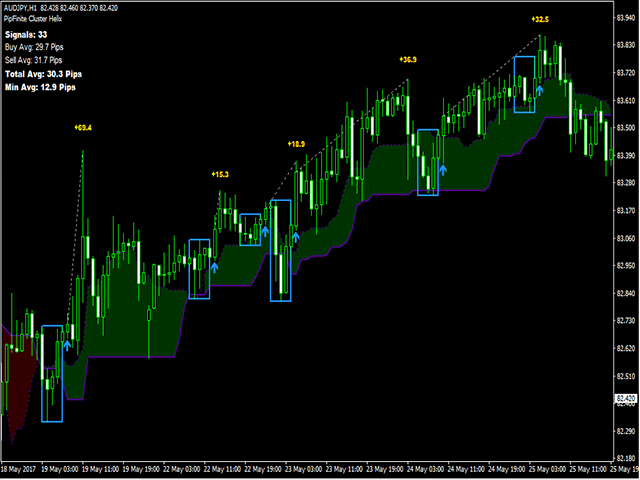

PipFinite Cluster Helix MT5

- Indicatori

- Karlo Wilson Vendiola

- Versione: 9.0

- Aggiornato: 7 luglio 2024

- Attivazioni: 5

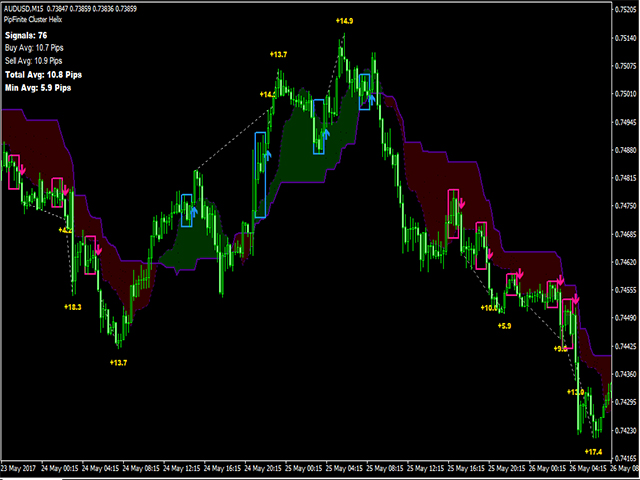

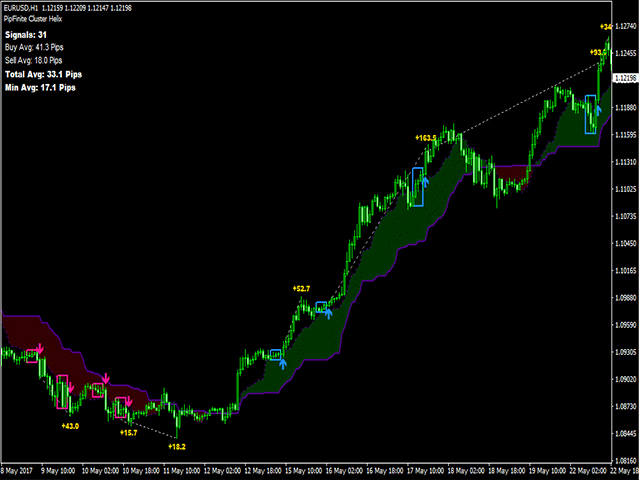

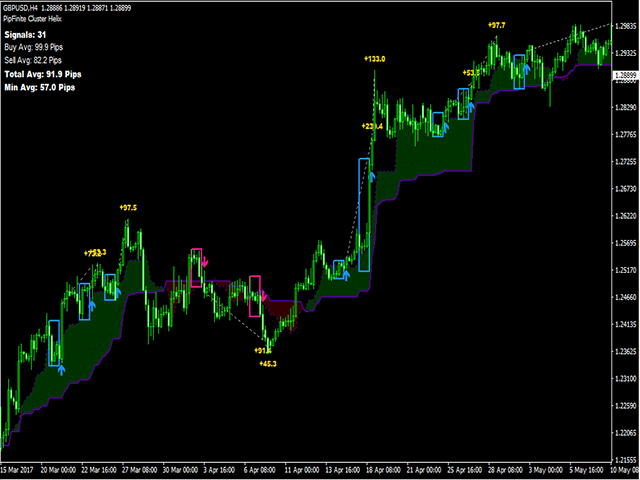

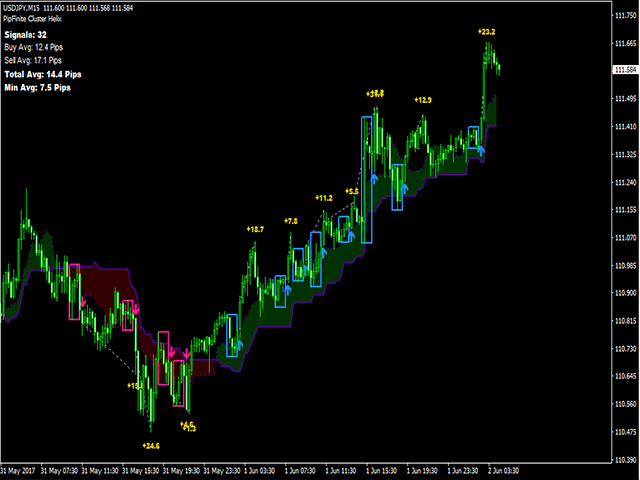

A combination of trend, pullback, range breakouts and statistics in one indicator

Mainly functions as an Entry indicator. Works in any pair and timeframe.

Suggested Combination

Cluster Helix with Strength Meter

- Strategy: Confirm signals with ideal strength levels

- Watch Video: (Click Here)

Features

- Detects range breakouts on pullback zones in the direction of the trend

- Analyzes statistics of maximum profits and calculates possible targets for the next signal

- Flexible tool, can be used in many ways to improve a trading system

- StopLoss Levels

- Option 1: Range Levels

- Below blue range box for buy signal

- Above red box for sell signal

- Option 2: Statistical Data

- Buy Average Value for buy signal

- Sell Average Value for sell signal

- Option 3: Higher Value

- Compare Option 1 and Option 2, Select the Higher Value

- TakeProfit Levels

- Option 1: Standard TakeProfit

- Buy Average Value for buy signal

- Sell Average Value for sell signal

- Option 2: Quick Takeprofit for Scalping

- Minimum Average Value

- Avoid late range breakouts

- RSI value below 70 for buy signals

- RSI value above 30 for sell signals

- Avoid trend weakness

- Only take the first 3 consecutive signals in the direction of the trend

- It is best to avoid the 4th signal and wait for the pullback zone to change color or reset

- Please watch the video for better understanding (Click Here)

- Exit Strategy

- Exit will depend on traders discretion according to his/her strategy

- Support/Resistance Areas

- Reversal signals from price action patterns

- We can use Exit Scope as alternate exit strategy

- Supporting Tool

- Confirmation to price action trading

- Increase probabilities by combining to Strength Meter

