ZigZag with Labels indicator MT4

- Indicatori

- Eda Kaya

- Versione: 1.6

- Attivazioni: 10

ZigZag with Labels Indicator for MT4

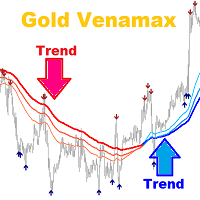

The ZigZag with Labels indicator for MetaTrader 4 highlights key turning points on a price chart where notable fluctuations occur, linking these points to help traders identify market trends. Additionally, it marks pivot points where price direction shifts. These pivots, also referred to as reversal points, arise due to the interaction between supply and demand. There are two main pivot types: major pivots, which indicate substantial price reversals, and minor pivots, representing smaller fluctuations.

ZigZag Indicator Overview

| Category | Elliott Wave - Support/Resistance - Pivot Points and Fractals |

| Platform | MetaTrader 4 |

| Skill Level | Beginner |

| Indicator Type | Reversal - Lagging |

| Time Frame | Multi-Time Frame |

| Trading Style | All trading styles |

| Trading Markets | Universal |

Understanding the ZigZag Indicator

Recognizing pivot points on a chart is crucial for technical traders. This indicator aids in detecting major market trends, chart patterns, key support and resistance zones, Elliott Wave formations, and consolidation areas.

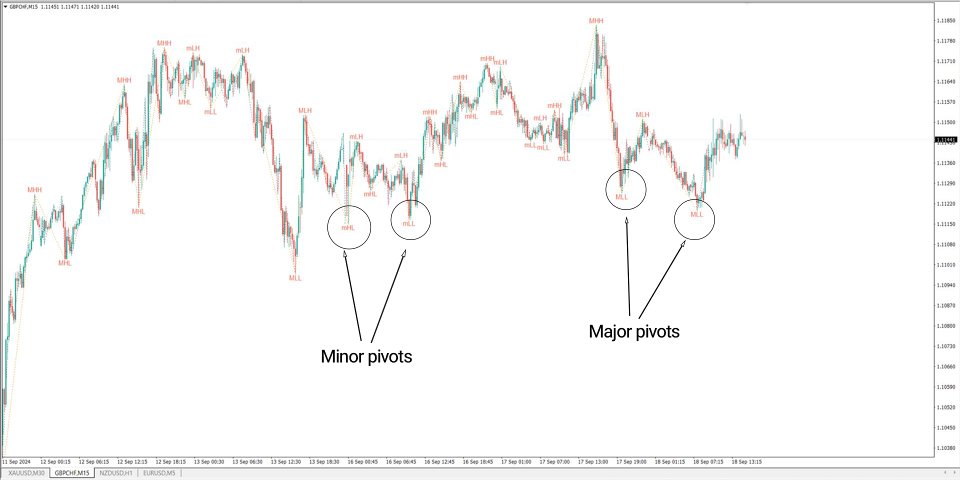

Major and Minor Pivot Points

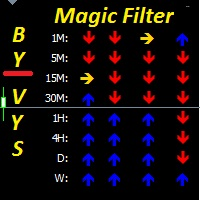

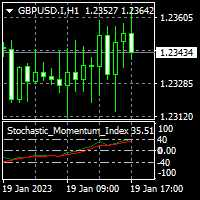

On the 15-minute GBP/CHF chart, the indicator highlights major pivots (M) and minor pivots (m), allowing traders to distinguish significant price movements and track overall trend direction.

Identifying Chart Patterns

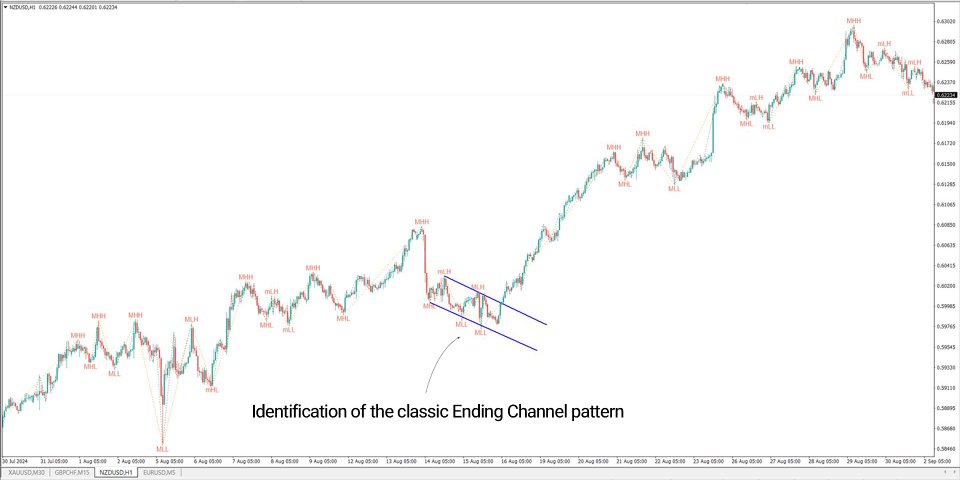

The 1-hour NZD/USD chart showcases how the ZigZag indicator detects technical formations like head and shoulders, double tops and bottoms, and wedge patterns. By mapping highs and lows, traders can confirm breakout and reversal setups.

