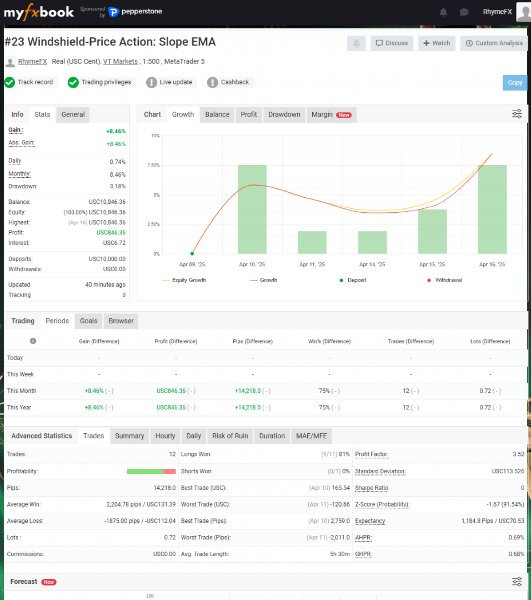

Windshield Price Action Slope EMA

- Experts

- Thawinchai Waharam

- Versione: 1.0

- Attivazioni: 5

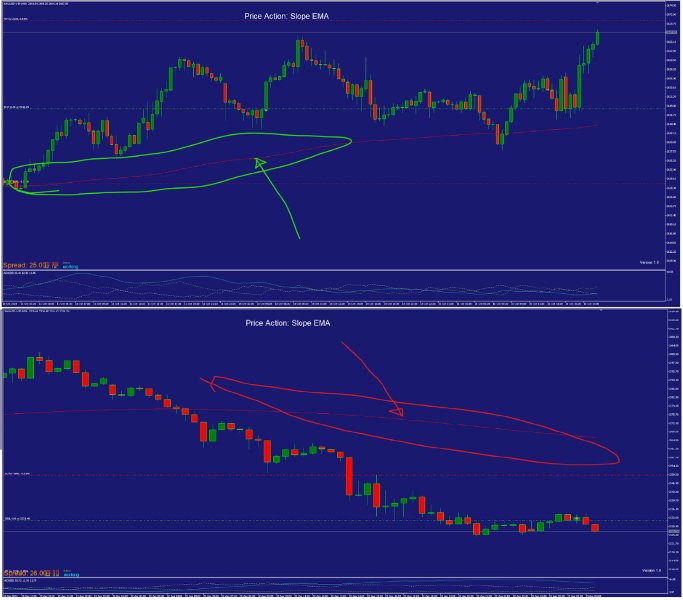

Price Action Strategy: Slope EMA

🔍 1. Utilizing Slope of EMA as a Signal

This system monitors the slope of the Exponential Moving Average (EMA), waiting for price breakout from consolidation before confirming trend direction:

-

Buy Entry: When the EMA slope turns positive and price is above the EMA

-

Sell Entry: When the EMA slope turns negative and price is below the EMA

🧱 2. Signal Filters for Precision

-

EMA Filter: Buy only above EMA, Sell only below EMA

-

ADX Filter: Avoid entries if ADX < 10 (low trend strength)

-

Spread Control: No trade if spread exceeds limit

-

Price Distance Filter: Avoid entries when price is excessively far from EMA

🚀 Key Features of the EA

-

Customizable Timeframes: Compatible with M1–H4

-

Risk Management: Equity-based lot sizing, Max Drawdown limit

-

Flexible SL/TP Settings: Supports RR ratios like 1:2, 1:3, or custom values

-

Trailing Stop Mechanism: Automatically locks in profits

-

Fully Automated 24/7: Ideal for passive income generation

🧭 Recommended Setup for Slope EMA EA

-

Platform: MetaTrader 4/5 (MT5 recommended)