- Avoid false signals by combining to Volume Critical

- Avoid buy signals if Volume Critical is Overbought

- Avoid sell signals if Volume Critical is Oversold

- Never repaints

- Never backpaints

- Never recalculates

- Signals strictly on the "Close of the bar"

- Compatible with Expert Advisor development

Day Trading Strategy (M15)

Buy Setup

- H4 Timeframe shows bullish pullback zone (green zone). Go to M15 timeframe for entries

- M15 Buy Signal

- Strength Meter Bullish Level 1 to Level 3 only (Use Period = 20 for settings)

- RSI is below 70

- Set your stoploss

- Option 1: Above the blue range box

- Option 2: Buy Average value

- Option 3: Select the higher value from Option 1 and 2

- Set yout takeprofit

- Option 1: Use average Buy Average value

- Option 2: For scalping, use Min Average value

Sell Setup

- H4 Timeframe shows bearish pullback zone (red zone). Go to M15 timeframe for entries

- M15 Sell Signal

- Strength Meter Bearish Level 1 or Level 3 only (Use Period = 20 for settings)

- RSI above 30

- Set your stoploss

- Option 1: Below the red range box

- Option 2: Sell Average value

- Option 3: Select the higher value from Option 1 and 2

- Set yout takeprofit

- Option 1: Use average Sell Average value

- Option 2: For scalping, use Min Average value

Scalping Strategy (M5)

Same as Day Trading Strategy but

- H1 as Higher Timeframe

- M5 as Entry Timeframe

- Strength Meter Period = 14 for settings

Swing Strategy (H1)

Same as Day Trading Strategy but

- D1 as Higher Timeframe

- H1 as Entry Timeframe

- Strength Meter Period = 7 for settings

Additional Guidelines

- Trade only London and US session for best breakout volatility

- Avoid signals 30 mins before and after major news releases

- Skip the 4th and succeeding signals. Wait for a reset to avoid trend weakness

Video References

Please Watch in High-Definition to further understand

- How it works (Click Here)

- How to trade (Click Here)

- How to avoid trend weakness (Click Here)

- Combining to Strength Meter (Click Here)

Great indicator!