OrderImbalanceIndicator

- Indicatori

- Aparecida Bertelli Bruna

- Versione: 1.0

- Attivazioni: 5

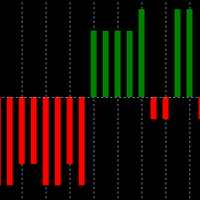

The Order Imbalance indicator, crucial in the toolkit of traders and market analysts, serves to highlight significant disparities between buy and sell orders within a specific financial asset. Essentially, it reveals the difference in volume between buy and sell orders over a defined period, typically in short, frequent intervals (You can choose the frequency).

For traders, Order Imbalance can be interpreted as a signal of buying or selling pressure in the market. A positive imbalance, where sell orders exceed buy orders, may indicate potential upward price momentum as demand outstrips immediate supply. Conversely, a negative imbalance, with more buy orders, could signal imminent selling pressure, potentially leading to a decline in the asset's price. (This happen because sellers wants the more liquid price to not increase the risk of market)

Beyond its direct application in technical analysis, Order Imbalance is often used in conjunction with other indicators to confirm emerging trends or market reversals. This dynamic metric allows traders to adjust their strategies based on shifts in supply and demand dynamics, offering valuable real-time insight into market sentiment.