ICT Power of Three

- Indicatori

- Thomas Bradley Butler

- Versione: 1.0

- Attivazioni: 5

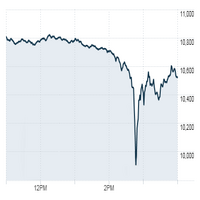

ONLY LOOK TO TRADE DURING TIMES AS SEEN IN SCREENSHOT. START TO LOAD THE INDICATOR BEFORE TO CALCULATE THE BARS SO IT SHOWS THE PHASES ACCORDING TO ICT.

1. London Silver Bullet (3:00 AM - 4:00 AM NY Time)

-

Before 3:00 AM:

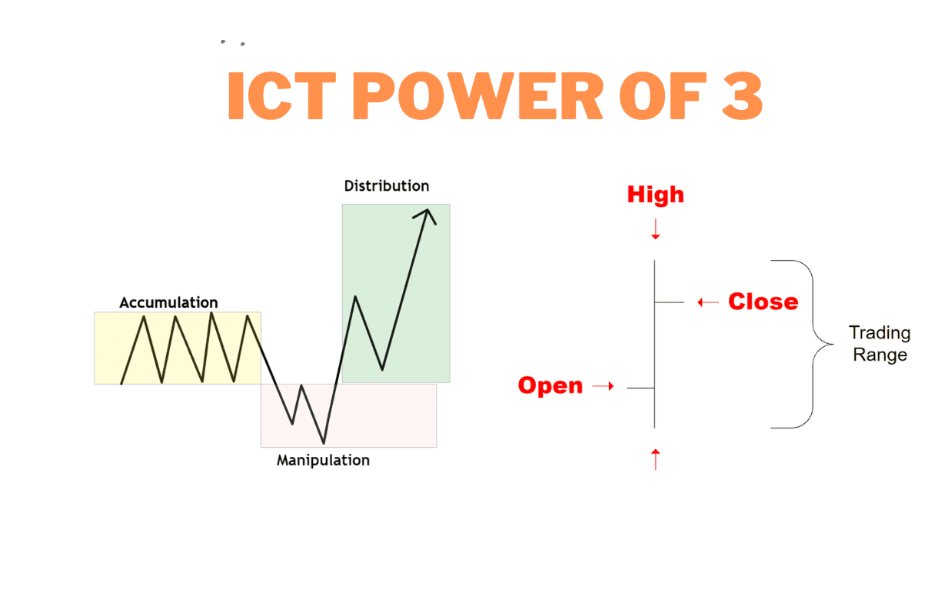

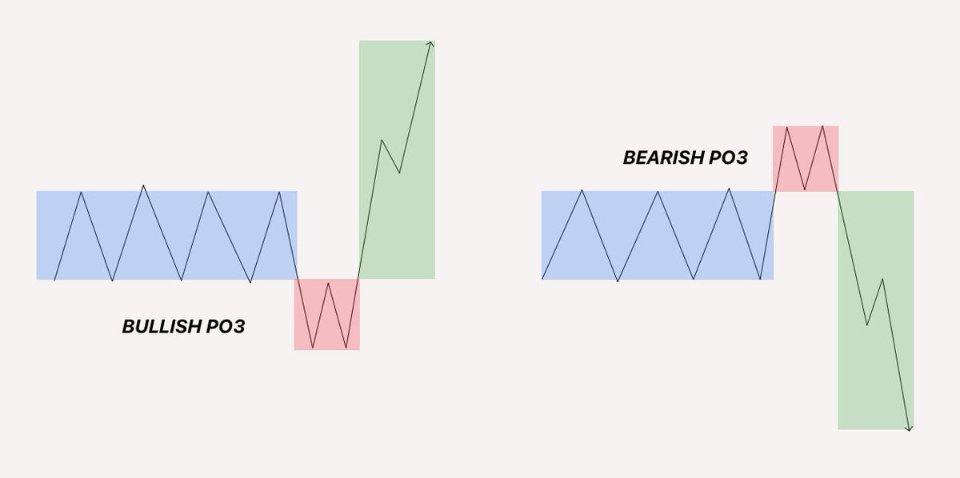

- The market is typically in the Accumulation Phase before the London open, where price consolidates, and large market players accumulate positions. You watch for this quiet consolidation leading up to the manipulation.

-

3:00 AM - 4:00 AM:

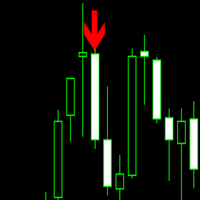

- Manipulation Phase occurs. During this hour, you might see a sudden spike or sharp move in price, which is intended to grab liquidity from traders on the wrong side of the market (stop hunts or false breakouts).

-

Trading Direction:

- After the manipulation (price spike), you trade in the opposite direction of this move:

- If price spikes up (stop hunt), look to go short after confirming a reversal.

- If price spikes down, expect a long opportunity when price starts to reverse upward.

This reversal typically happens as the manipulation phase ends, setting up your Silver Bullet trade.

- After the manipulation (price spike), you trade in the opposite direction of this move:

2. NY AM Silver Bullet (10:00 AM - 11:00 AM NY Time)

-

Before 10:00 AM:

- The early part of the New York session may see Accumulation, where price consolidates. Watch for consolidation or quiet trading before the Silver Bullet window opens.

-

10:00 AM - 11:00 AM:

- During this time, the Manipulation Phase happens, where the market might push prices sharply in one direction, creating false signals or stop hunts.

-

Trading Direction:

- As with the London session, once the manipulation is done, you trade in the opposite direction:

- If price moves up rapidly (false breakout), you would wait for confirmation of a reversal and go short.

- If price drops (false breakdown), watch for signs of a reversal and go long.

- As with the London session, once the manipulation is done, you trade in the opposite direction:

3. NY PM Silver Bullet (2:00 PM - 3:00 PM NY Time)

-

Before 2:00 PM:

- Accumulation may happen again earlier in the afternoon. The market often consolidates quietly before the manipulation phase begins.

-

2:00 PM - 3:00 PM:

- The Manipulation Phase occurs during this hour, where large price movements might act as false signals (liquidity grabs or stop hunts). Again, this is the moment of manipulation.

-

Trading Direction:

- Look for a reversal after the manipulation:

- If price spikes upward, expect a short entry once the price starts reversing down.

- If price drops sharply, look for a long position as the price reverses up.

- Look for a reversal after the manipulation:

Key Principles:

- Manipulation Phase: During the Silver Bullet window (the specified hour), institutional traders often manipulate the market, causing sharp, deceptive moves.

- Opposite Direction Trading: The goal is to trade against these manipulated moves after they occur. Institutions typically reverse the market after sweeping liquidity.

- Confirmation: Always wait for a clear reversal signal after manipulation before entering the trade. This could be through price action or a reversal pattern.

This strategy leverages market manipulation in these key time windows to trade against false moves and profit from the true direction that follows manipulation.