ML adaptive superTrend for MT4

- Indicatori

- Minh Truong Pham

- Versione: 1.0

- Attivazioni: 10

Introducing the Machine Learning Adaptive SuperTrend, an advanced trading indicator designed to adapt to market volatility dynamically using machine learning techniques. This indicator employs k-means clustering to categorize market volatility into high, medium, and low levels, enhancing the traditional SuperTrend strategy. Perfect for traders who want an edge in identifying trend shifts and market conditions.

What is K-Means Clustering and How It Works

K-means clustering is a machine learning algorithm that partitions data into distinct groups based on similarity. In this indicator, the algorithm analyzes ATR (Average True Range) values to classify volatility into three clusters: high, medium, and low. The algorithm iterates to optimize the centroids of these clusters, ensuring accurate volatility classification.

Key Features

- 🎨 Customizable Appearance: Adjust colors for bullish and bearish trends.

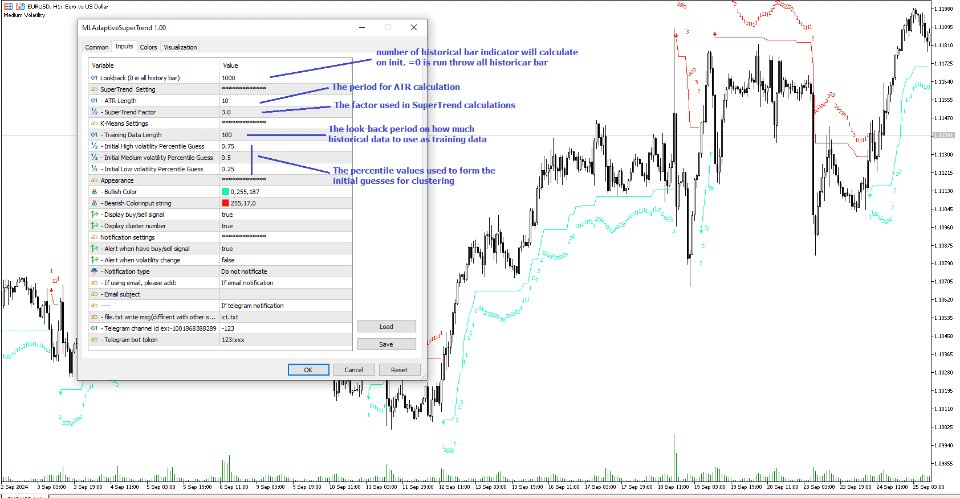

- 🔧 Flexible Settings: Configure ATR length, SuperTrend factor, and initial volatility guesses.

- 📊 Volatility Classification: Uses k-means clustering to adapt to market conditions.

- 📈 Dynamic SuperTrend Calculation: Applies the classified volatility level to the SuperTrend calculation.

- 🔔 Alerts: Set alerts for trend shifts and volatility changes.

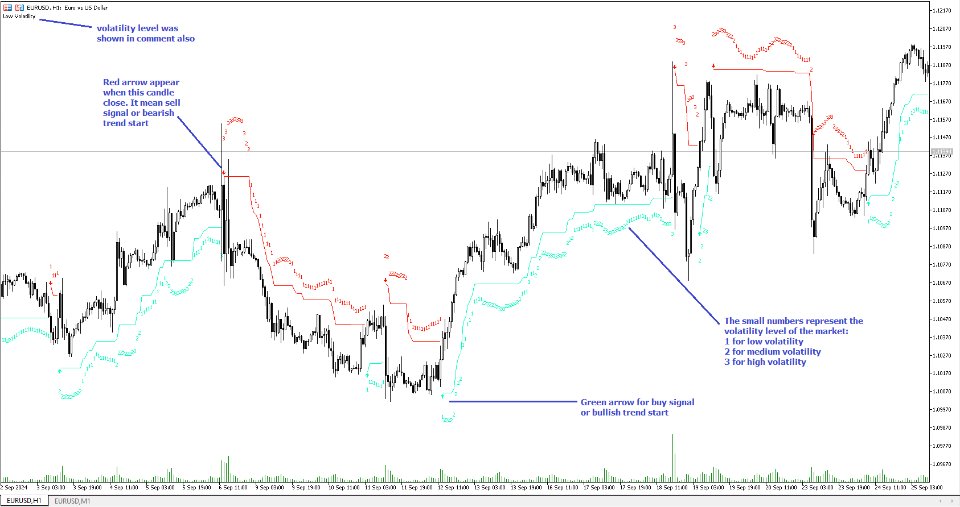

- 📋 Display volatility level as comment

Quick Guide to Using the Machine Learning Adaptive SuperTrend Indicator

🛠 Add the Indicator: Add the indicator to chart. Customize settings like ATR length, SuperTrend factor, and volatility percentiles to fit your trading style. (Figure 1)

📊 Market Analysis: Observe the color changes and SuperTrend line for trend reversals. Use the data table to monitor volatility clusters. (Figure 2)

🔔 Alerts: Enable notifications for buy/sell signal or when volatility change.

How It Works

The indicator begins by calculating the ATR values over a specified training period to assess market volatility. Initial guesses for high, medium, and low volatility percentiles are inputted. The k-means clustering algorithm then iterates to classify the ATR values into three clusters. This classification helps in determining the appropriate volatility level to apply to the SuperTrend calculation. As the market evolves, the indicator dynamically adjusts, providing real-time trend and volatility insights. The indicator also incorporates a data table displaying cluster centroids, sizes, and the current volatility level, aiding traders in making informed decisions.

Add the Machine Learning Adaptive SuperTrend to your MT charts today and experience a smarter way to trade! 🌟📊

How It Trade

There are 2 profitable strategies when using this indicator:

+ You can enter an order when the buy/sell signal appears

+ Or when the signal appears (synonymous with the new trend started), wait until the price retracement nears the trendline. This helps you enter an order at a better price. (figure 3)