Bias Detection Bot

- Experts

- Niquel Mendoza

- Versione: 1.10

- Aggiornato: 14 agosto 2024

This expert advisor (EA) leverages a sophisticated Bias(ICT) detection strategy, ensuring that your trades align with the prevailing market direction. Whether you're looking to capture trend continuation or anticipate market reversals, this bot provides the tools you need to trade with confidence.

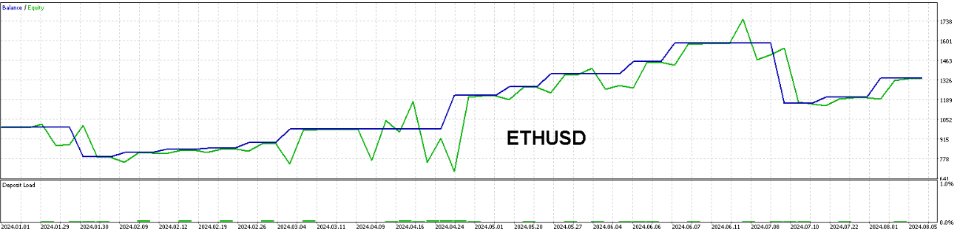

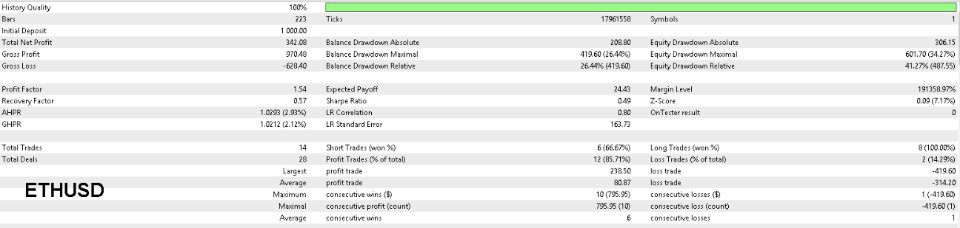

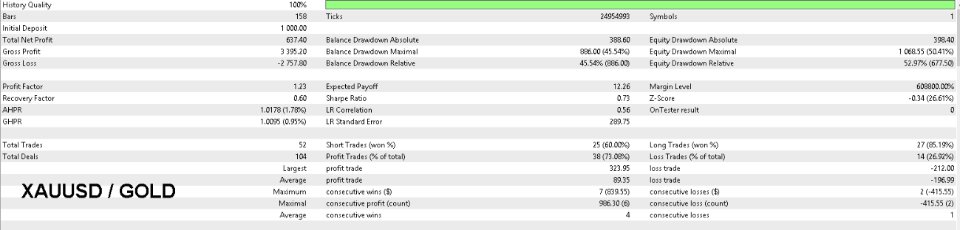

Transparent Testing:

