Correlation GridXpert MT5

- Experts

- Adekanmi Ayodele Ojuri

- Versione: 1.0

- Attivazioni: 10

Types of Correlation

Here are the three types of correlation that exist in the financial world:

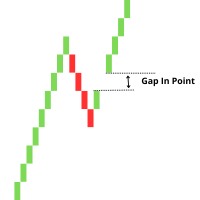

Positive Correlation: When two assets move in the same direction, they share a positive correlation. A classic example can be seen in the relationship between oil prices and the stocks of oil companies. As oil prices rise, the revenue and profits of oil companies generally increase, leading to a rise in their stock prices. This direct relationship highlights a positive correlation. Companies such as Exxon Mobil and Chevron often exhibit this trend.

Negative Correlation: In contrast, negatively correlated assets move in opposite directions. Consider the relationship between gold and the stock market. Investors often flock to gold during market instability, leading to a rise in gold prices as stock asset prices fall. This inverse correlation relationship exemplifies a negative correlation.

No Correlation: Although it’s very rarely in financial markets, some assets have unrelated movements, showcasing no correlation, meaning zero correlation. For instance, the price of wheat and technology stocks generally do not follow a predictable movement pattern with each other.

The EUR/USD and GBP/USD:

An example of strong positive correlation between two currency pairs is: EUR/USD and GBP/USD. This means when the EUR/USD chalks up a high, you’ll typically see a similar scenario on the GBP/USD.

A trader who enters long on the EUR/USD and also the GBP/USD, therefore, is exposed to greater directional risk – essentially doubling your position size.

If you have a directional bias for a given currency, you can spread your risk using two strongly positive correlated pairs.

The EUR/USD and USD/CHF:

Two well-known inversely correlated markets are the EUR/USD and USD/CHF. This means when the EUR/USD chalks up a high, you’ll typically see the opposite form on the USD/CHF, and vice versa.

By acknowledging this correlation, traders can avoid positions that effectively cancel each other out. If you have a directional bias, buying both EUR/USD and USD/CHF will offset the moves in each pair.

Should you look to hedge – defined as a risk management strategy used in limiting or offsetting the probability of loss from fluctuations in prices – you can enter long (buy) EUR/USD and if it starts moving against you, you can hedge the position by selling a negatively correlated pair, such as USD/CHF.

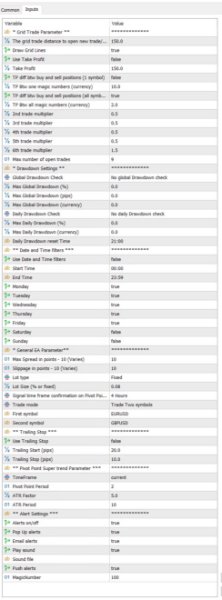

Note: This EA uses the Pivot Points Super trend indicator for entry signals.

Parameters can be adjusted accordingly and this EA can also be used independently of the correlation strategy.