Self drawn Fibonacci indicator

- Indicatori

- Ge Senlin

- Versione: 3.0

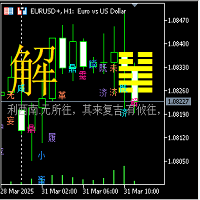

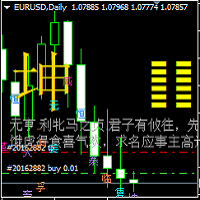

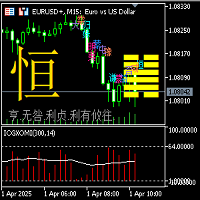

Functional description of automatic Fibonacci line indicator (including high and low channel lines)

Indicator name

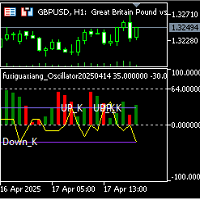

Automatic Fibonacci retracement line + high and low channel auxiliary

Functional introduction

This indicator combines the automatically identified high and low points of the band, automatically draws the Fibonacci retracement/extension line, and draws the highest and lowest price channel lines of the current analysis interval to provide traders with clearer support/resistance reference and trend analysis basis.

Main functions

1. Automatic band identification

o The program identifies key bands according to the preset algorithm Fractal high and low points);

o Select the most recent obvious high and low points as the basis for drawing;

o Automatic update without manual intervention.

2. Fibonacci retracement/extension line drawing

o Automatically calculate the following commonly used ratios: 0%, 23.6%, 38.2%, 50%, 61.8%, 100%, 161.8%, etc.;

o Draw horizontal reference lines for each level and mark the values;

3. High and low channel line drawing

o Automatically draw "highest price line" and "lowest price line" price labels within the selected calculation interval;

o Display the price channel width within the current interval to facilitate judgment of whether the price is in the breakthrough/oscillation stage.

4. Automatic update and multi-period adaptation

o Indicators are automatically refreshed with the market;

o Can be used for any time period (such as 1 minute to weekly);

o Keep the chart tidy and adapt to short-term and band strategies.

5. Chart-friendly settings

o Supports custom line color, transparency, and style;

Technical parameters

Interval length: specifies the number of K-lines to display price labels

Application scenarios

• Predicting callback/rebound areas in trending markets;

• Determining whether the price breaks through a key ratio;

• Using price channels to identify shock consolidation or impending market changes;

• Providing a reference for take-profit/stop-loss areas to improve the stability of the trading system.

Advantages

• No manual operation required, automatic identification and drawing;

• Dynamically tracking market evolution and automatically adjusting key positions;

• High and low channels assist in identifying breakthroughs, retracements, and other forms;

• Adapting to a variety of trading styles: trends, bands, short-term, etc.