Smart Trade AI

- Experts

- Goo Cheong Meng

- Versione: 10.7

- Aggiornato: 20 ottobre 2024

- Attivazioni: 5

Smart Trade AI - Your Intelligent Trading Partner

"Smart Trade AI" is an advanced Expert Advisor (EA) developed using cutting-edge AI technology to strategically identify overbought and oversold conditions for optimal entry signals, supported with dynamic risk management with Dollar Cost Averaging (DCA). This EA is designed for traders who prioritize disciplined, long-term growth over risky, get-rich-quick schemes.

Key Features:

- Entry Signals: Detects overbought and oversold conditions with quality.

- DCA Recovery Strategy: If the trend moves against your position, Smart Trade AI uses a Dollar Cost Averaging (DCA) strategy and dynamically adjust the Take Profit (TP) point, exit and recover the trade as soon as possible. This intelligent recovery action ensures better chances of exiting the trade profitably.

- Lot Size and Distance Multiplier: The EA incorporates adjustable lot size multipliers and distance multipliers for managing DCA trades effectively, all while avoiding the pitfalls of traditional martingale systems.

- Risk Management: Drawdown risk is carefully controlled by pre-defined Stop Loss (SL) limits, ensuring that the potential loss is capped even during challenging market conditions.

- Designed for Long-Term Profit: Smart Trade AI is crafted for traders who seek steady, consistent profits over time. This strategy is not a "quick-win" solution but a reliable, long-term approach to sustainable trading.

- Optimized for Multiple Currency Pairs: Smart Trade AI is suitable for a wide range of currency pairs, allowing traders to diversify their strategies across various markets, choosing best currency pair condition for entry automatically. Optimized set files will be provided for multiple currency pairs. Recommended to run all the provided currency pairs with the set files provided, let Smart Trade AI to maximize your profit and manage your risk carefully.

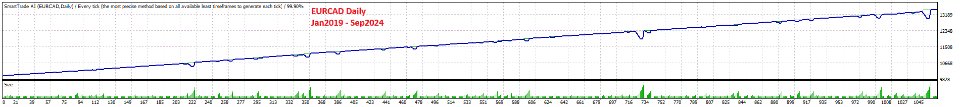

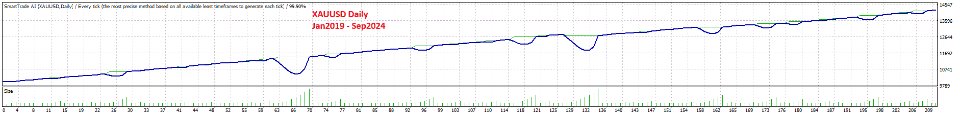

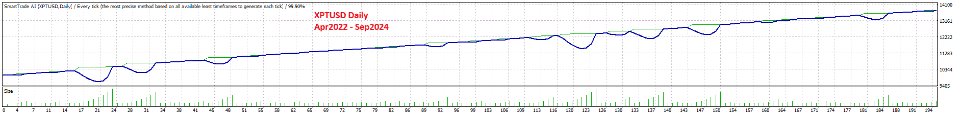

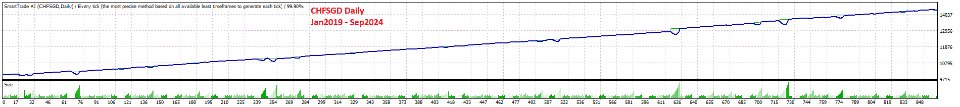

- Backtested with Comprehensive Data: This EA has been rigorously optimized using the Tick Data Suite (Dukascopy data) from 2019 to 2024, including periods of extreme market volatility, such as the COVID-19 market downturn. This ensures robustness and adaptability in different market conditions.

- Telegram Group: Join our SmartTradeAIGroup community to grow together. You can send your comment and question in the group using the MQL5 or Telegram chat.

- Live Signal

Who Should Use This EA?

- Discipline-focused Traders: This EA is suitable for traders with the patience and discipline to manage trades carefully and avoid emotional decisions. If you're looking for a robust trading solution that focuses on small but consistent profits over time, Smart Trade AI is the tool to elevate your trading performance.

Why is Smart Trade AI Only $30 for 6 Months?

I’ve purchased and tested many Expert Advisors (EAs) from the MT4 market, only to be disappointed when they failed to perform in the long term. After spending a significant amount of money on these expensive tools, I realized that high price doesn’t always mean better results. That's why I want to offer Smart Trade AI at an affordable rate of just $30 for 6 months. You get the opportunity to test it out in real account for 6months with just $30, not $500 at one go. You can also back test for free before you make the decision.

My goal is to make effective, AI-powered trading tools accessible to traders of all experience levels without breaking the bank. Smart Trade AI has been rigorously optimized and back tested across various market conditions, including the volatility during the COVID-19 downturn, without sacrificing quality or performance.

You might wonder: if the EA is so good, why am I selling it at such a low price? The answer is simple—I need capital to continue trading with small and consistent profit, and by offering this EA at an affordable rate, it's a win-win for both you and me. You get a reliable trading tool without the high costs typically associated with premium EAs, and I gain the capital I need to grow my own trading account.

