Better Saduk v24

- Utilità

- Betty Naliaka Barasa

- Versione: 1.12

- Attivazioni: 5

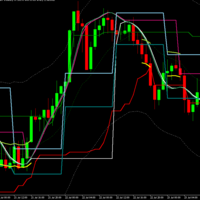

The Saduk v24 indicator is a highly specialized tool designed to improve trading decisions by delivering precise signals based on market dynamics. It integrates momentum, trend direction, and volume analysis to help traders identify optimal entry and exit points, making it valuable for both trend-following and counter-trend strategies.

When used with support and resistance levels, its effectiveness is significantly amplified. These levels represent critical zones where prices often reverse or consolidate due to increased buying (support) or selling (resistance) pressure. Combining these levels with Saduk v24’s signals can enhance the accuracy and timing of trades.

Key Features of Saduk v24:

- Market Momentum Analysis: Helps identify the strength of a trend and potential reversals.

- Trend Direction: Provides clarity on whether the market is bullish or bearish.

- Volume Integration: Confirms whether a price move is supported by sufficient trading volume, adding reliability to signals.

How Saduk v24 Works with Support and Resistance:

- Entry at Support: If the price approaches a strong support level, Saduk v24 can generate a buy signal after confirming a potential bounce.

- Entry at Resistance: When the price nears a resistance level, the indicator can help determine if a breakout is likely or if a sell opportunity exists by signaling a potential reversal.

Advantages of Combining Saduk v24 with Support and Resistance:

- Enhanced Trade Accuracy: Avoid false breakouts and improve trade timing by using confirmations at key price levels.

- Risk Reduction: Filter out low-probability trades by waiting for alignment between the indicator’s signals and price action at critical levels.

- Disciplined Entry Strategy: Promotes patience and ensures that entries are based on stronger confluences.

Incorporating the Saduk v24 indicator with support and resistance strategies leads to better-timed entries, improved risk management, and a more structured approach to technical trading. This combination is ideal for traders seeking high-probability setups.