Secutor CFD MT5

- Experts

- Evren Caglar

- Versione: 1.1

Why Secutor and If It Can Be Used With Prop Trading Challenges?

We took the institution way in the development of Secutor EA. Our starting point was mathematics and probability theory. This is how Secutor EA was born.

Secutor EA is the second free trading algorithm from Institution Breaker. With Cybele EA, we have completed the set of free trading algorithms. We advise using Secutor EA and Cybele EA together. Our simulations have shown better risk-return ratios when Secutor EA and Cybele EA are used in conjunction. Portfolio results are provided in the screenshots section.

You can read my article for how to obtain x13x return with portfolio diversification.

For Which Trading Instrument Secutor Can Be Used?

Secutor EA is developed to be used with DAX index trading with M30 timeframe. You can click to download the set file.

Note: After you install and share a review on the page of the Secutor, you can join the 'Institution Breaker Trading Group' where I share key knowledge about trading, markets, how to correctly setup an EA and more. Just message me for the link.

Why Standard Forex Theory Almost Always Creates Sooner Or Later A Significant Pressure On Our Margins?

That said, in the development process of Secutor EA and Cybele EA, we paid particular attention to avoid this ‘correlation effect’. Secutor EA and Cybele EA rely on completely different trading algorithms and trade completely different instruments: DAX and NASDAQ.

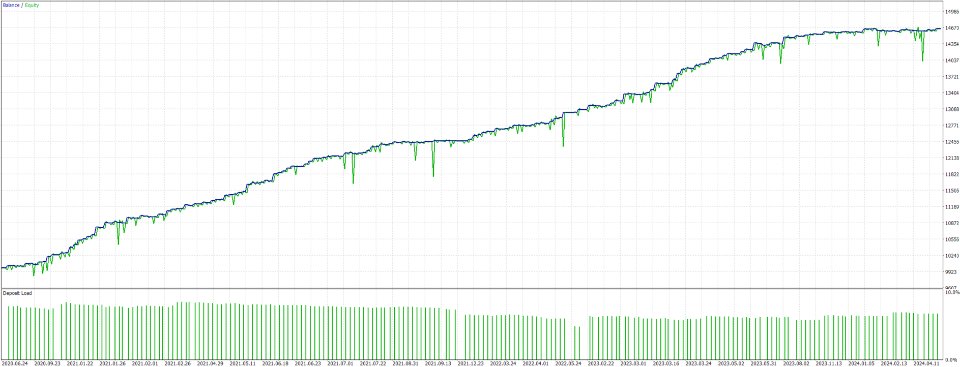

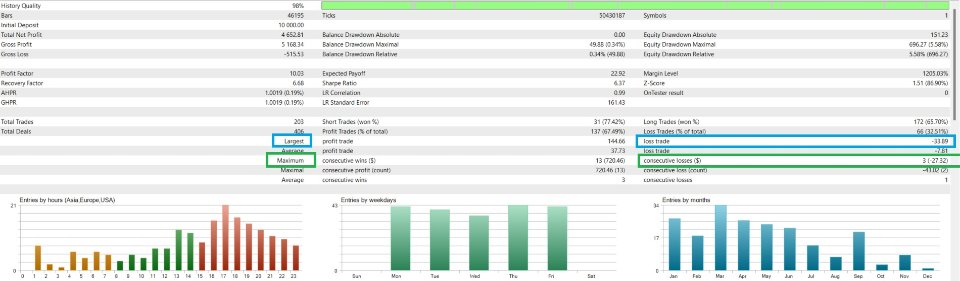

Robustness and Consistency Tests

We also would like to add that Secutor EA has passed rigorous testing procedures for consistency and reliability. - Secutor is based on a complex trading algorithm but all these complexity put under the hood. Even first time EA users can easily run without hassle.

- As we stated earlier, for developing a successful trading algorithm, you must use different testing tools. Secutor is developed completely outside of the MQL5 platform.

- During the development process, significant time and effort has been carried out for the robustness checks with 'what if scenarios', 'Monte Carlo simulations', 'out of sample tests' and 'sequential optimization' method.

- Secutor is also tested in many brokers and the consistency and robustness of test results are compared under different tick-data environments.

Can and How Secutor Be Used In Prop Trading Challenges?

- Short answer is yes, it can be used.

- Secutor does not use grid and martingale strategies.

- It is also not programmed for high frequency trading.

- Secutor is a position trader and has a complex algorithm to decide trade entry points.

- Secutor presents many time and day adjustment parameters which some prop companies require.

- Every position comes with TP and SL points as soon as an order is placed.

- Secutor provides a perfect risk-return ratio and is safe up to the 5% daily DD limit.

- Secutor is one of the safer algorithms on marketplace for 'Black Swan events in financial markets.

- Therefore, Secutor can be used in prop company challenges as long as you use it with correct settings.

https://www.mql5.com/en/blogs/post/757739

Before First Time Use Secutor :

- To start with, we provide Secutor 'free of charge'. You should never think it is not a qualified trading algorithm. It does quite a good job with DAX and can beat many expensive trading algorithms with its safeness and robustness.

- Always be kind and do not hesitate to ask questions. If you are happy with it, please leave a comment. The support is important for us to present more developed trading algorithms.

- Remember, Secutor is designed only for DAX and only with M30 timeframe.

- Recommended minimum balance is $1k for 0.1 lot standard accounts and $100 with 0.01 lot for the cent accounts.

- We strongly recommend you use Secutor in a demo account for at least 2-3 weeks before you put it in the real or prop company accounts. (This rule should be applied to every EA you use.)

- We strongly recommend you test Secutor with at least 2 strategy testers from different brokers. Return and risk should be more or less the same. If you have more than 20% difference in results across brokers, you may need to re-calibrate some parameters. (This rule should be applied to every EA you use.)

- Grid and martingale strategies are not used. When EA places an order, it places TP and SL points straightaway.

- The starting lot is 0.1 lot for standard accounts. That is, if the index moves from 10000.0 to 10001.0 your gain is $1. Depending on your equity, you may prefer increasing or decreasing the lot size. In your broker, you need to check this in the demo account.

- As for some brokers, when the index moves from 10000.00 to 10001.00, 0.1 lot generates $0.1 gain. For example, for the ICMarkets, you need to change the lot size from the default 0.1 lot to 1 lot to match our results.

You can control the following parameters:

- Ulcer Index Period: The period of Ulcer Index

- Move Stop Out Coefficient: Imagine the situation: You open a position and the position turns positive for the beginning but does not hit TP. Now imagine price started to move opposite direction. Should you wait or get out? If opposite signal is received, Secutor closes this open position and does not allow to turn from positive to negative. This is complex algorithm and this coefficient controls the magnitude of this decision making progress.

- Adjust Tick Size: As we noted earlier, the data flow can change from one broker to another, which is the main source of failures of expert advisors. This parameter normalizes the tick values to a standard value. So, you should not have a huge difference across different brokers when this parameter is set to true.

All other parameters are self explaining. You need to ask your broker the server time and you should adjust the time in line with your broker's time seen in market watch of the terminal.

NICE!