RSI MA Grid Pro Advanced Automated Trading EA

- Experts

- Ong Kai Wen Kelvin

- Versione: 1.0

- Attivazioni: 5

Introducing the RSI_EA, an advanced automated trading Expert Advisor (EA) designed for the MetaTrader 4 platform. This EA combines the power of the Relative Strength Index (RSI) and Moving Averages (MA) with sophisticated money management strategies to maximize your trading potential.

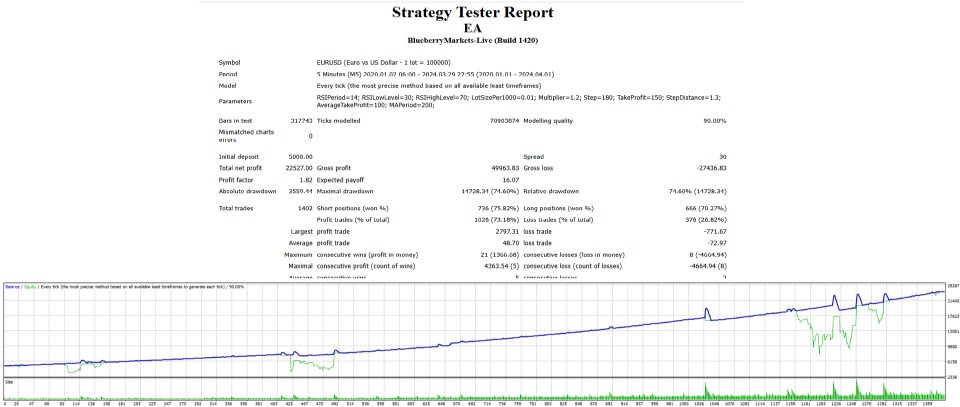

Rigorous backtesting from 2020 to 2024 to ensure that your capital is safe without stop outs using

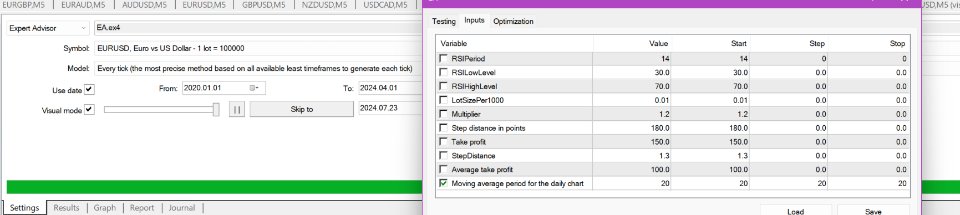

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

To be used on EURUSD 5M Chart - KEY SETTINGS for live trade: RSILowLevel: 30, RSIHighLevel: 70, LotSizePer1000: 0.01, MAPeriodsmall: 20 (FOLLOW THE SETTINGS SHOWN ON STRATEGY TESTER)

It is optimum to ensure maximum profit with no stop-outs

The settings are there to try on your own for back-testing

Key Features

-

Relative Strength Index (RSI) Strategy:

- RSI Period: Default set to 14, allowing you to gauge the market's momentum over 14 periods.

- RSI Levels: Buy when RSI is below 30 and sell when RSI is above 70, indicating oversold and overbought conditions respectively.

-

Dynamic Lot Sizing:

- Lot Size Per $1000: Scales your lot size according to your account balance, ensuring appropriate risk management.

- Multiplier: Increases lot size for subsequent trades to capitalize on favorable market conditions.

-

Sophisticated Order Management:

- Step Distance: Controls the spacing between new orders to manage risk and capitalize on market movements.

- Take Profit: Ensures profitable trades by setting take-profit levels.

- Average Take Profit: Adjusts target prices dynamically based on the average entry price of open positions.

-

Advanced Filtering with Moving Averages:

- Daily Moving Average (MA) Filters: Uses 20, 50, and 200-period moving averages to validate trade signals, adding an extra layer of confirmation

Benefits

- Automated Trading: Eliminates emotional trading by executing trades based on predefined criteria.

- Risk Management: Dynamic lot sizing and step distances help manage risk effectively.

- Precision and Efficiency: Combines RSI and moving averages to ensure high-probability trade entries.

- Scalability: Suitable for various account sizes due to its adaptive lot size calculation.