FTMO Gold

- Experts

- Michael Prescott Burney

- Versione: 999.95

- Aggiornato: 16 febbraio 2025

- Attivazioni: 20

FTMO Gold – High-Performance Expert Advisor for XAUUSD H1

Overview

FTMO Gold is an advanced Expert Advisor designed for trading XAUUSD on the H1 timeframe. It is optimized for funded trading challenges and long-term portfolio growth, integrating a sophisticated risk management framework, dynamic trade execution, and rigorous backtesting. With 99% modeling quality in backtests, FTMO Gold has demonstrated a strong balance between profitability and capital protection, producing consistent equity growth with controlled drawdowns.

Input Parameters and Strategy Configuration

FTMO Gold is built for precision trading, incorporating robust trade management, risk control, and adaptive profit-taking mechanisms.

The risk management settings allow for both dynamic and fixed lot sizing. Traders can select between dollar-based per 0.01 lot size or fixed lot sizing. The trailing stop mechanism includes trailing step pips at 5.0, trailing stop profit pips at 10.0, take profit pips at 10.0, and break-even profit pips at 5.0, ensuring locked-in profits and reduced risk exposure.

The trade execution settings support a maximum of 100 open positions. The EA can be configured to trade in both buy and sell directions or be restricted to sell-only mode, providing flexible trade bias control.

To enhance account protection, a maximum spread filter between 0 and 10 pips prevents trade execution in unfavorable market conditions. Minimum equity protection ensures trades are only placed if account equity meets the required threshold. A daily loss limit enforces a maximum allowable daily loss to prevent excessive drawdowns. Stop-loss strategies include ATR-based stop-loss and time-based exit, enhancing adaptability in volatile market conditions.

FTMO Gold also offers a profit locking feature, allowing traders to secure profits once predefined levels are reached. Holiday trading can be enabled or disabled to prevent execution during low-liquidity market conditions.

The daily trade window configuration allows precise control over entry and exit times for each weekday, ensuring trades align with peak market liquidity.

Backtesting and optimization are conducted using in-sample and out-of-sample periods to validate performance. Walk Forward Optimization ensures the EA remains adaptive and effective in real-time trading environments.

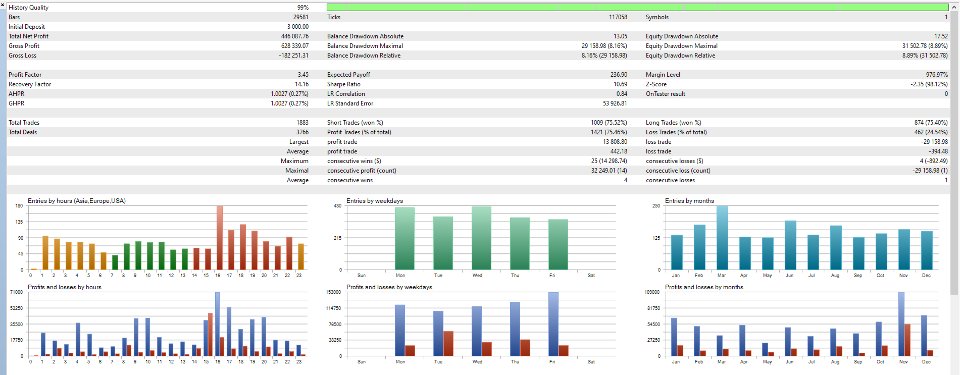

Backtest Performance and Key Metrics

FTMO Gold was tested on XAUUSD H1 with a $3,000 starting deposit, achieving exceptional profitability with strict risk control.

Total net profit reached $446,087, with a gross profit of $628,339 and a gross loss of -$182,251. The profit factor stood at 3.45, indicating strong profitability relative to risk, while the recovery factor was 14.16, reflecting quick recovery from drawdowns. The Sharpe ratio was 10.69, showcasing excellent risk-adjusted returns.

The EA executed 1,883 total trades. Short trades had a win rate of 75.52 percent, while long trades had a win rate of 75.40 percent. Overall, the profit trade percentage was 75.46 percent, with the largest profit trade recorded at $13,808 and the largest loss trade at -$29,158. Maximum consecutive wins reached 25 trades, accumulating $14,292 in profit, while maximum consecutive losses were four trades totaling -$892.

Drawdown and Risk Metrics

Balance drawdown absolute was $29,158, with a maximum balance drawdown of $31,502, representing 8.89 percent. The relative drawdown stood at 8.16 percent. Equity drawdown absolute was $17.52, while relative equity drawdown was 8.89 percent.

Trading Patterns and Seasonal Trends

FTMO Gold performed best between 15:00 and 23:00 UTC, during periods of high market liquidity. The EA demonstrated consistent profitability across the trading week, with Monday through Friday maintaining strong returns. Seasonal performance remained steady, with peak profitability in March and December.

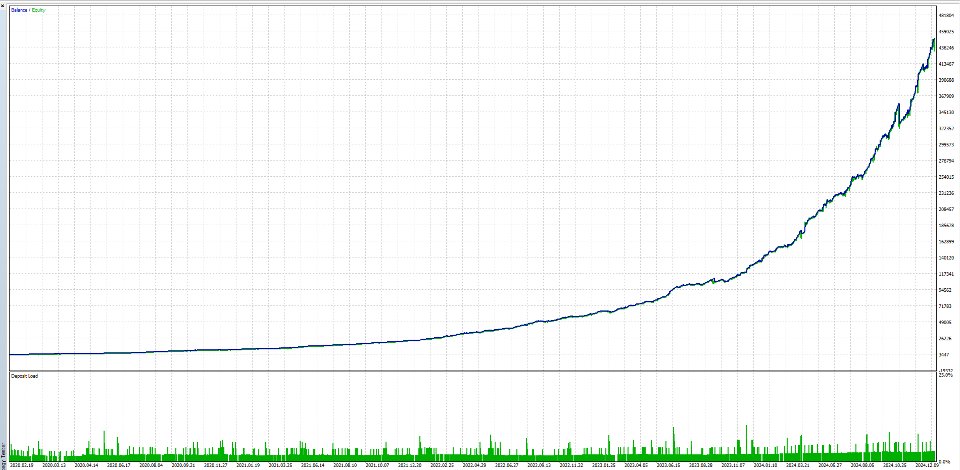

Equity and Balance Curve Analysis

The equity and balance curve for FTMO Gold displayed steady, exponential growth, proving the EA’s efficiency in maintaining consistent profitability over time.

The curve demonstrated smooth and consistent equity growth, reflecting a well-balanced risk-reward strategy. Minimal stagnation periods indicated the EA’s ability to adapt to market fluctuations. Evenly distributed deposit load ensured capital efficiency and controlled risk exposure.

Why Choose FTMO Gold

FTMO Gold delivers a high win rate and profitability, with over 75 percent of trades closing in profit and a profit factor of 3.45. The advanced risk management system includes ATR-based stop-loss, maximum drawdown control, and daily loss limits, ensuring strong capital protection. The EA is scalable for different trading styles, working efficiently with both fixed and dynamic lot sizing, making it suitable for various account sizes.

Built for long-term adaptability, FTMO Gold utilizes Walk Forward Optimization to maintain consistent performance across changing market conditions. Specifically designed for XAUUSD trading, it capitalizes on high-probability setups on the H1 timeframe.

FTMO Gold is the perfect solution for traders seeking a stable, well-optimized, and profitable EA for XAUUSD. It focuses on risk-adjusted returns, sustainability, and long-term growth, making it ideal for prop firm trading and individual portfolio expansion.