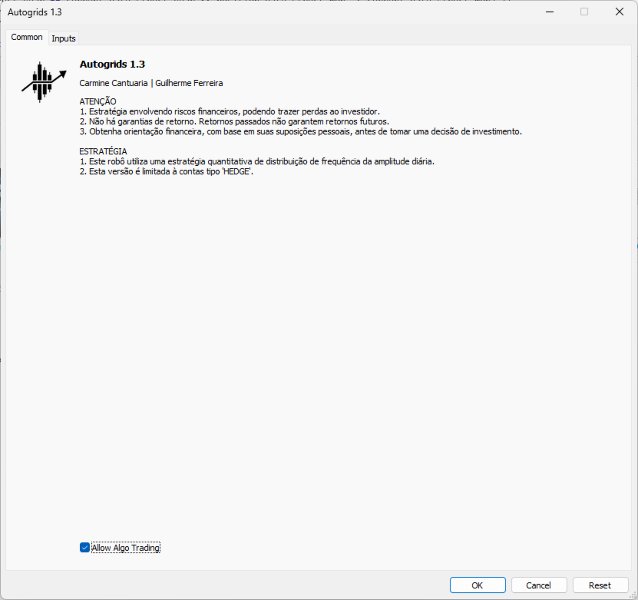

Autogrids

- Utilità

- Guilherme Emiliao Ferreira

- Versione: 1.3

- Aggiornato: 11 febbraio 2025

- Attivazioni: 5

AUTOGRIDS MT5

Autogrids EA is a cutting-edge trading automation tool designed to give Forex traders an unparalleled edge in the market. Built on a powerful quantitative strategy, it analyzes the frequency distribution of daily price movements, leveraging historical data to create a highly optimized operational grid.

Unlike conventional grid trading systems, Autogrids EA strategically models price distributions to define precise trading intervals, ensuring optimized entry points. Whether the market is trending or ranging, this data-driven approach enhances trade accuracy and maximizes efficiency—all without the need for constant manual intervention.

With exclusive operation modes to various market conditions, Autogrids EA is the go-to solution for traders looking to automate with precision, reduce emotional trading, and unlock their full profit potential.

Trade smarter. Trade faster.

Key Benefits

Fully Automated Execution :: Removes emotional decision-making, ensuring trades align with a pre-defined quantitative strategy.

Optimized Entry and Exit Points :: Uses statistical modeling to determine high-probability trading zones, reducing uncertainty.

Exclusive Operation Modes for Grid Setup :: Unlike other robots, Autogrids EA provides multiple operation modes that allow users to configure the placement of buy and sell orders based on their trading strategy: [00] Symmetrical Hedging – Buy and sell orders positioned at the same prices for balanced exposure. [01] Spot Grid – Sell orders above and buy orders below the previous day’s close, ensuring dynamic positioning. [02] Inverted Spot Grid – Buy orders above and sell orders below the previous day’s close, reversing the standard spot grid logic. [03] Long – Focuses on buy orders, placing them above and below the previous day’s close. [04] Short – Focuses on sell orders, placing them above and below the previous day’s close.

Consistent Performance Across Market Conditions :: Strategies designed to work effectively in both trending and ranging markets.

Data-Driven Decision Making :: Utilizes frequency distribution of daily range, eliminating subjective trading approaches.

Improved Trading Efficiency :: Automates complex analysis and trade execution, freeing up time for traders.

Backtesting Capability :: Enables users to validate strategies with historical data before live deployment.

Versatile Asset Compatibility :: Works across various markets, including Forex, stocks, and commodities.

Minimizes Overtrading Risks :: Provides structured execution to prevent excessive entries based on market noise.

Optimized for Hedge Accounts :: Ensures compatibility with hedging strategies, allowing effective position management.

Key Features

Quantitative Strategy Integration :: Leverages statistical distribution modeling of daily amplitude.

Structured Grid Execution :: Trades are placed based on predefined intervals derived from historical data modeling.

Customizable Trade Parameters :: Users can configure grid size, lot sizing, and interval settings.

Smart Order Management :: Ensures proper execution with strategic trade spacing.

Time-Zone Awareness :: Aligns with the MetaTrader platform's time zone for accurate session tracking.

Multi-Asset Support :: Compatible with multiple asset classes for diversified trading opportunities.

Seamless Session Recovery :: If the EA is removed or MetaTrader is closed, simply reapplying it to the asset with the same parameters ensures that existing positions and orders continue to be managed automatically.

