Adaptive Trade Master

- Experts

- Mustafa Akdeniz

- Versione: 1.6

- Aggiornato: 12 febbraio 2025

- Attivazioni: 5

Adaptive Trade Master

No need to say anything. It will prove itself.

Here is the Login Information.

Account Number : 71629605

Investor Password: ATM 1002

Server : Exness-Trial10

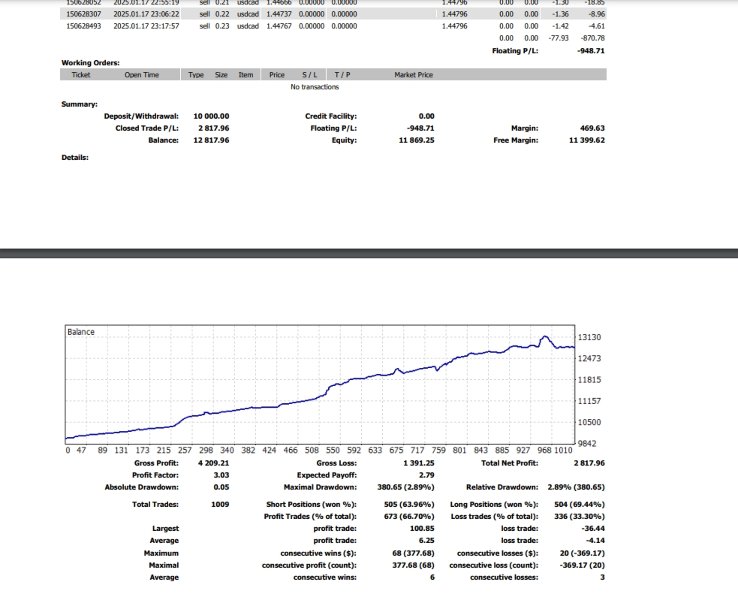

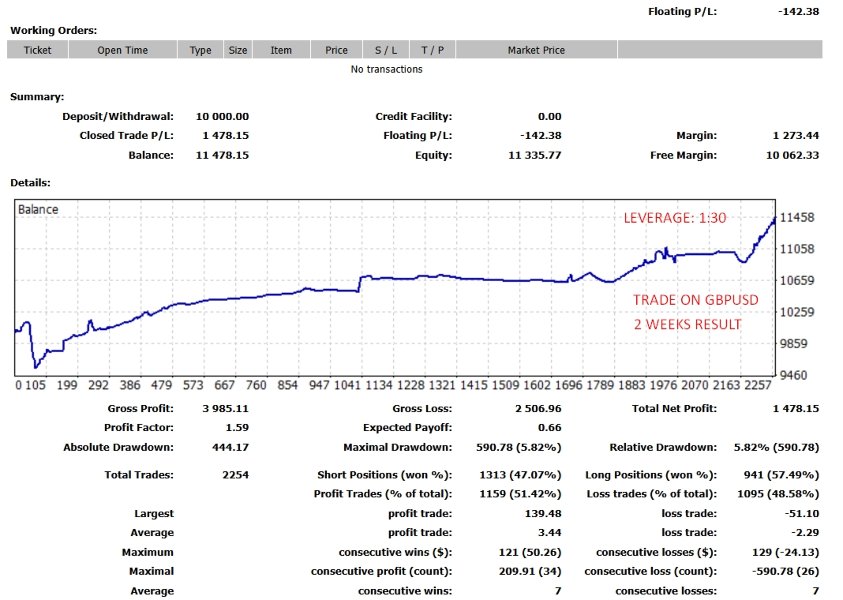

Images are not from the backtest. It is taken from order history (Forward Test).

Newer trust to backtest results. And you can use it on any pair, even on BTCUSD too.

Please watch it and give me your review.

The " Adaptive Trade Master " is an advanced MetaTrader Expert Advisor designed to automate trading decisions based on specific parameters and risk management strategies. It operates by opening buy or sell positions and managing them with dynamic lot sizes, taking profits in dollars, and adjusting the opening intervals as trades progress.

Please contact me for the best setup template according to your broker information and account limitations after purchasing.

Key Features:

- Order Management: Opens and closes positions based on user-defined criteria, ensuring precise control over trades.

- Dynamic Lot Sizing: Calculates the lot size based on the number of open positions, ensuring risk is managed while allowing for scalability in trading.

- Profit Target: The EA closes all positions once a set profit target in dollars (TakeProfitDollar) is reached, ensuring the account's profitability is safeguarded.

- Time-based Trade Management: Only trades within specified time windows, defined by the StartHour and EndHour parameters, providing flexibility in trading sessions.

- Risk Control: Includes an option to set a maximum risk percentage ( MaxRisk ), providing an additional layer of control over trade exposure.

- Dynamic Opening Intervals: The EA progressively increases the interval between opening new positions by using the TimeMultiplier , allowing for adaptive trading strategies.

- Customizable Settings: All core parameters such as lot size, stop loss, slippage, maximum orders, and trade intervals are fully customizable, offering users flexibility in adapting the EA to their specific needs.

- Account Protection: The EA ensures that no more than the maximum allowed open positions are active at any time, as specified by the MaxOrders parameter.

- Manual Trade Override: Allows users to set the order type (buy or sell) and manually adjust trading hours for more tailored trading control.

- It calculates lot size dynamically based on the number of open positions, adhering to broker limits for lot sizes.

- Profit calculation is handled automatically, and once the profit target is reached, all positions are closed.

- The EA enforces the maximum number of allowed positions and checks if there is sufficient free margin to open new trades.

- Customizable trading times ensure the EA only operates during specified hours, ensuring trades align with user preferences.

- The EA adapts the opening intervals dynamically, with each new position opening at an increasingly longer interval to adjust for changing market conditions.

Ideal for traders looking for a customizable, automated trading solution that focuses on managing risk, maximizing profits, and ensuring precise trade execution within specified time frames.

How to Get More Benefit from Adaptive Trade Master:To maximize performance with Adaptive Trade Master, it’s recommended to:

-

Choose a Reliable Broker: Opt for a broker with low spreads and fast execution to reduce trading costs and improve EA efficiency.

-

Leverage: Use a 1:500 leverage to open larger positions with lower capital, enhancing potential profits, but ensure risk management is in place.

-

Investment Amount: A starting investment of 5,000 USD or more provides more trading opportunities, improving overall performance.

-

Risk Management: Properly manage risks and set appropriate risk levels to ensure safety while maximizing gains.

By following these recommendations, Adaptive Trade Master will perform at its best, optimizing both returns and risk control.