Slipp Market

- Experts

- Ewa Joanna Jagiello Stepien

- Versione: 1.0

- Attivazioni: 20

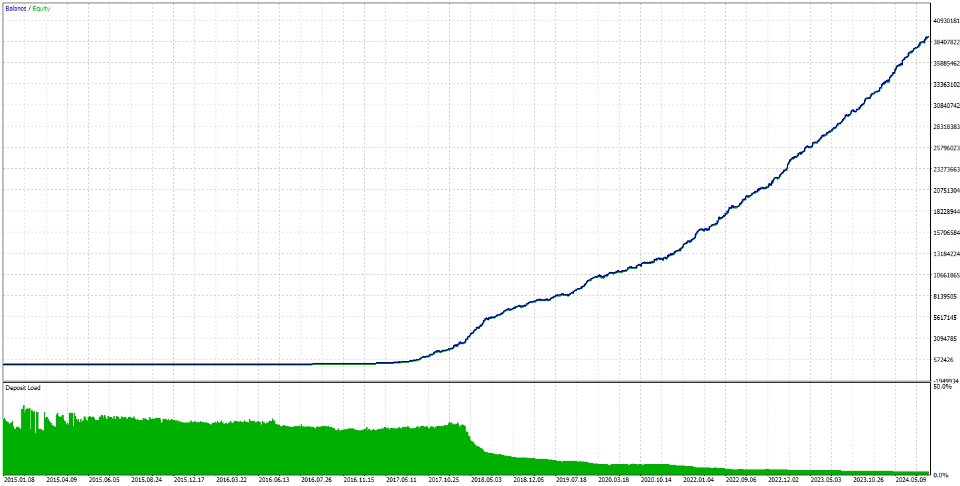

Slipp Market is an advanced trading tool that leverages a negative slippage strategy during key macroeconomic data releases, as well as heightened volatility from market openings in strategic regions around the world (e.g., London, New York, Tokyo). The EA automatically detects these moments and activates itself when volatility is at its peak, maximizing profit opportunities.

Supported Markets:

Slipp Market operates on major Forex currency pairs, such as:

- EUR/USD

- GBP/USD

How It Works:

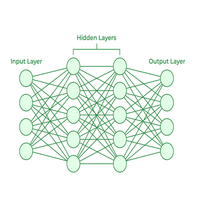

Automatic Detection of High-Volatility Hours: Slipp Market is equipped with an algorithm that identifies key times for data releases and major market openings, activating the strategy only under optimal conditions.

Limit Orders in High-Volatility: The EA places limit orders, which, during sudden price changes, are executed at more favorable prices, allowing entry close to the peaks or troughs of intense moves.

Fast Trailing Stop: The EA automatically secures profits with a quick trailing stop, protecting them as the price moves in the desired direction.

Loss Prevention Mechanism: If the price reverses direction, the EA quickly closes the position and places new orders, minimizing risk while maximizing profit potential.

Optimized for High-Volatility Conditions: The EA operates only during periods of intense volatility, allowing maximum leverage of slippage while avoiding losses during calm periods.

Minimum Requirements:

- Minimuml deposit: 100 USD

- Minimum leverage: 1:30

- Timeframe: M15

Benefits:

Automated trading in key market volatility moments

Built-in algorithms for high-volatility detection

Fast trailing stop for profit protection

Advantageous use of slippage at critical market times

Risk minimization through advanced order management

Slipp Market is an ideal tool for traders looking for a strategy optimized for dynamic moments in the Forex market.