Daily Financial Summary and Mobile Notifications :: Displays a quick financial summary on screen and sends a concise trading report to the MetaTrader mobile app at the beginning of each new trading day.

Secure Licensing and Subscription Management :: Distributed exclusively through the MetaTrader Market, ensuring enhanced security, reliability, and protection against unauthorized use.

User-Friendly Interface :: Designed for both novice and experienced traders with intuitive controls.

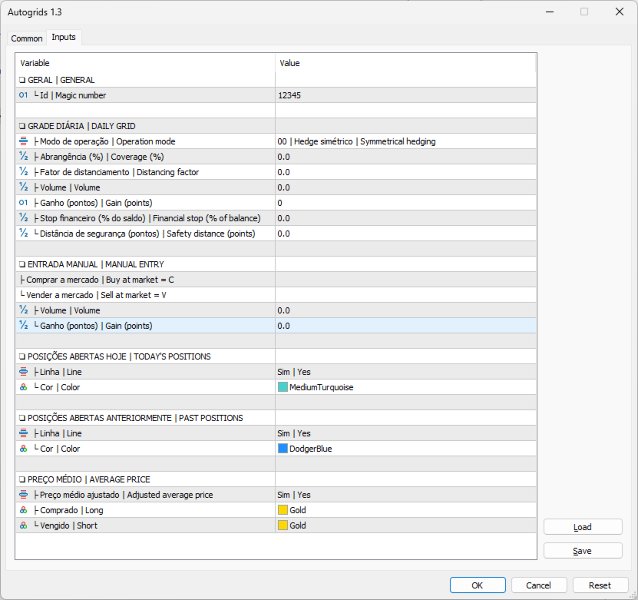

Key Input Parameters and What They Mean for You

Magic Number :: A unique identifier that ensures Autogrids EA only manages its own trades, keeping everything organized and seamless.

Operation Mode :: Choose how your buy and sell orders are structured with five powerful grid setups: [00] Symmetrical Hedging – Buy and sell orders positioned at the same prices for balanced exposure. [01] Spot Grid – Sell orders above and buy orders below the previous day’s close, ensuring dynamic positioning. [02] Inverted Spot Grid – Buy orders above and sell orders below the previous day’s close, reversing the standard spot grid logic. [03] Long – Focuses on buy orders, placing them above and below the previous day’s close. [04] Short – Focuses on sell orders, placing them above and below the previous day’s close.

Coverage (%) :: Adjusts the grid based on frequency distribution for precision trading. Higher values cover wider price movements, while lower values tighten the grid.

Distancing Factor :: Fine-tune order spacing by increasing grid distance in multiples (e.g., 1x, 2.5x, 3.1x the original spacing). Ideal for adjusting risk and trade frequency.

Volume :: Set the lot size for each order, ensuring compliance with the minimum trading volume of your broker.

Gain (Points) :: Define the exact profit target per trade in points, locking in profits automatically (e.g., 100).

Financial Stop (% of Balance) :: Built-in risk control. If your account balance drops to a certain percentage (e.g., 25%), the EA removes pending orders and stops opening new trades—but does NOT close existing positions, ensuring controlled risk exposure without forced liquidation.

Safety Distance (points) :: Prevents order clustering by ensuring a minimum distance between positions and grid orders.

Manual Entry (For Hands-On Control)

- Volume :: Set custom trade sizes for manual buy/sell execution by pressing C (for buy) or V (for sell).

- Gain (points) :: Define your profit target for manually placed trades. (e.g., 100).

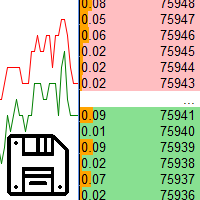

Today's Positions and Visualization

- Lines and Colors :: Enable horizontal lines over today’s opened trades and customize colors for easy visual tracking.

Past Positions and Visualization

- Lines and Colors :: Highlight historical trade levels with customizable colors, making price action analysis easier.

Average Price

- Adjusted Average Price :: Activate real-time average price calculation, including the adjusted profit target.

- Long and Short Colors :: Set color-coded reference lines to visualize the calculated adjusted average prices.

Sentimentos sinceros! As qualidades do Robô se baseiam nas suas ações de qualidades, consistências, confiança e de fácil manuseio. Atualizações periódicas são implantadas com segurança e transparência de acordo com as necessidades que o mercado exige e com fedback sempre positivo dentro da nossa comunidade bastante interativa. Suporte de excelência que está sempre à disposição para nos ajudar. Só tenho a agradecer, muito obrigado Guilherme, você e o robô Autogrids estão de parabéns!!!