Sylvaris Expert

- Experts

- Ruengrit Loondecha

- Versione: 1.1

- Attivazioni: 10

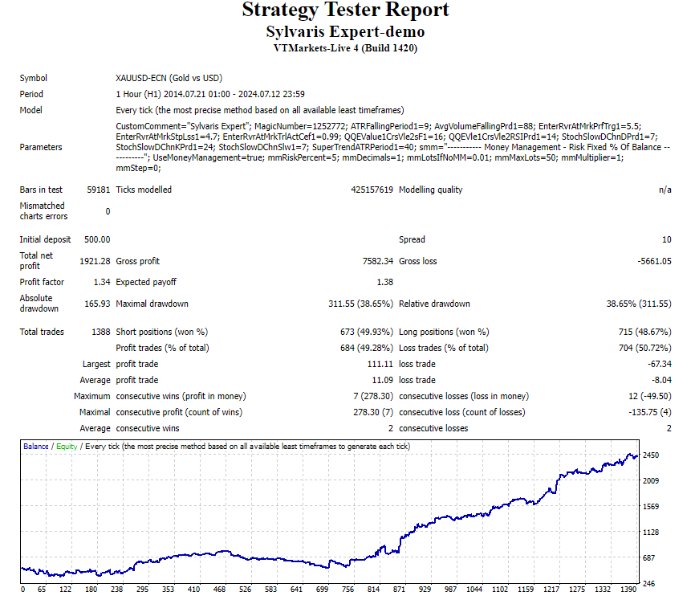

- Sylvaris Expert

- Working best with GOLD - H1

- Require minimal 500$ for 0.01 (AutoLot feature inside)

- Optimize update monthly. stay in Comment

- Live trade @ https://t.me/lullfrx

Indicators and Concepts

-

Quantitative Qualitative Estimation (QQE):

- QQE is an enhanced version of the Relative Strength Index (RSI) that uses a smoothed RSI and additional volatility filters. It helps identify the trend's strength and potential reversal points, offering a more refined signal compared to standard RSI.

-

Average True Range (ATR):

- ATR measures market volatility by calculating the average difference between the high and low prices over a specified period. It helps set stop-loss levels by providing a sense of the average price movement.

-

Average Volume (AvgVolume):

- AvgVolume indicates the average trading volume over a specific period, giving insights into market activity and confirming the strength of price moves. High volume often validates the direction and momentum of price movements.

-

SuperTrend:

- SuperTrend is a trend-following indicator that provides buy and sell signals based on ATR and a multiplier. It helps determine the current trend and potential reversal points by acting as dynamic support and resistance.

-

Stochastic Oscillator (Stoch):

- The Stochastic Oscillator measures the closing price relative to the range of highs and lows over a specified period. It helps identify overbought and oversold conditions, signaling potential price reversals.

Trade Style

-

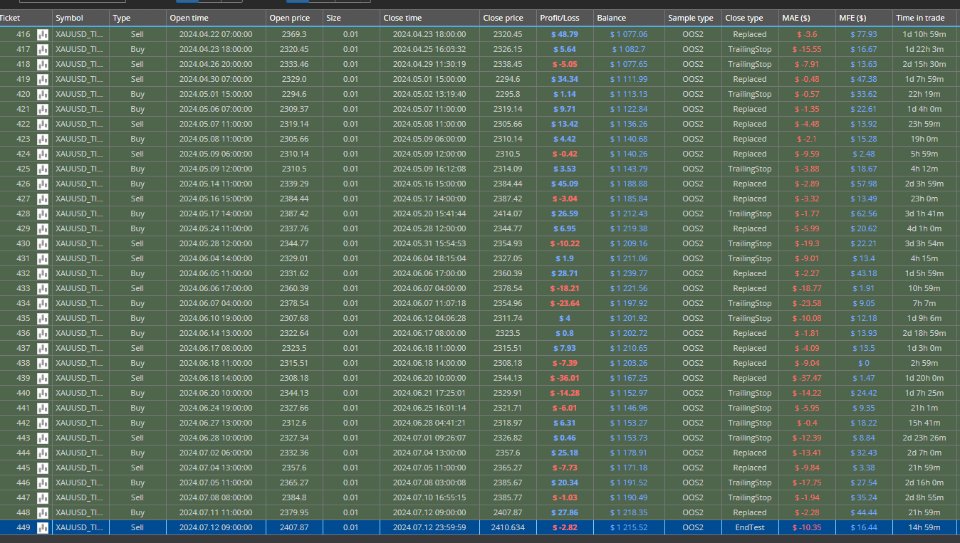

Open/Reverse Order:

- This strategy involves entering a new trade (open order) or switching the direction of an existing trade (reverse order) based on the signals from the indicators. For example, a buy signal could trigger a new long position or reverse a short position, depending on the market conditions and indicator signals.

-

Take Profit (TP) and Stop Loss (SL) with Percentage:

- TP and SL levels are set as a fixed percentage from the entry price. This approach defines the risk and reward parameters of each trade, ensuring consistent profit-taking and loss management.

-

Session Close Trailing Stop:

- A trailing stop is set and adjusted based on price movements during a trading session. As the price moves in favor of the trade, the trailing stop adjusts to lock in profits while allowing for some fluctuation. The trailing stop is updated at the close of each session, providing a dynamic exit strategy that adapts to daily price action.