Box Reversal EA

- Experts

- Jimmy Peter Eriksson

- Versione: 1.10

- Aggiornato: 27 marzo 2025

- Attivazioni: 10

The Idea Behind the Box Reversal EA

Markets often reverse strongly after overextended price movements, especially during specific hours of the day. These reversals typically result from profit-taking or corrections from extreme price levels.

The Box Reversal EA uses the Average True Range (ATR) to dynamically define a "box" around the current price:

- The box size is determined by the ATR, multiplied by an adjustable value for customization.

- The top and bottom of the box are placed at half the adjusted ATR value above and below the price.

- If the price breaks out of the box, the EA identifies it as an overextension and enters a reversal trade.

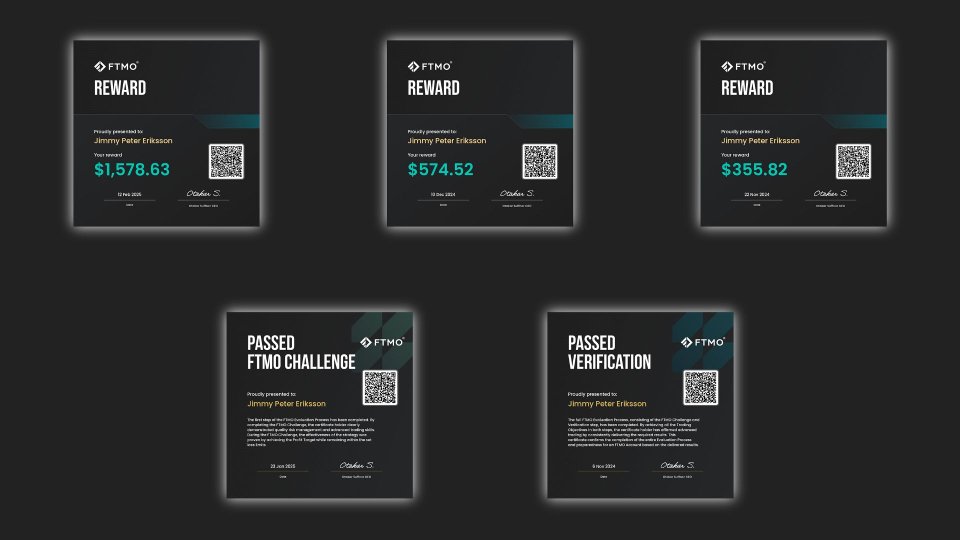

Prop Firm Ready: This EA works with both Prop Firm Challenges and Live Prop Firm Accounts.

Smart Filters for Higher Accuracy

The EA includes filters to detect strong prior directional moves, increasing the likelihood of a reversal. These filters ensure trades align with high-probability setups while avoiding trends that are likely to continue.

Works Across Multiple Markets

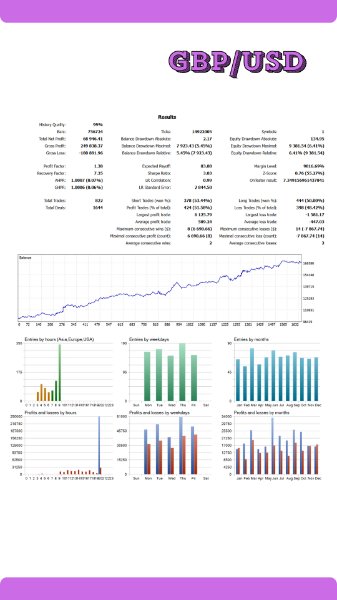

The Box Reversal EA is optimized for pairs like GBPUSD and EURGBP but works on various other markets. You can test it yourself and decide which instruments suit your trading style. For your convenience, detailed results and input settings for GBPUSD are provided in the screenshots section.

Why It Works

By combining ATR-based dynamic sizing, advanced filters, and time-based exits, the Box Reversal EA adapts to changing market conditions. This makes it a robust tool for intraday traders seeking to profit from predictable market reversals.

Got questions about setting up the bot? Feel free to reach out—I'm happy to help!