By keeping the price affordable, I hope to grow a community of traders who use and benefit from Smart Trade AI, sharing their experiences and results, while the EA and set files be constantly updated.

Set File Parameters Explanation:

Download the optimized set files here.

Take note that for long term success, it is recommended to use Daily chart, as it will provide most quality set up that can significantly reduce drawdown. The idea is to run all the set files provided, to capture best set up across multiple currency pairs. Most of the time, we expect to obtain 0.5-0.8% result per pair per month, running 10-15pairs > 5%-12% per month. On the other side, if a series of DCA trades hit SL (which is a unlikely case), a loss of around ~20% of the account can happen. In long term, the account will recover and make profit over time due to the success rate is higher than SL case. Recommended min deposit is 2000.

-

MagicNumber: This is the unique identifier for the EA's trades. Each EA and currency pair has its own Magic Number to prevent conflicts with trades.

-

RestAfterLoss: When set to TRUE, the EA pauses trading after a losing series of trades for a defined period.

-

RestHour: This determines how long (in hours) the EA will rest after a losing trade series. For example, 336 hours represents a week.

-

AutoLot: When set to TRUE, the EA calculates the lot size automatically based on account balance and the LotPer1000Balance parameter.

-

LotPer1000Balance: If AutoLot is enabled, the EA uses this to calculate the lot size relative to the account balance. The lot size increases as the balance grows. You can increase the lot size from set files value by max 50% more to avoid taking too much risk to your account. The default value 0.20 in the EA is only for MT4 market validation purpose, please make sure you load the set file value. Correct lot size range from 0.002-0.005 per 1000 balance depend on your risk appetite.

-

FixedLotSize: If AutoLot is disabled, this sets a fixed lot size for all trades.

-

RecoveryTradeOn: If TRUE, the EA will open additional trades in the opposite direction during a losing streak, based on the DCA (Dollar Cost Averaging) strategy.

-

DCA_StepPoints: This defines the distance (in points) between each recovery trade in the series.

-

LotMultiplier: This multiplier determines the lot size increase for each subsequent trade in the recovery series.

-

DistanceMultiplier: This multiplier adjusts the price distance between trades in a recovery series, increasing it after each new trade.

-

MaxTradesEachSide: Limits the maximum number of trades allowed in either direction (buy or sell).

-

TakeProfitPoints: The number of points away from the entry price where the EA will set the Take Profit level for each trade.

-

AverageTakeProfitPoints: When multiple trades are open in a series, the EA sets a collective Take Profit point based on the average entry price plus this number of points.

-

StopLossPoints: The number of points away from the entry price where the EA will set the Stop Loss level for each trade.

-

FilterTradingTime: When set to TRUE, trading is restricted to specific time windows defined by TimeStart1 , TimeEnd1 , TimeStart2 , TimeEnd2 , TimeStart3 , and TimeEnd3 .

-

TimeStart1, TimeEnd1, TimeStart2, TimeEnd2, TimeStart3, TimeEnd3: These parameters define up to three different trading time windows during which the EA is allowed to open trades. Times are in the format HH.

-

FirstTradeOnMonday, FirstTradeOnTuesday, FirstTradeOnWednesday, FirstTradeOnThursday, FirstTradeOnFriday: These options allow the user to specify on which days the EA is allowed to place its first trade in a new series.

-

IsWeeklyGoal: If enabled, the EA will stop trading for the rest of the week once the account reaches the WeeklyGoalPercentage .

-

WeeklyGoalPercentage: The percentage gain in account equity after which the EA will stop trading for the week, if IsWeeklyGoal is enabled.

-

IsPortfolioSL: If TRUE, the EA will stop trading if the account's equity drawdown exceeds the defined PortfolioSLPercentage .

-

PortfolioSLPercentage: The maximum drawdown percentage of the account equity allowed before the EA stops trading, if IsPortfolioSL is enabled.

-

IsMaxSpread: When enabled, the EA checks the current market spread before placing trades. If the spread exceeds MaxSpread , trading is skipped.

-

MaxSpread: The maximum spread allowed (in points) for the EA to open a new trade.

-

AllowFirstBuyTrade: Enables or disables the ability to open a new buy trade when certain conditions are met.

-

AllowFirstSellTrade: Enables or disables the ability to open a new sell trade when certain conditions are met.

-

Stochastic_K (Default: 5), Stochastic_D (Default: 3), Stochastic_Slowing: These parameters configure the Stochastic Oscillator, which is used to determine overbought and oversold conditions for entry signals.

-

StochasticOversold: The threshold below which the market is considered oversold, and a buy entry may be triggered.

-

StochasticOverbought: The threshold above which the market is considered overbought, and a sell entry may be triggered.

Risk Disclaimer:

Please note that past performance, including backtest results, does not guarantee future performance. While backtesting helps to optimize the Expert Advisor (EA) based on historical data and market conditions, trading in live markets can be affected by factors that were not present in the backtest, such as market volatility, liquidity, and slippage.

Although backtesting can improve the strategy and increase the probability for long-term success, we must always manage risk appropriately and trade only with capital you can afford to lose.