D Channel

- Indicatori

- Pavel Gotkevitch

- Versione: 1.2

- Aggiornato: 25 marzo 2022

- Attivazioni: 5

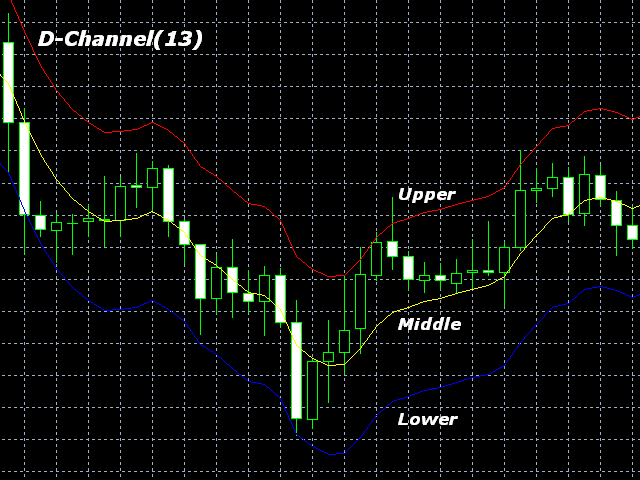

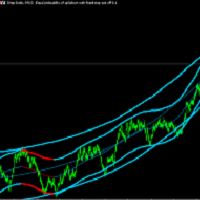

D-Channel is a technical indicator defining the current Forex market status - trend or flat.

The indicator is based on DEMA (Double Exponential Moving Average). The advantage of DEMA is that it eliminates false signals at the saw-toothed price movement and allows saving a position at a strong trend.

The indicator can work on any timeframe, though H1 and higher timeframes are recommended to minimize false signals.

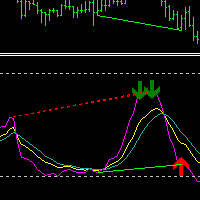

The indicator displays a channel as lines located above and below the average line. The upper and lower channel lines can act as support and resistance levels.

Sell when the price reaches the upper line, buy when it reaches the lower line.

You should use a small stop loss to protect against false signals.

The following can be set in the indicator's Inputs tab:

- indicator period;

- one of the seven price types (Close, Open, High, Low, Median, Typical, Weighted);

- horizontal shift of all lines;

- vertical shift of the upper and lower lines relative to the central line.

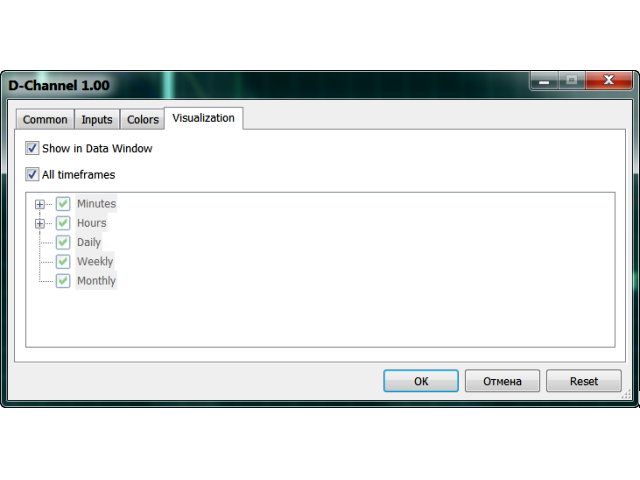

The color, style and width of indicator lines can be configured on the Colors tab.

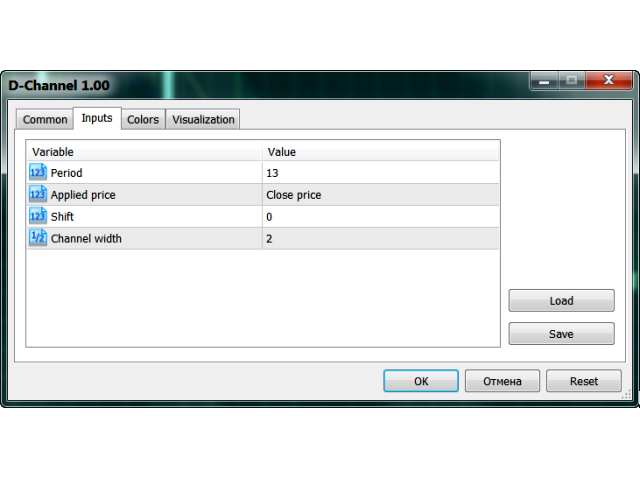

D-Channel Indicator Parameters

- period - number of bars used for the indicator calculations;

- applied price - select from the seven applied price types;

- shift - horizontal shift of all lines;

- channel width - vertical shift of the upper and lower lines.

The D-Channel indicator is calculated by the following formulas:

- Upper Level = DEMA(N,P) + High(t)*CW/1000

- Lower Level = DEMA(N,P) - Low(t)*CW/1000,

where:

- Upper Level - is the upper channel border;

- Lower Level - lower channel border;

- DEMA - Double Exponential Moving Average;

- N - averaging period;

- P - price used for calculations (Close, Open, High, Low, Median, Typical, Weighted);

- High(t) and Low(t) - are high and low prices on the current period;

- CW - channel width (vertical shift of the upper and lower lines relative to the central line).

L'utente non ha lasciato alcun commento sulla valutazione.