BreakoutGenius base

- Experts

- Pinjia Liu

- Versione: 2.1

BreakoutGenius base is a trading strategy designed specifically for the gold market (XAUUSD) within the financial markets. This strategy leverages market price actions and the breakout of key price levels to identify potential trading opportunities. The essence of the strategy lies in accurately setting Buy Stop and Sell Stop orders to automatically enter the market as gold prices break through these preset levels.

Attention!! Attention!! Attention!! Before using, please turn off this parameter in the parameter Settings .

Please_close_before_use=false;

Please use the strategy setup files! (Download XAUUSD 2 Decimal.set setup file) (Download XAUUSD 3 Decimal.set setup file)

Test Report :(Download XAUUSD 10 year Test Report)

Product Promotion:

BreakoutGenius Full feature version is on sale now, please click for detailsStrategy Signals: Click to view strategy signals

Strategy Principle:

- Identification of Key Price Levels: Through the analysis of historical data, key support and resistance levels for gold prices are identified. These levels are pivotal points for future price trend transitions, reflecting the power struggle between buyers and sellers.

- Order Setup: Anticipating a price breakout of these key levels, Buy Stop or Sell Stop orders are placed above or below these levels, respectively. This provides the strategy with an automatic trigger mechanism, enabling trade execution without the need for real-time monitoring.

- Breakout Confirmation and Execution: Once the price successfully breaks through and activates an order, the strategy automatically executes a buy or sell operation, setting corresponding stop loss and profit targets. A breakout is considered a signal of market direction change, hence quickly entering the market post-breakout captures the major part of the price movement.

- Risk Management: The strategy emphasizes risk control, with the potential loss from each trade strictly contained within an acceptable range for the investor. The stop loss is set at a certain distance from the breakout point, protecting the account from significant losses while avoiding premature market exits due to minor fluctuations.

- Profit Target Planning: Profit targets are set based on historical price behavior and the key levels of order points, ensuring each trade has a clear profit realization plan.

parameter setting:

- Please_close_before_use Turn off before use, parameter set to false

- CustomComment The order comment

- MagicNumber The order magic number, used to distinguish different trading strategies.

- KaufmanEffRtoPrd The period length for the Kaufman Efficiency Ratio.

- ProfitTargetCoef The profit target coefficient, used to calculate the order's target profit level.

- StopLoss The order's stop loss level.

- AST_TrailingStop The trailing stop loss trigger point in pips.

- ASTTrailingStep The trailing stop loss step size in pips.

- smm parameter description

- UseMoneyManagement The money management switch, if turned on, the following money management parameters will be used.

- mmRiskPercent The risk percentage per trade.

- mmLotslfNoMM The fixed lot size to use when money management is turned off.

- mmMaxLots The maximum position size limit.

- sdtw parameter description

- DontTradeOnWeekends The switch to avoid trading on weekends.

- FridayCloseTime The Friday market close time.

- SundayOpenTime The Sunday market open time.

- seod parameter description

- ExitAtEndOfDay The switch to exit at the end of the trading day.

- EODExitTime The end of day exit time.

- seof parameter description

- ExitOnFriday The switch to exit on Fridays.

- FridayExitTime The Friday exit time.

- sltr parameter description

- LimitTimeRange The switch to limit the trading time range.

- SignalTimeRangeFrom The trading start time.

- SignalTimeRangeTo The trading end time.

- ExitAtEndOfRange The switch to exit at the end of the trading time range.

- OrderTypeToExit The order type to exit.

- smtpd parameter description

- MaxTradesPerDay The maximum number of trades per day.

Usage Instructions:

- Currency Pair: XAUUSD

- Time Frame: H1

- Minimum Deposit: $10000

- Account Type: ECN, Raw or Razor, with very low spreads.

- Brokers: IC Markets, Exness - With the lowest spreads

- Important Note: Using a low-spread account is crucial to achieve the best results!

- Setup Files: (Download XAUUSD 2 Decimal.set setup file) (Download XAUUSD 3 Decimal.set setup file)