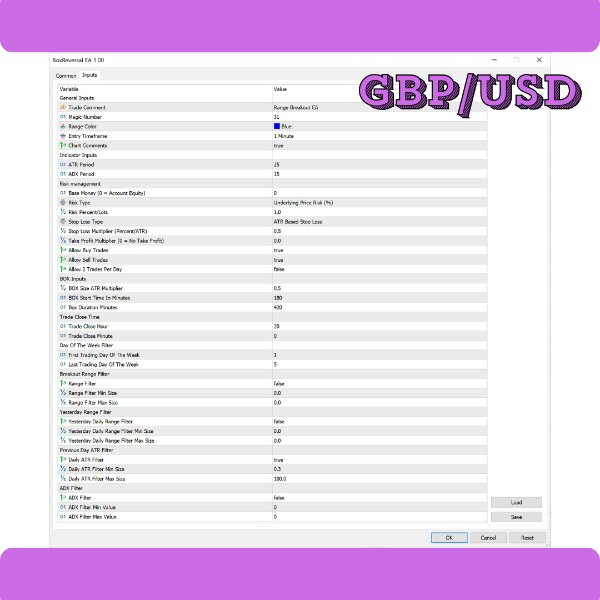

<General Inputs>

Trade Comment: A label for all trades made by the EA.

Magic Number: Unique identifier for the EA's trades.

Range Color: Color of the price range on the chart.

Entry Timeframe: Timeframe used for trade entries (recommended M1).

Chart Comments: Enables or disables comments on the chart.

<Indicator Inputs>

ATR Period: Average True Range Period.

ADX Period: Average Directional Index Period.

<Risk Management>

Base Money: Reference account balance for calculating risk, (If choosing "0" the risk will be calculated using the Account Equity).

Risk Type: Method for calculating trade risk (Lots, underlying price percent, or percent based on stop loss distance).

Risk Percent/Lots: Amount of risk per trade (Percentage or fixed lots).

Stop Loss Type: Method for setting stop loss (Daily ATR value, underlying price percent, or range-based stop loss).

Stop Loss Multiplier: Sets the stop loss distance based on a percentage of the underlying price or ATR.

Take Profit Multiplier: Sets the take profit distance based on the ATR.

Allow Buy Trades: Allows buy trades to be entered by the EA.

Allow Sell Trades: Allows sell trades to be entered by the EA.

Allow 2 Trades Per Day: Enables up to two trades per day (if enabled, one buy and one sell trade are allowed; if disabled, only one trade is allowed).

<Box Inputs>

Box Size ATR Multiplier: Sets the box size as a multiple of the ATR. Adjust to control how big or tight the box is.

Box Start Time (Minutes): The time (in minutes after midnight) when the box is created.

Box Duration (Minutes): How long the box remains active before expiring.

<Trade Close Time>

Trade Close Hour: Hour when open trade is closed.

Trade Close Minute: Minute when open trades is closed.

<Day Of The Week Filter>

First Trading Day Of The Week: Sets the first day to allow trades, starting from 1 (Monday) through 5 (Friday). For crypto, 6 is Saturday, and 0 is Sunday.

Last Trading Day Of The Week: Sets the final day to allow trades, with 5 being Friday. For crypto, 6 is Saturday, and 0 is Sunday.

<Yesterday Range Filter>

Yesterday Daily Range Filter: Blocks trades if yesterday's total range is too large or small.

Yesterday Daily Range Filter Min Size: Minimum size of yesterdays total range compared to the underlying price in percent.

Yesterday Daily Range Filter Max Size: Maximum size of yesterdays total range compared to the underlying price in percent.

<Previous Day ATR Filter>

Daily ATR Filter: Prevents trading if yesterday's total range is larger or smaller than the daily ATR.

Daily ATR Filter Min Size: The minimum allowed range for the previous day is the daily ATR multiplied by this value.

Daily ATR Filter Max Size: The maximum allowed range for the previous day is the daily ATR multiplied by this value.

<ADX Filter>

ADX Filter: Enables or disables the filter to assess trend strength using the Average Directional Index (ADX).

ADX Filter Min Value: Trades are only allowed if the ADX value is greater than this value.

ADX Filter Max Value: Trades are only allowed if the ADX value is less than this value.

very helpful author and very useful strategy! everyone who is searching for a real automated trading strategy I can advise to buy this EA. The strategy has simple rules and works well across multiple currencies which proofs its concept. It's a great addition and even a "must have" in every non grid martingale gambling stile portfolio. This EA works perfectly in addition to breakout strategies. You will diversify your risk and profit from every market situation - if it is trendy or ranging - you get your cut. The Autor is extremely helpful. I noticed a small drawing error with the box, messaged him and the next day I woke up the update was already ready! Thats a service. You will get excellent support on this EA. So, all in all: 5/5. Are there any bumpers? No! Fair, Price, proven strategy, good support.