Executor Trend Indicator

- Indicatori

- Ren Xiang Wang

- Versione: 1.30

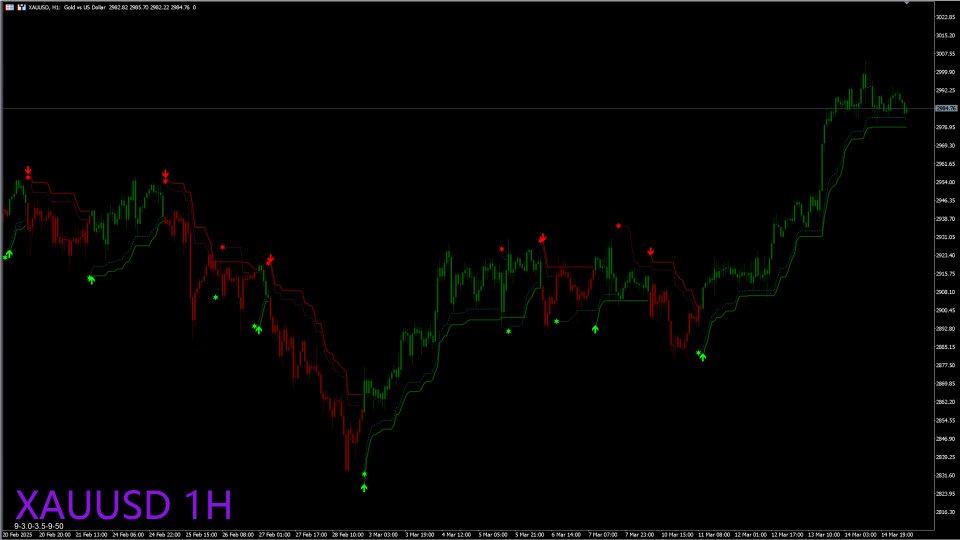

OV-VCS_ATR Trading Rules

The OV-VCS_ATR indicator is a popular trend-following technical analysis tool that helps traders identify the current market trend and potential entry/exit points. Below are the general trading rules for using the

OV-VCS_ATR indicator:

1. Indicator Overview

-

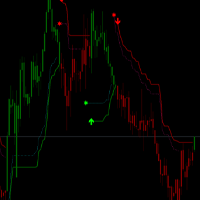

The OV-VCS_ATR indicator consists of a line plotted on the price chart, which changes color to indicate the trend direction:

-

Green Line: Indicates an uptrend (buy signal).

-

Red Line: Indicates a downtrend (sell signal).

-

2. Trading Rules

Buy Signal (Uptrend)

-

Entry: When the OV-VCS_ATR line turns green, it signals a potential buy opportunity. Enter a long position (BUY) when the price closes above the OV-VCS_ATR line.

-

Stop Loss: Place the stop loss just below the OV-VCS_ATR line or at a recent swing low.

-

Take Profit: Use a trailing stop (e.g., follow the OV-VCS_ATR line) or set a fixed profit target based on support/resistance levels.

Sell Signal (Downtrend)

-

Entry: When the OV-VCS_ATR line turns red, it signals a potential sell opportunity. Enter a short position (SELL) when the price closes below the OV-VCS_ATR line.

-

Stop Loss: Place the stop loss just above the OV-VCS_ATR line or at a recent swing high.

-

Take Profit: Use a trailing stop (e.g., follow the OV-VCS_ATR line) or set a fixed profit target based on support/resistance levels.

3. Key Parameters

-

ATR Period: The OV-VCS_ATR indicator uses the Average True Range (ATR) to calculate volatility. A common setting is ATR(9).

-

Multiplier: A multiplier applied to the ATR to determine the distance of the OV-VCS_ATR line from the price. Common values are 3.0, 3.5. A higher multiplier makes the indicator less sensitive to price fluctuations.

4. Additional Tips

-

Trend Confirmation: Combine the OV-VCS_ATR indicator with other tools like moving averages, RSI, or MACD to confirm the trend direction.

-

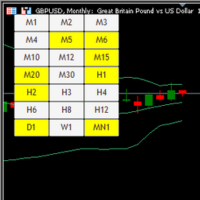

Timeframe Suitability: The OV-VCS_ATR indicator works well on multiple timeframes (e.g., 1-minute, 1-hour, daily charts). Adjust the ATR period and multiplier based on your trading style (scalping, day trading, or swing trading).

-

Avoid Choppy Markets: The OV-VCS_ATR indicator may generate false signals in sideways or ranging markets. Use it in trending markets for better accuracy.

5. Example Strategy

-

Identify Trend: Wait for the OV-VCS_ATR line to turn green (uptrend) or red (downtrend).

-

Enter Trade: Open a BUY position when the price closes above the green OV-VCS_ATR line or a SELL position when the price closes below the red OV-VCS_ATR line.

-

Manage Risk: Set a stop loss below/above the OV-VCS_ATR line and use a trailing stop to lock in profits.

-

Exit Trade: Close the position when the OV-VCS_ATR line changes color (e.g., green to red or red to green).

By following these rules, traders can effectively use the OV-VCS_ATR indicator to identify trends and manage trades. However, always backtest and practice in a demo account before applying it to live trading.