-

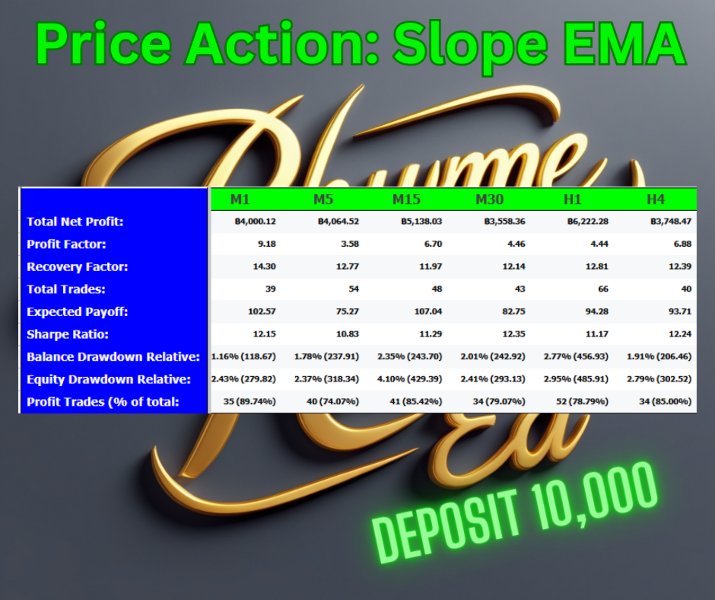

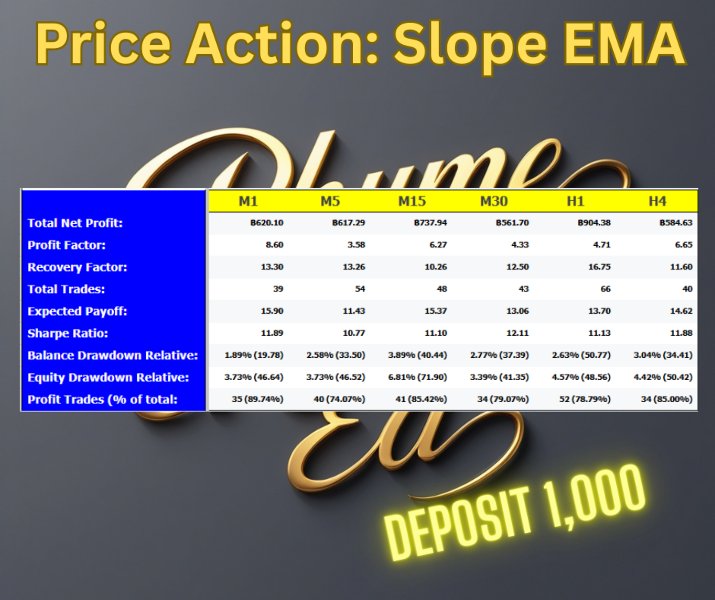

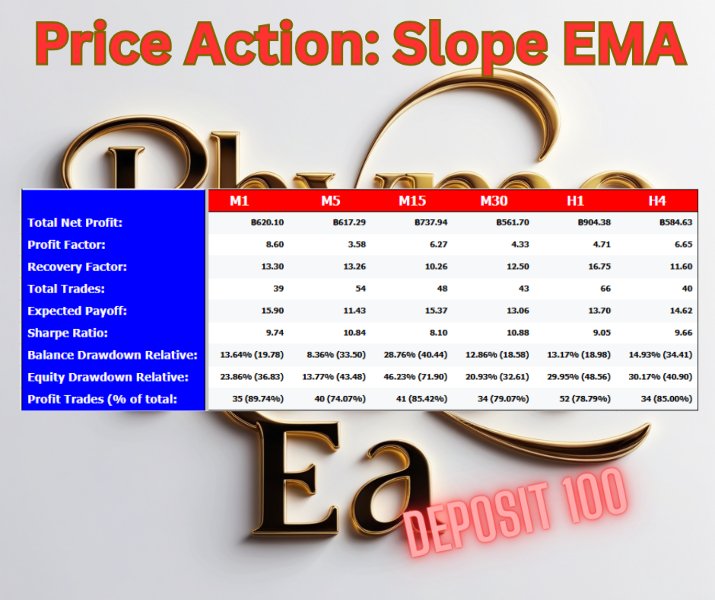

Timeframe: H1 (1 Hour), 6 set files avilable for M1, M5, M15, M30, H1 and H4

-

Currency Pair: XAUUSD (Gold vs. USD)

