LuckyNumber

- Experts

- Ilia Stavrov

- Versione: 1.255

- Aggiornato: 19 novembre 2024

- Attivazioni: 7

Automated Trading Advisor LuckyNumber

Recommended instruments: the most volatile markets - Gold, Silver, indices.

Timeframe used: any.

Step into the future of automated trading with the LuckyNumber advisor, which transforms complex market analyses into simple yet effective trading solutions. This advisor is perfectly suited for both beginners and experienced traders looking to optimize their strategies in the Forex market.

Advantages of LuckyNumber:

- User-Friendly Interface: Easy setup allows users to focus on trading strategies without needing extensive technical knowledge.

- Adaptive Algorithms: Utilizes advanced mathematical models, such as moving averages and standard deviation, to identify optimal entry and exit points in the market.

- Risk Management: Built-in features for lot management and spread control provide reliable capital protection.

Core Operation Algorithm of the LuckyNumber Advisor:

- Searches for a trading channel controlled by the parameters CandleCount and MinChannelWidth, enabling the filtering of excessively “wide or narrow” time channels and “low” price channels.

- Decisions regarding market entry are made based on built-in filters: spread control, trend-based Moving Averages, Standard Deviation, and slippage filters.

- The trading cycle begins when the price reaches the 38.2% level according to Fibonacci levels, with the assumption that the price may continue its movement towards the 100% level.

- The cycle concludes at the 61.8% level; if the price reverses before reaching this level, an order is flipped at the 23.6% level with a volume multiplied by the Multiplier, ending the trading cycle when the price reaches the 0% level.

- This cycle repeats until the current order reaches the 61.8% or 0% levels or the trading order volume hits the MaxLotMultiplier value.

Customizable Parameters:

- LotSize: Initial trade volume (default 0.1).

- Multiplier: Defines how much the volume increases when opening subsequent orders in the cycle (default 2.0).

- MaxLotMultiplier: Limits the maximum lot size relative to LotSize (default 16.0).

- CandleCount: Number of candles for determining the price channel (default 20).

- MinChannelWidth: Minimum "height" of the price channel measured in new points; trading is prohibited if the channel is “below” this value.

- AllowMultipleCyclesInSameChannel = false: Multiple trading cycles in a channel. If true, a new cycle can occur in the same channel after the first cycle, provided all entry conditions are met. If false, only one trading cycle is allowed per channel.

- MaxSpread: Sets the maximum spread limit in new points (default 20).

- SpreadPause: Waiting time in seconds if the spread exceeds the specified maximum (default 60).

- MagicNumber: Unique magic number identifying orders opened by this advisor (default 123456).

- OrderComment = "My Trading Comment": Add a comment to the order.

- SlippageTolerance: Maximum allowable slippage in new points (default 10).

Moving Average Parameters:

- UseMAFilter: Enables or disables filtering by moving average.

- MAPeriod: Period for calculating the moving average (default 14).

- MAShift: Shift value for the moving average.

- MAMethod: Defines the calculation method (default simple moving average).

- MAPrice: Specifies which price to use for the moving average (default close price).

Standard Deviation Parameters:

- UseSDFilter: Enables or disables filtering by standard deviation.

- SDPeriod: Period for calculating standard deviation (default 20).

- SDShift: Shift value for standard deviation.

- SDMethod: Defines the calculation method (default simple moving average).

- SDPrice: Specifies which price to use for standard deviation (default close price).

- SDThreshold: Defines the filtering level for standard deviation (default 0.5).

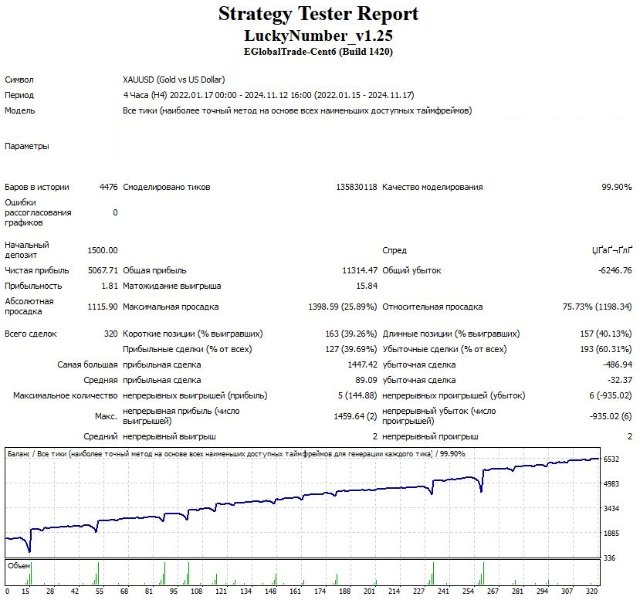

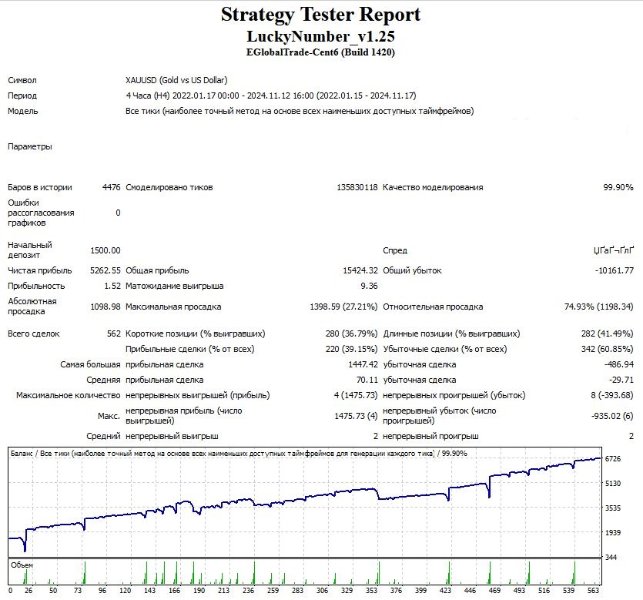

The advisor undergoes backtesting and forward testing with execution quality exceeding 99.9%.