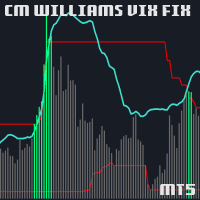

CM Williams Vix Fix

- Indicatori

- Fernando Lahude Ritter

- Versione: 1.0

This is CM Williams VIX Fix Indicator by ChrisMoody adapted to MQL5

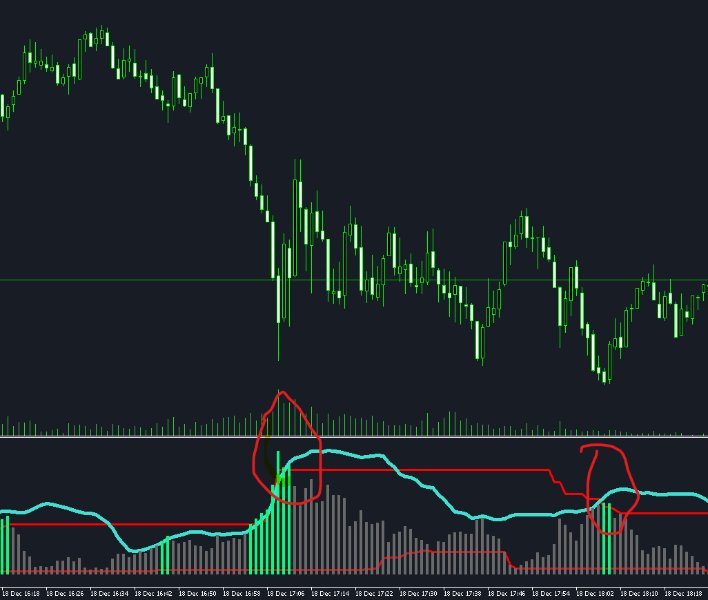

The CM Williams VIX Fix indicator, developed by Larry Williams, is a technical analysis tool designed to replicate the market sentiment insights provided by the CBOE's VIX, but applicable to a wide range of asset classes beyond stock indices.Unlike the actual VIX, which measures implied volatility in the S&P 500 options market, the VIX Fix utilizes historical price data to identify periods of significant market stress, often associated with market bottoms.The indicator calculates the difference between the highest close over a specified period (commonly 22 days) and the current low, divided by the highest close, and then multiplied by 100 to express it as a percentage.This calculation highlights how close the current price is to recent lows, signaling increased volatility and potential buying opportunities when the indicator spikes.The CM Williams VIX Fix is versatile and can be applied to various timeframes and asset classes, making it a valuable tool for traders seeking to gauge market sentiment and identify potential reversal points across different markets. For a more in-depth understanding and practical demonstration of the CM Williams VIX Fix indicator, you might find the following video helpful:

Very simple, very useful, and perfect for my swing trade style. exactly one of the indicators I needed. Thank you, innovative developer.