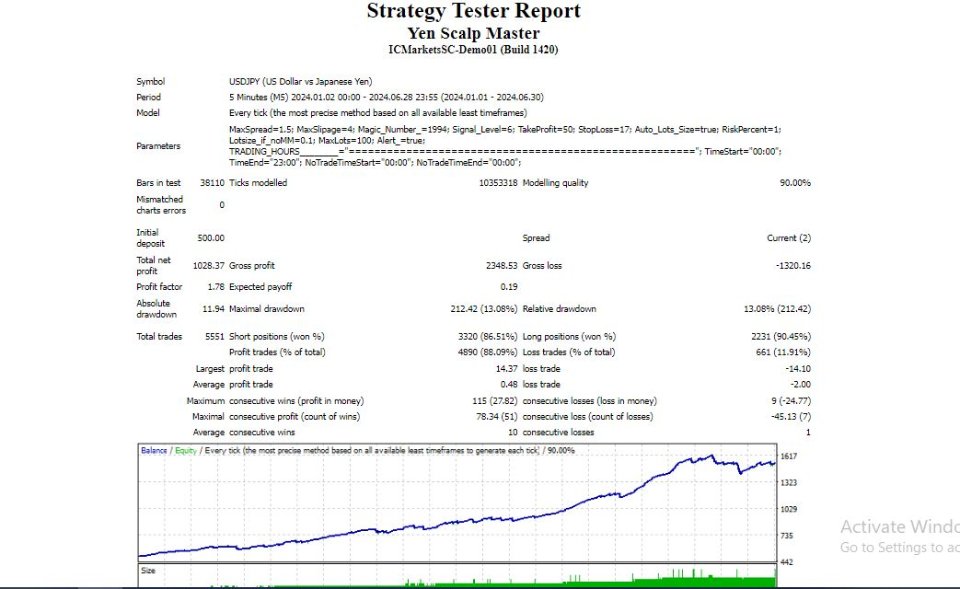

Yen Scalp Master

- Experts

- Augustine Kamatu

- Versione: 1.4

- Aggiornato: 19 agosto 2024

- Attivazioni: 20

Yen Scalp Master is an advanced Expert Advisor (EA) designed for high-frequency trading, specializing in JPY currency pairs with low spreads. It is optimized for scalping, offering traders a robust tool to capitalize on small price movements within short timeframes. With built-in features like dynamic trailing stops, risk management, and a Martingale strategy, this EA is customizable to fit both aggressive and conservative trading styles.

Key Features:

-

Scalping Strategy Optimization:

- Currency Pairs: Optimized for JPY pairs, specifically designed for low-spread pairs such as USDJPY, EURJPY, and others.

- Timeframes: Best performance on low timeframes (M5), suitable for high-frequency trading.

- Trade Execution: Employs precise entry and exit points to capture small price movements, typical of scalping strategies.

-

Dynamic Trade Management:

- TakeProfit and StopLoss: Configurable take profit and stop loss levels, allowing traders to adjust risk/reward ratios.

- Trailing Stop: Implements virtual trailing stops to lock in profits as the market moves favorably.

- Martingale Strategy: Includes a Martingale system that increases position size after losses, aiming to recover losses in subsequent trades.

- Grid Trading: Can deploy grid strategies by placing orders at predefined intervals to capitalize on market retracements.

-

Risk Management Tools:

- RiskPercent: Automatically calculates lot size based on the user-defined percentage of account balance at risk.

- MaxSpread and MaxSlipage: Ensures trades are executed within acceptable spread and slippage levels, preventing costly entries in volatile conditions.

- Dynamic Position Sizing: Adjusts lot size dynamically based on account balance and market conditions.

-

Customization and Flexibility:

- Trade Modes: Offers different trading modes (Aggressive, Moderate) that can be selected based on the user’s risk tolerance and market outlook.

- Time-Based Trading: Users can configure the EA to trade only during specific hours, avoiding low-liquidity periods or news events.

- Dynamic Adjustment: Parameters like TakeProfit, StopLoss, and grid size can be adjusted dynamically based on real-time market analysis.

Recommended trade settings and conditions:

- Timeframe: M5

- Default EA settings

- Low latency VPS

- Low spread 0 to 1 pip