All Trades EA

- Experts

- Simone Gargano

- Versione: 1.0

Aug. 2016,

I strongly believe that, in the end, the market moves randomly. Last events shows us that this is the truth. All traders, banks and analyst predicted a strong bearish move but happened exactly the opposite. Should they change their job and start to bet on horses? No, but basically, would be the same thing!

Well, if you bring two inexperienced traders and each of them take opposite trades (long and short), both will probably close their positions in a loss. This means that it's always a matter of managing in a correct way the opened positions.

To do this we use math!

How it works

- open trades with no logic (buy or sell) once a day at midnight (if Daily timeframe is used). In fact the EA will open a trade at new bar comes.

- Set the stoploss calculated by ATR.

- Manage the opened trades with a trailingstop calculated by ATR.

What is ATR

ATR is a common indicator used to calculate the average market movement based on X last bars. By this, we will calculate where to put the Stop loss and when start to trail it.

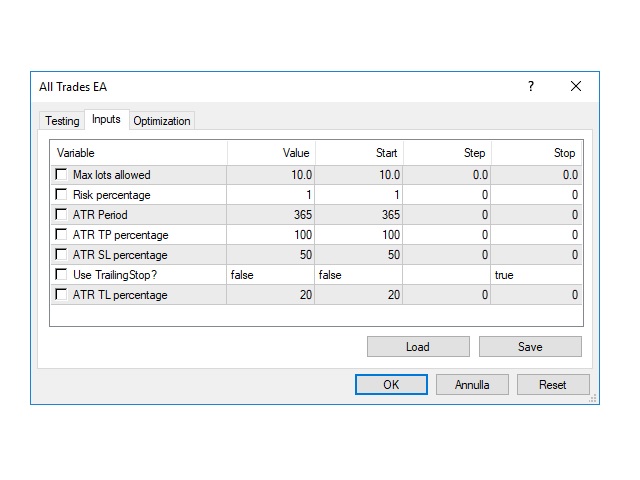

Settings

- Max Lots allowed = set the max lot size allowed per trade by the auto Money management

- Risk percentage = to be adapted according to your trading style. The more is higher the more is dangerous.

- ATR Period = if the chart used is daily, every period will be equal to a day. As explained abow it's used to calculate the average movement.

- ATR TP, SL, TL percentage = these values are not calculated by PIPS but by ATR. This means that if it is used at 100% it will be equal to the current ATR value. Note: if you use a Timeframe lower than Daily you should increase considerably those values until there are no errors under the Journal tab.

Good job.