Traders Dynamic Index

- Indicatori

- Miguel Chambel

- Versione: 2.0

- Aggiornato: 9 marzo 2025

- Attivazioni: 5

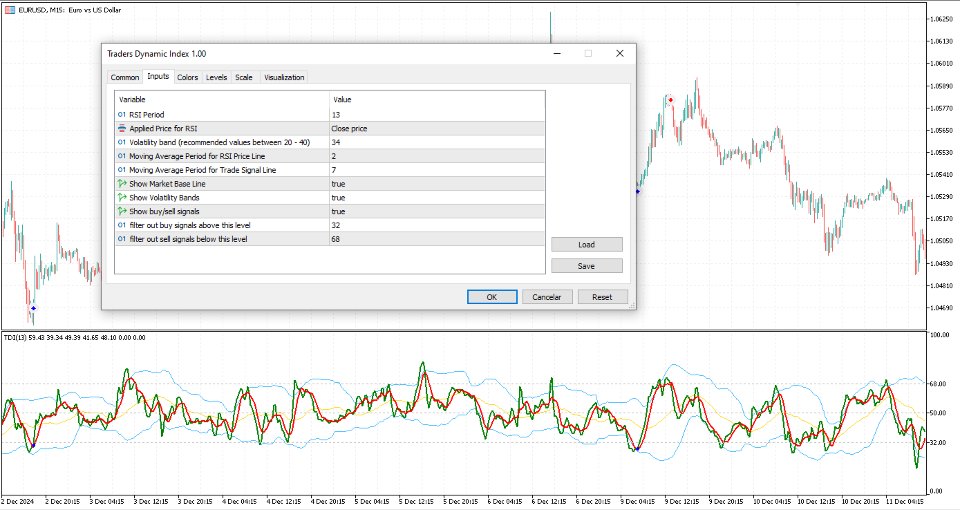

Traders Dynamic Index (TDI) - Overview

The Traders Dynamic Index (TDI) is a versatile indicator based on the RSI oscillator.

It helps traders identify market conditions and potential reversals.

The TDI combines multiple indicators into one, providing a comprehensive view of market dynamics.

Components:

- Green line: RSI Price Line

- Red line: Trade Signal Line

- Blue fill: Volatility Band

- Yellow line: Market Base Line

Visual Signals:

1. Trend Direction:

- Immediate:

- Green over Red: Price action is moving up.

- Red over Green: Price action is moving down.

- Overall:

- Yellow line trends between lines 32 & 68. Watch for bounces off these lines for market reversals.

- Trade long when price is above the Yellow line, and trade short when price is below.

2. Market Strength & Volatility:

- Immediate:

- Green Line Slope High: Strong market.

- Green Line Flat Slope: Weak, sideways market.

- Overall:

- Blue Fill expanding: Strong, trending market.

- Blue Fill constricting: Weak, ranging market.

- Extremely tight Blue lines: Expect a market spike due to economic announcements or other conditions.

Using TDI in an Expert Advisor (EA):

To use the TDI indicator in an EA, you can call it using the `iCustom` function and retrieve its buffer values for generating trade signals.

Here is a brief example:

// Create the indicator handle int handle_tdi = iCustom(Symbol(), Period(), "Traders Dynamic Index", inp_PeriodRSI, PRICE_CLOSE, inp_Volatility_Band, inp_RSI_Price_Line, inp_Trade_Signal_Line, true, true); // Check for buy signal (RSI Price Line crosses above Trade Signal Line) if(rsi_price_line[1] < trade_signal_line[1] && rsi_price_line[0] > trade_signal_line[0]) { // Place a buy order Print("Buy signal detected"); // Add your order placement code here } // Check for sell signal (RSI Price Line crosses below Trade Signal Line) if(rsi_price_line[1] > trade_signal_line[1] && rsi_price_line[0] < trade_signal_line[0]) { // Place a sell order Print("Sell signal detected"); // Add your order placement code here }