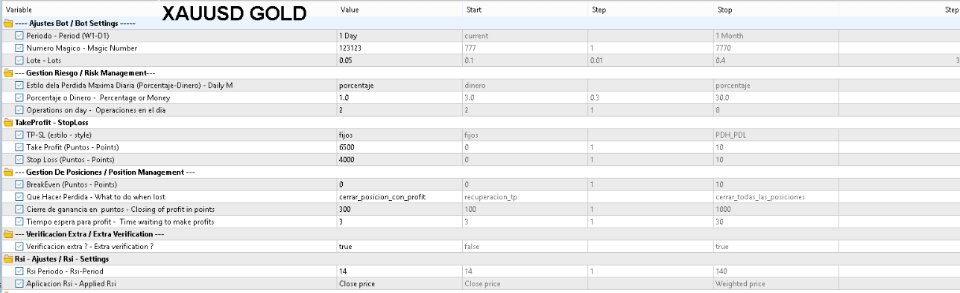

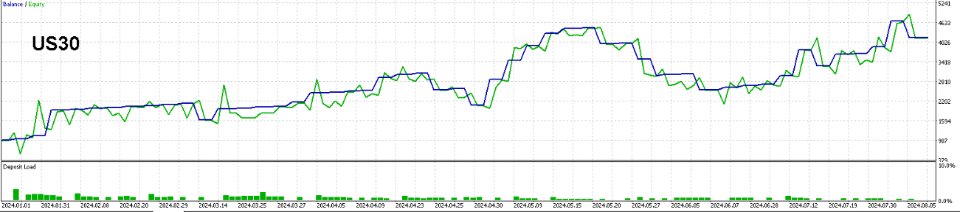

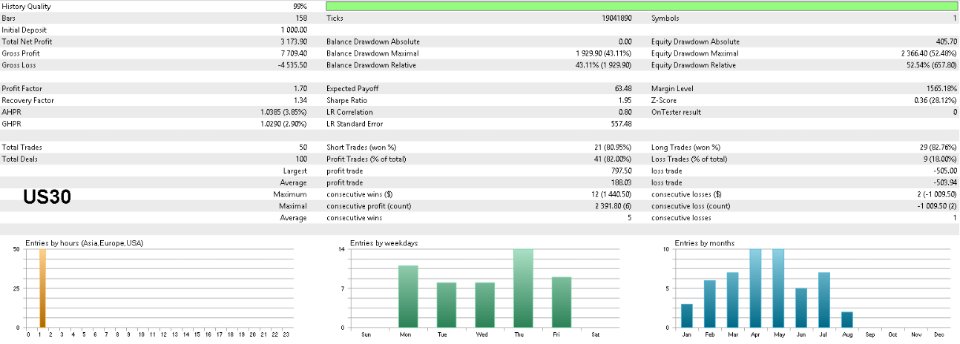

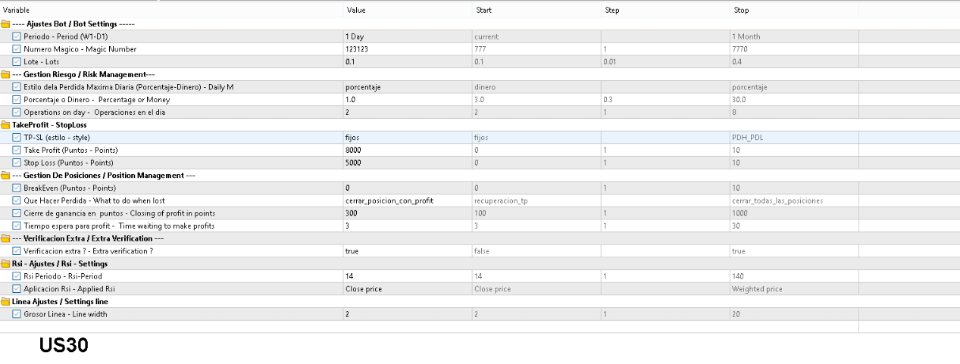

We have performed fully transparent testing on symbols such as US30, ETHUSD, and XAUUSD(GOLD) in the strategy tester.

These results give you a clear view of our bot's performance under various market conditions.

Recommendations:

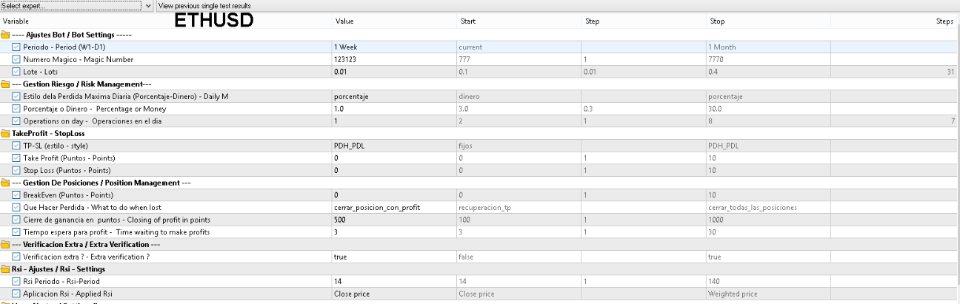

- When choosing the lot size, it is important that you adjust it based on your maximum daily loss allowed. Our bot operates on two time frames: weekly and daily. Depending on the time frame you select, you can optimize your lot size more efficiently.

- Weekly Trading: If you opt for the weekly time frame, we suggest you consider an increase in lot size. For example, if you normally make five trades a week with a lot size of 0.05 in each, you could add these lots together and use a lot size of 0.25 (0.05 * 5 trades) for the one weekly trade in this bot. This allows you to effectively concentrate your risk on one well-planned trade.

- Daily Trading: If you prefer the daily time frame, you can add up the lots of your daily trades to adjust your lot size accordingly. For example, if you make several trades a day, calculate the total lot size you would use in a day and apply it to the bot's daily trade.

- Que Hacer Perdida - What to do when lost: We recommend setting this to “cerrar_posicion_con_profit” for the BackTest.

- Time waiting to make profit - Time waiting to make profits:

- This function defines the maximum time, measured in candles, that the bot will wait before making a decision on the trade if the price has not evolved favorably.

Specific Operation:

- Flexible Configuration: if you select, for example, a value of 3 candles, the bot will evaluate the trade after these 3 candles. If the price has not moved in your favor, the bot will seek to close the position as soon as a profit, even minimum, is reached.

- Close Profit in Points: This parameter allows you to define an additional margin over the entry price, ensuring that the trade closes with a specific profit in points. This value is added to the entry price to determine the exact closing point of the trade, the points can be set with “Closing of profit in points”.

- Extra verification ? - Extra verification ?: Enabling (true) this option allows the bot to be more rigorous and selective in determining the reversal points, ensuring greater consistency in the trading strategy.

Operation:

- Bullish Reversal: With the extra check enabled, the bot will identify a bullish reversal only when it detects two red candles followed by a green candle. Previously, the bullish reversal could include less accurate setups, such as two red candles followed by another red candle.

- Bearish Reversal: Similarly, the bot will consider a bearish reversal when there are two green candles followed by a red candlestick. In previous versions, less strict settings were allowed, such as two green candles followed by another green candle.

Recommended Usage to Maximize Bot Performance

1. Calculation of Break Even on 1-Minute (1M) chart:

- Recommendation: To obtain the greatest accuracy in your trades, we suggest calculating Break Even points using the 1 minute (1M) time frame. This approach allows for fine tuning, ensuring that the break-even point is set optimally according to the immediate market behavior.

2. Setting Stop Loss (SL) and Take Profit (TP) on Daily (D1) or Weekly (W1) Chart:

- Recommendation: If you prefer to use fixed Stop Loss and Take Profit levels, we recommend calculating these levels on the daily time frame (1D) in case you choose daily or (1W) in case it is weekly. Based on our tests, a ratio of 1:1.5 has proven to be effective.

- For example, you can set a Stop Loss of 1000 points and a Take Profit of 1500 points, which balances risk and reward in a solid way (this will depend on the points of each symbol).

3. Use Low Lots to Minimize Risk:

- Recommendation: we suggest trading with small lots, since this bot tends to reduce equity by 10% or more during its operation. Keeping lot sizes low helps to mitigate this risk and protect your capital, allowing for more sustainable trading in the long run.