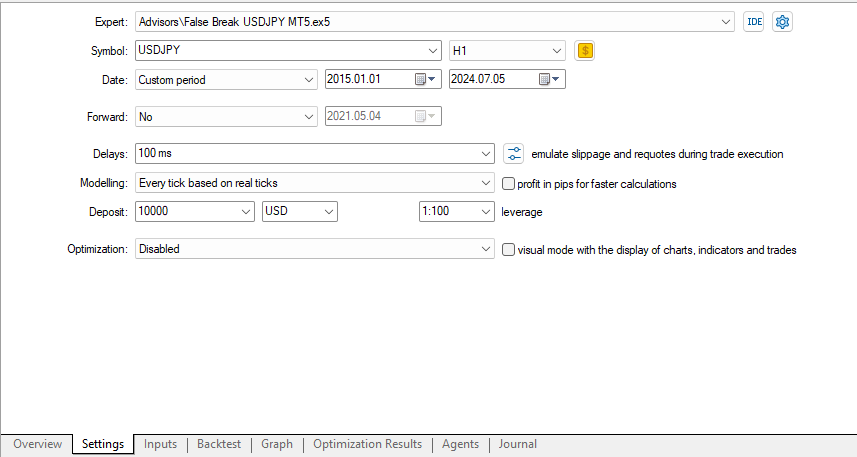

False Breakout Strategy for propfirms MT4

- Experts

- Norman Andres Martinez Bravo

- Versione: 1.0

- Attivazioni: 5

False Breakout Strategy - USDJPY

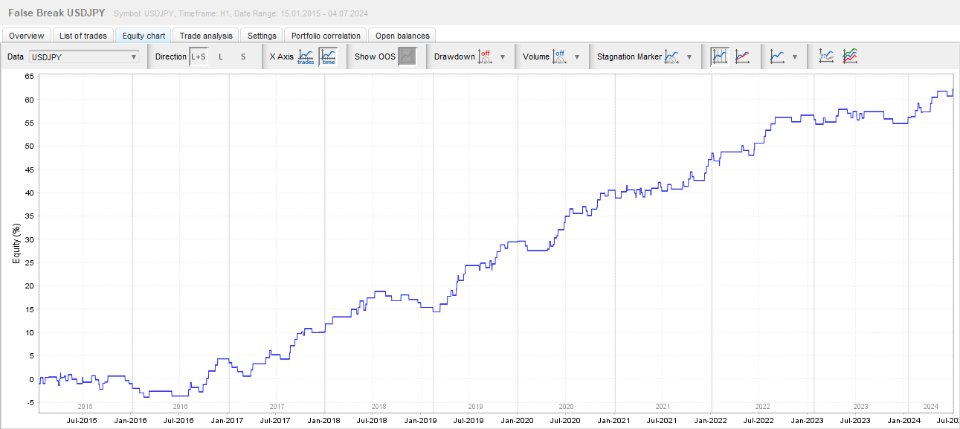

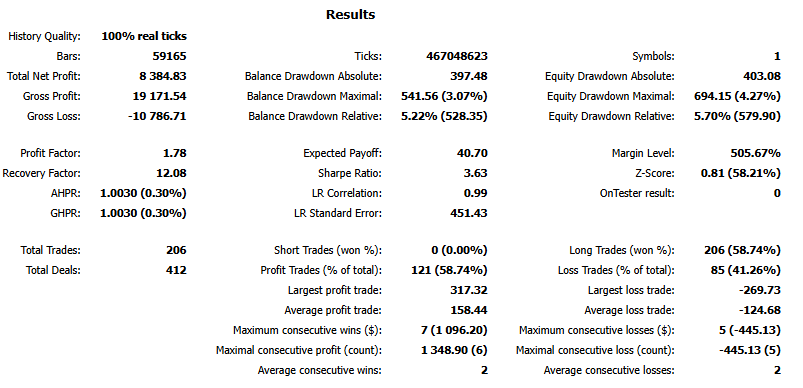

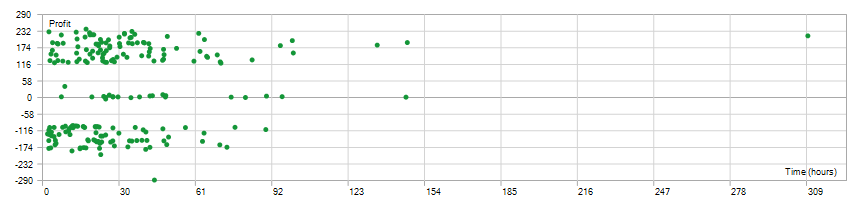

This fully automated strategy is designed to identify buying opportunities in the USDJPY pair, combining advanced technical analysis with risk management to achieve consistent profitability in the long term.

Key Features:

