.

- Strength Mode: here you can select the mode you want to use for the strength calculation ... (Price, Moving Average, MACD, Stochastic, RSI, WPR, Momentum, CCI, ADX, PSAR, DeMarker, AC, AO, Bulls, Bears, Ichimoku, Force Index, OsMA, RVI). Of course, each indicator has its own usual inputs to be set as per your need. Switching between modes can be done directly from the chart!

- Strength Period: this number is the number of candles used for the calculation. You can set any number from 1 to whatever you want...

- Strength Timeframes: multiple timeframes can be combined together, so the strength will be MTF (all valid Timeframes names are provided in the Timeframes List inputs).

- Symbol prefix/suffix: if your broker provides symbols like xxxEURUSDyyy, just add the xxx in prefix and yyy in suffix.

- Horizontal/Vertical Shift: you can set here any number to place the dashboard anywhere on the chart.

- Strong/Weak Levels: from 1 to 10, when levels are reached, it can give an alert (popup/sound/email/push) and color the currency for a clear visual. Alert can be activated/deactivated directly on the chart by clicking on the "bell" icon (at least one alert option must be enabled in the parameters).

- Minutes Between Alerts: minimum number of minutes between each alert for each currency.

- Then all usual parameters for the standard indicators like provided in your MT5 platform (see below).

The dashboard can be displayed in a compact mode, to monitor only the 2 currencies for the current chart. Just click on the left edge of the dashboard as shown in the video.

- Moving Average

- Period: period of the MA

- Shift: shift of the MA

- Method: method of the MA

- ApplyTo: applied price of the MA

- MACD

- FastEMA: fast EMA period of the MACD

- SlowEMA: slow EMA period of the MACD

- SignalSMA: SMA period of the MACD

- Applied Price: applied price of the MACD

- Stochastic

- KPeriod: k period of the STO

- DPeriod: d period of the STO

- Slowing: slowing of the STO

- MAMethod: method of the STO

- PriceField: applied price of the STO

- RSI

- Period: period of the RSI

- ApplyTo: applied price of the RSI

- WPR

- Period: period of the WPR

- Momentum

- Period: period of the Momentum

- ApplyTo: applied price of the Momentum

- CCI

- Period: period of the CCI

- Applied Price: applied price of the CCI

- ADX

- Period: period of the ADX

- PSAR

- Step: step of the PSAR

- Maximum: maximum of the PSAR

- DeMarker

- Period: period of the DeMarker

- Bulls

- Period: period of the Bulls

- Bears

- Period: period of the Bears

- Ichimoku

- Tenkan sen: period of the Tenkan sen

- Kijun sen: period of the Kijun sen

- Senkou span b: period of the Senkou span b

- Force Index

- Period: period of the Force Index

- Method: method of the Force Index

- Volumes: volumes of the Force Index

- OsMA

- FastEMA: fast EMA period of the OsMA

- SlowEMA: slow EMA period of the OsMA

- SignalSMA: SMA period of the OsMA

- Applied Price: applied price of the OsMA

- RVI

- Period: period of the RVI

Very useful, but maybe it’s right to place a 200EMA; only sell if the price is under, only buy if the price is over. So simple.

Hi, Eric! I said it only as a general rule, very useful. Better a pair of right and winning trades as thirty losing trades 😉