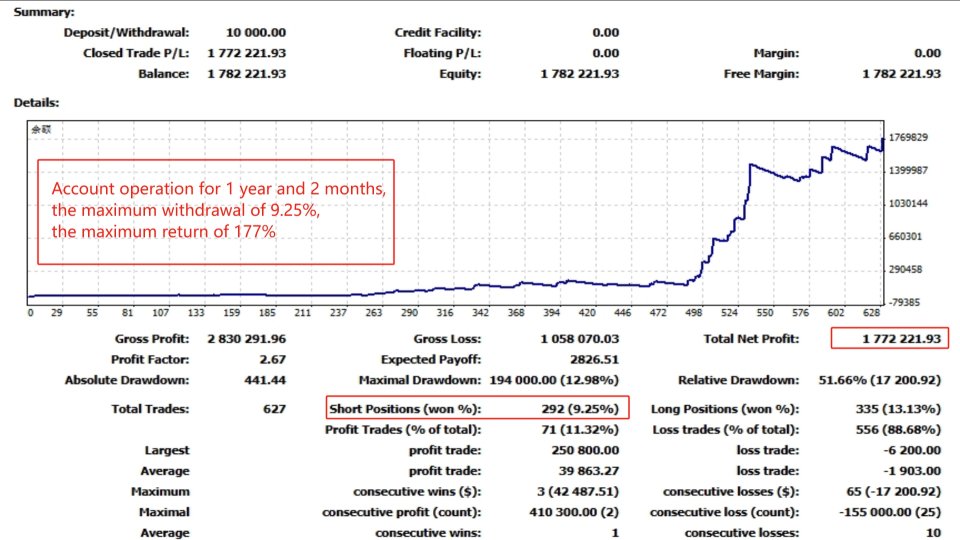

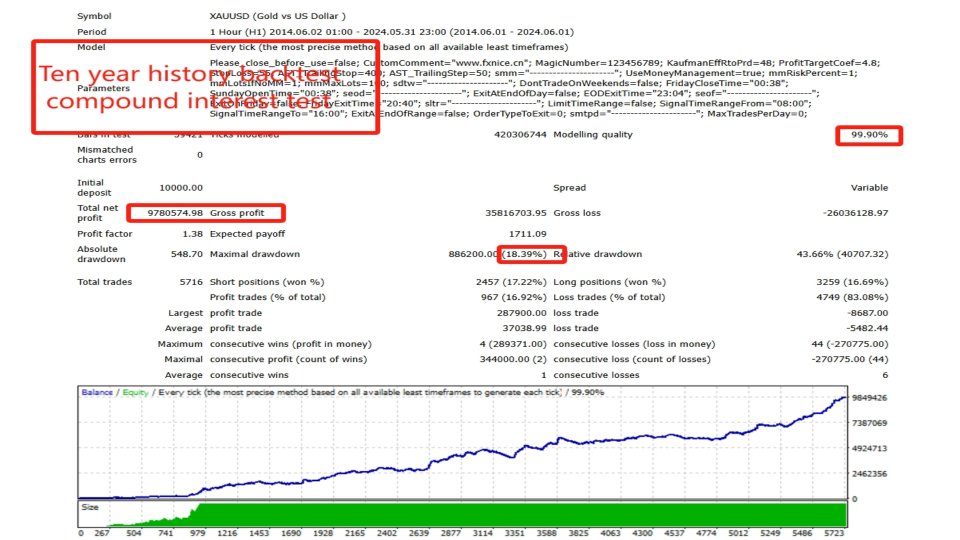

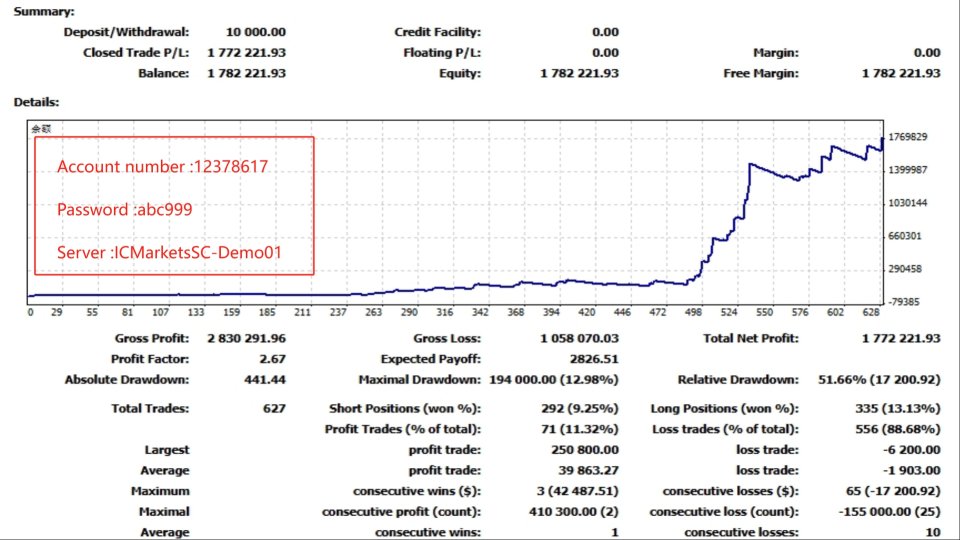

Backtesting:

Simply use the preset settings to run on the XAUUSD H1 time frame.