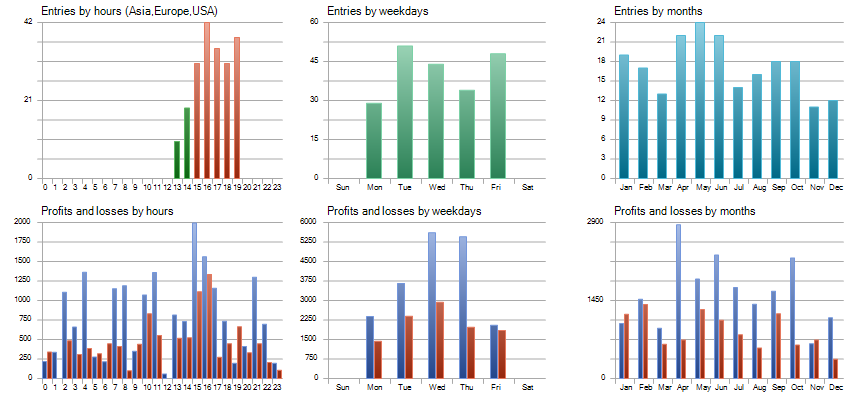

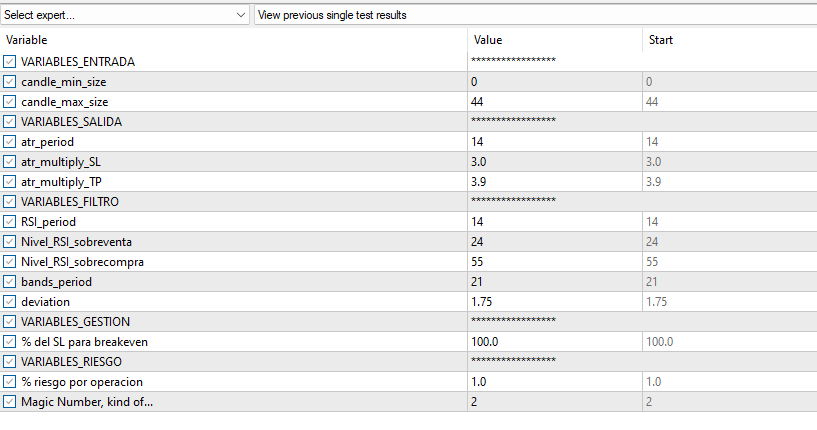

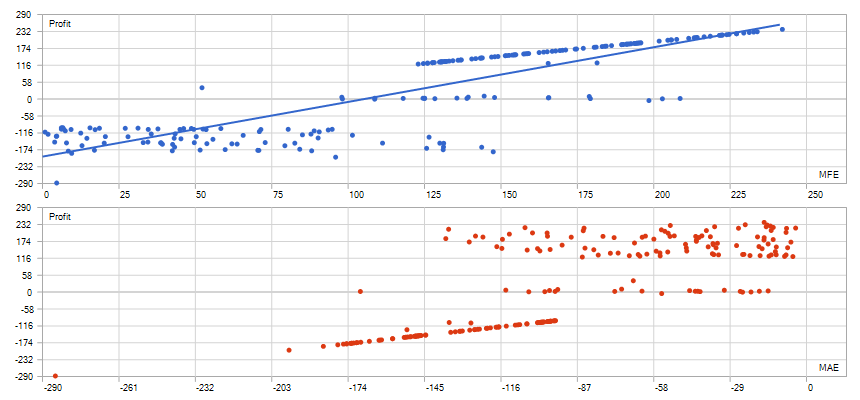

- False breakout trading logic: The strategy identifies ranges formed during previous sessions before New York and London. During these key sessions, it monitors downward breakouts and confirms a false breakout with the formation of a bullish engulfing candle before executing a precise buy order.

- Advanced filters for accuracy: Incorporates technical indicators such as Bollinger Bands and RSI, along with a filter for maximum candle size, ensuring trades are only executed under optimal market conditions.

- Adaptability to various market conditions: Optimized for stable performance across different market scenarios, whether in high volatility or consolidation.

- Superior risk management: Allows only one active trade at a time, minimizing exposure and ensuring operational stability.

Commitment to long-term success:

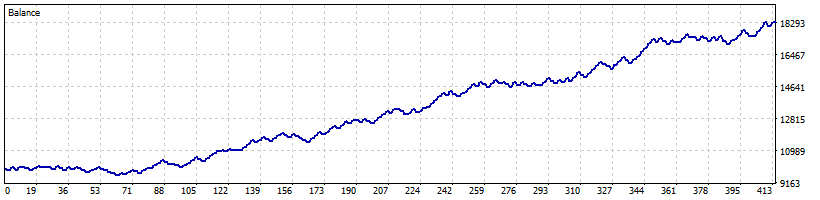

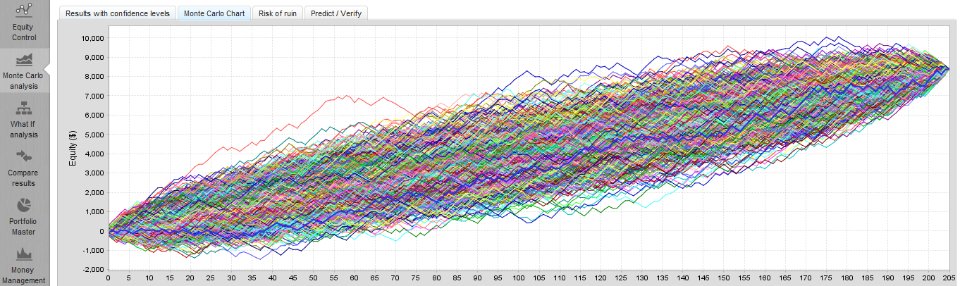

This strategy does not promise quick profits or instant results. Instead, it has been meticulously optimized since 2015 to deliver consistent performance, low drawdowns, and a sustainable growth curve over time. It’s ideal for traders focused on building a solid, long-term profitable account, especially those seeking to meet the requirements of prop trading firms.

Fully automated:

With this strategy, the entire process of analysis and execution is handled automatically, eliminating the stress of manual trading and enabling you to focus on achieving your long-term goals.

Why choose this strategy?

- Developed by experienced traders with a focus on stability and performance.

- Perfect for those who value controlled and gradual account growth.

- Suitable for independent traders and prop firm aspirants alike.