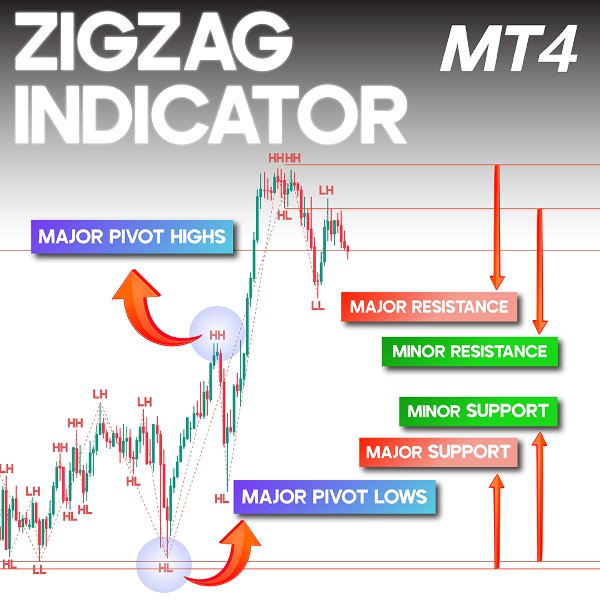

Support and Resistance Zones

Pivot points play a key role in determining support and resistance levels. In the 30-minute EUR/USD chart, the indicator identifies major pivots, making it easier for traders to pinpoint crucial price zones where reversals are likely to happen.

Elliott Wave Analysis

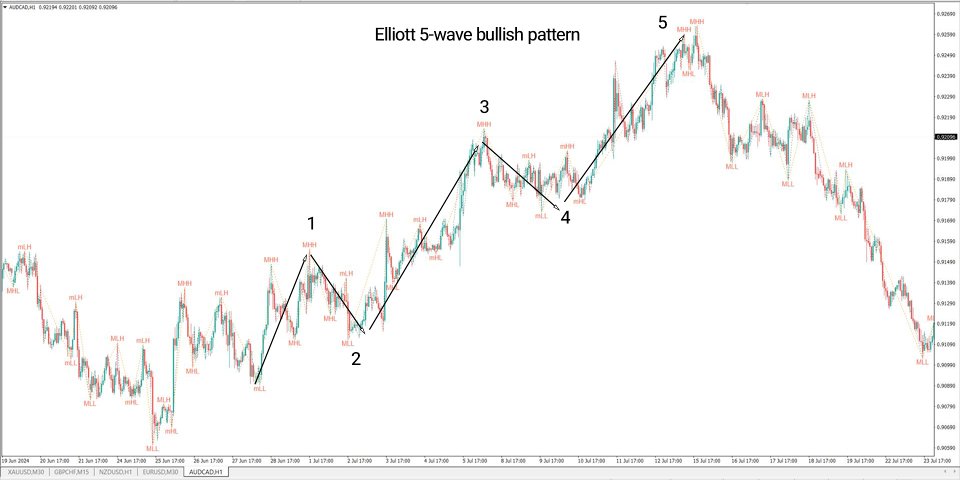

In the 1-hour AUD/CAD chart, the ZigZag indicator assists in recognizing Elliott Wave structures, an essential tool for technical analysis. The indicator highlights major price swings, helping traders identify 5-wave bullish formations or corrective phases.

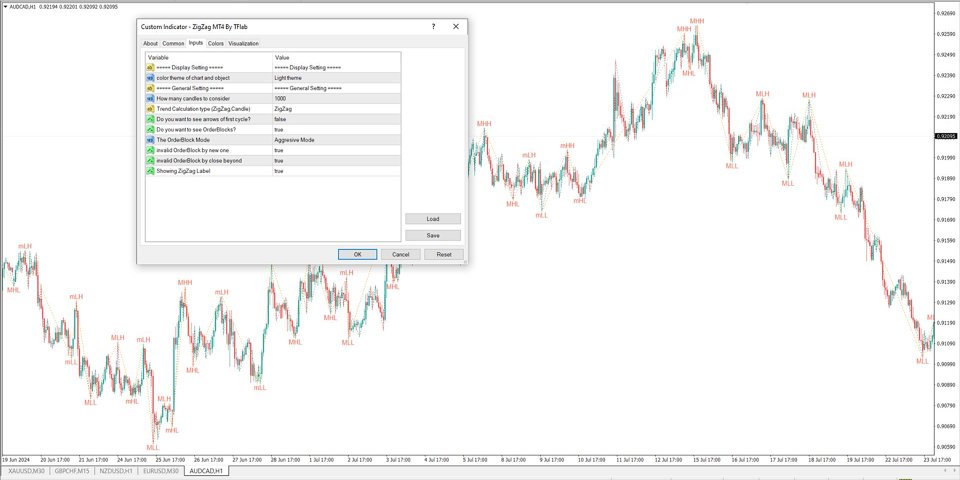

Indicator Configuration

Display Settings:

- Select a preferred chart theme.

General Settings:

- Candle count for analysis: Uses the last 1000 candles for trend detection.

- Trend Calculation (ZigZag Candle): Determines trends based on ZigZag patterns.

- Arrows for first cycle: Can be disabled if unnecessary.

- Order Blocks Visibility: Enable or disable based on preference.

- Order Block Mode: Default is set to Aggressive.

- New Order Blocks on Invalidation: Automatically generates new order blocks.

- Label Display: Enable or disable ZigZag labels.

Conclusion

The ZigZag indicator is a powerful tool for spotting trend reversals and chart patterns, making it essential for traders analyzing price action. It is user-friendly and adaptable to all financial markets, helping traders refine their strategies with greater precision.