-

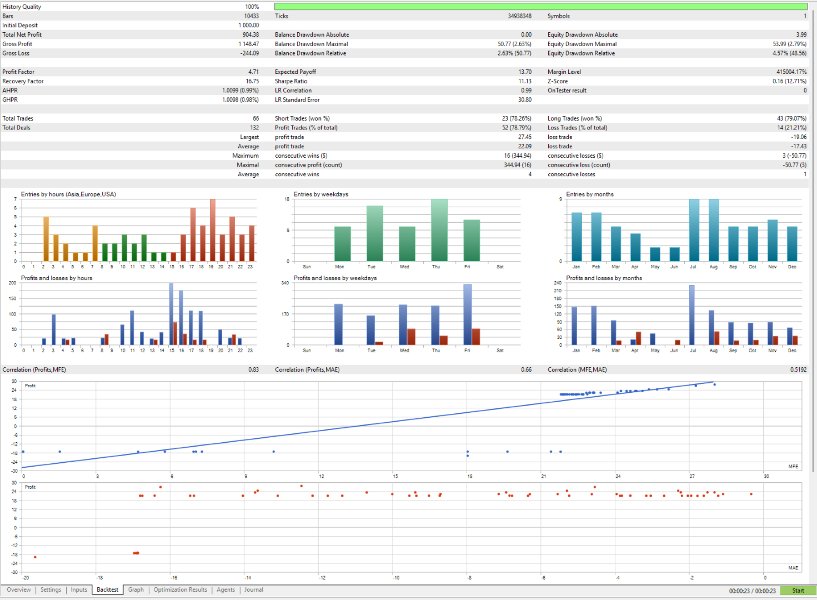

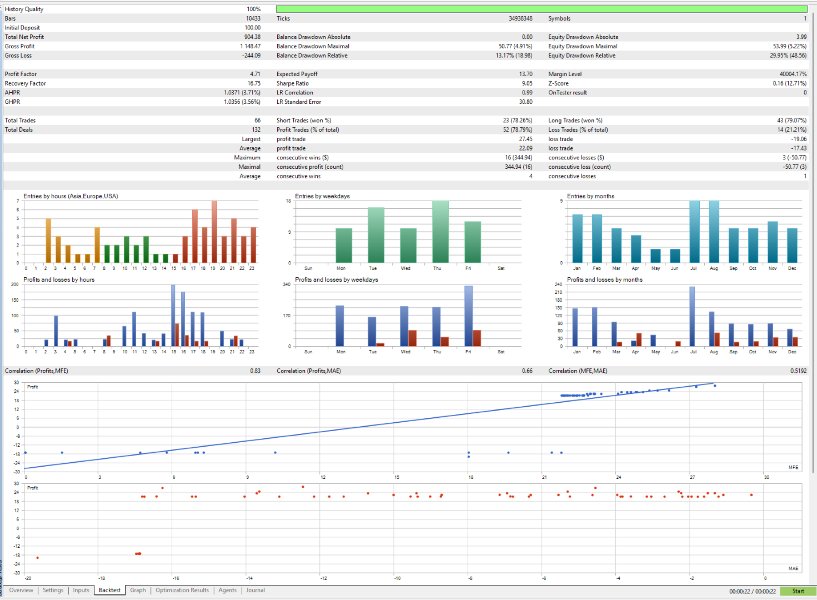

Minimum Capital: $100 (>$1,000 recommended)

-

Broker: Reputable broker with low spreads

✅ Strengths & ❗ Limitations

✅ Strengths:

-

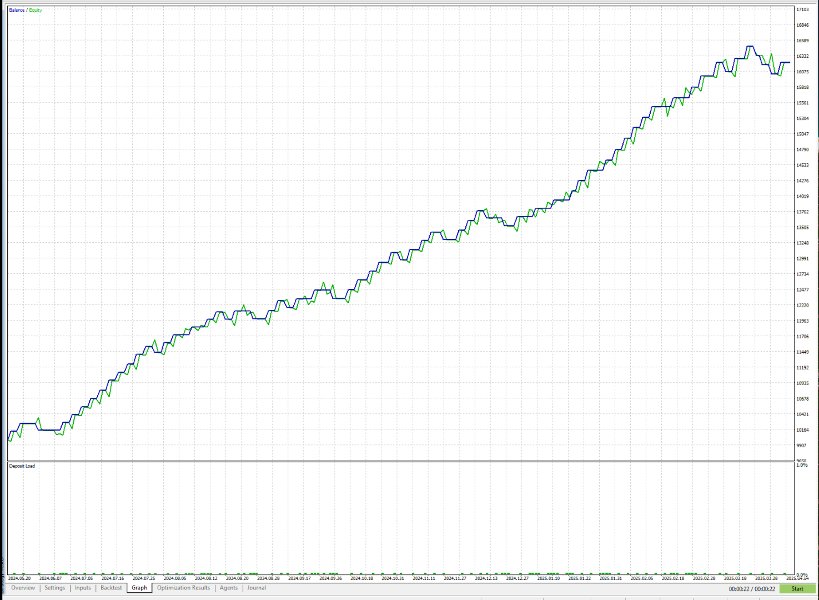

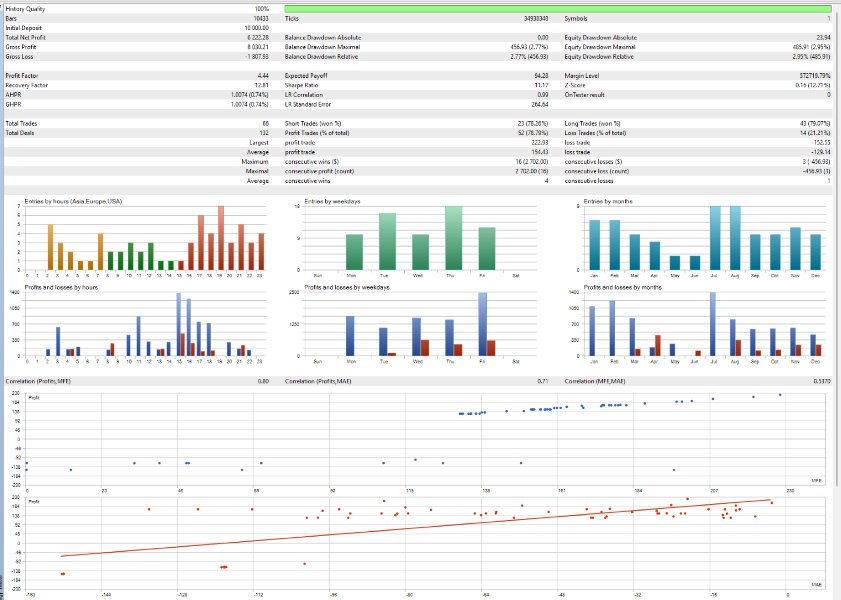

Approx. 80% win rate, Drawdown < 3% ($10,000 capital)

-

$6,200 profit in 1-year backtest

-

Robust trend analysis and risk management structure

❗ Limitations:

-

Trades only during strong, clearly defined slopes

⚙️ EA Parameter Breakdown

Core Strategy

-

TimeFrame = 1H

-

EMA_Period = 19

-

Candle_Body_pips = 51

-

Slope_Candles = 8

-

Slope_Pips = 170

Signal Filters

-

Spread = 40

-

ADX_Period = 51

-

ADX_Score = 14

-

Distance_near_EMA = 4500

-

Distance_far_EMA = 0

Risk Management

-

Lot_Devided = 200,000

-

SL = 1690 pips / TP = 2720 pips

-

Trailing Stop = 50 pips, Step = 120, Start = 2200

Advanced Options

-

On_Recovery = false

-

Consecutive_losses = 2

-

Recovery_Lot = 2.0

💡 Lot Calculation Examples

-

Capital $10,000 → 10,000 / 200,000 = 0.05 Lots

-

Capital $1,000 → 1,000 / 100,000 = 0.01 Lots

-

Capital $100 → 100 / 200,000 = 0.01 Lots (rounded up)

📌 Algorithmic trend-following strategy with slope-based validation for safer, high-probability entries.