EA Golden Dance h1 MT5

- Experts

- Sergey Demin

- Versione: 1.0

- Attivazioni: 15

Fully automatic Advisor Portfolio for XAUUSD (Gold) MT5.

Timeframe h1 - all basic strategies;

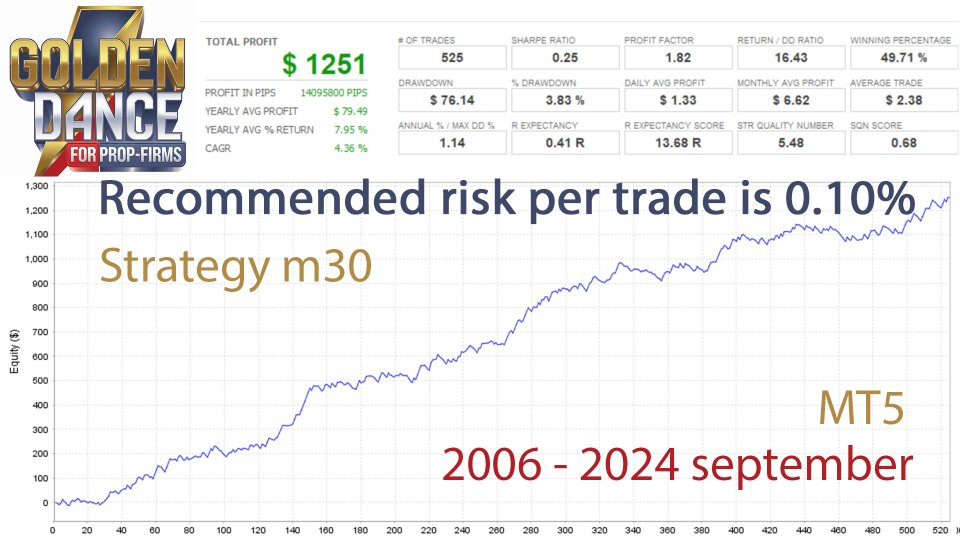

Timeframe m30 - additional strategies.

I use this Advisor in my Portfolio on a prop company.

I created the Advisor entirely for myself for trading on large accounts, from $60,000 and up.

The Advisor is a giant ready-made portfolio that contains all profitable trading strategies specifically for Gold.

Advisor trading principle:

In some planned periods, all the largest currency funds and investment organizations regularly hedge by buying Gold.

Gold is bought in gigantic volumes. The price of this instrument grows accordingly.

This process has always been used, but it began to be actively used since 2010.

This is the approach to trading Gold that the Advisor uses.

The advisor will only buy Gold, and will do this together with giant corporations.

In addition, there is a stable pattern of movement of this instrument during global holidays (for the above-mentioned reason)

The main Holidays are taken into account:

- Chinese New Year;

- Memorial Day;

- Columbus Day;

- Labor Day.

I have set up trading during holidays separately in the advisor settings. You can turn this strategy on or off as desired.

Thus, the advisor has three strategies:

- Trading by Impulse;

- Trading on major Holidays;

- Trading by Trend + Trading by Reverse.

The user must run strategies separately on the H1 timeframe (the H1 strategy and the Holidays strategy are enabled) and on the second separate chart with the m30 timeframe (the m30 strategy is enabled)

Each strategy has a stop loss. For prop firms, a deposit of more than $20,000 is desirable. Enable risk per trade 0.1% (in the advisor settings).

The advisor is fully configured and ready to trade by default (as is).

In the advisor settings, view all the magic numbers (they should all be different, and differ from those if you use other advisors on Gold)

Also set in the settings:

UseMoneyManagement = true;

Risk Percent 0.1% (for prop firms) or 1% for personal real accounts;

Decimals = 2 with LotsIfNoMM = 0.01 (Decimals = 1 with LotsIfNoMM = 0.1)

Do not change MaxLots;

InitialCapital = 20,000 (if you have an account with a prop firm of 20,000 and you only have this one advisor), if you have an account with a prop firm = 20,000, but several other advisors are trading, then it is recommended to allocate a smaller amount for this advisor. You need to divide the deposit amount by the number of advisors that are trading on your account.

Attention:

- The advisor usually opens 2-3 orders, sometimes it can open a series of transactions up to 8 orders at the same time, so do not exceed the recommended Risk per transaction;

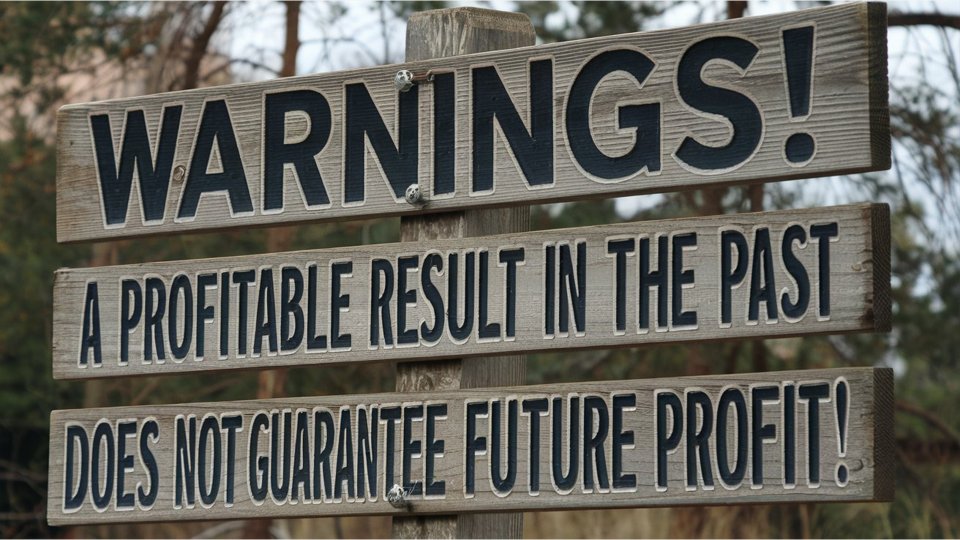

- Profitability in the past does not guarantee profitability in the future!