HINN Lazy Trader

- Utilità

- Georg Vahi

- Versione: 2.1

- Aggiornato: 9 novembre 2024

- Attivazioni: 5

$450 (-20%) instead of $565 until 11/29

Be sure to watch this video before using

A community for users, product discussion, update news, and first line of support

Use Webmoney For payments in cryptocurrencies.

How I use this algo tool

Lazy Trader is NOT SUITABLE FOR SCALPING EVERY MINUTE MOVEMENT, ESPECIALLY IN CRYPTO. WITHOUT UNDERSTANDING WHAT IS HAPPENING ON THE CHART, THERE IS NO POINT IN BLINDLY HOPING FOR PROFITS!

Lazy Trader does NOT USE openAI chat-gpt-4 technologies, which are added to descriptions for product promotion including on the MT market. It includes a system for collecting statistical data which is currently operating in a completely autonomous mode and is not directly connected to learning mechanisms. In other words, the foundation for learning has been laid and will be implemented in the future, but at the moment it is effectively switched off.

Lazy Trader complies with CFT standards and does NOT use "cheating" methods prohibited by most brokers. That means no high-frequency trading, no arbitrage, no attempts to profit from quote pinging. Lazy Trader operates as closely as possible to how a human would, only better.

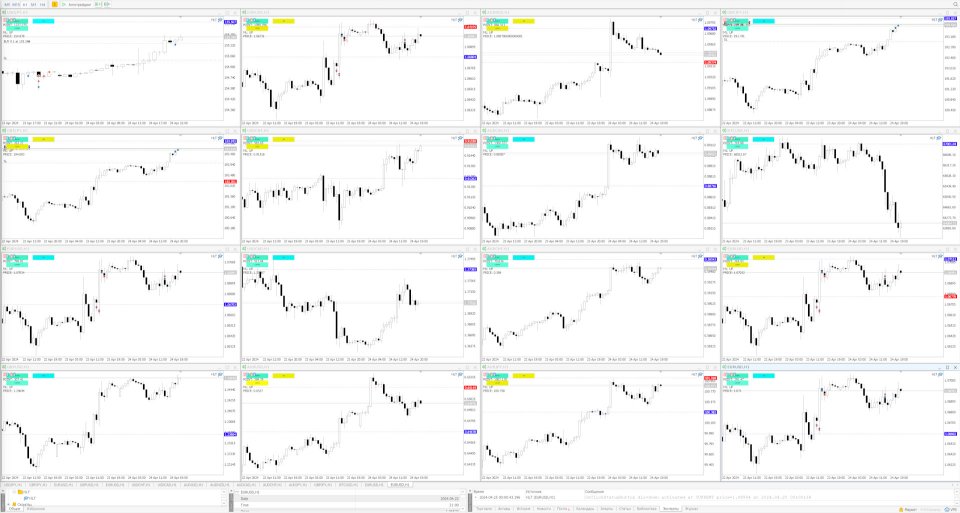

Suitable for trading with any futures, including crypto assets.

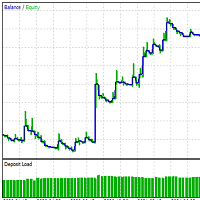

Lazy Trader autonomously sizes positions, waiting for "confirmation"—a combination of indicators and patterns in the user-specified interest zone. It employs various approaches of modern technical analysis/smc, including proprietary ones: using the structure by Larry Williams combined with imbalances (SMC), liquidity (SMC), the concept of a balanced range (HINN). Entry models have 5 different variations, using analysis across several timeframes. Some of the entry models are beyond the usual hyped methodologies, which positively affects the win rate. Each opened position has a computationally determined stop loss not too tied to the structure in the classical sense. It controls losses within a set range of values. It uses a system of intermediate fixations, which implies that Hedging Mode must be allowed by your broker for the account where the tool is used. Optionally, it trails the stop after intermediate fixations. It has flexible settings for stop loss lengths, volume of each position acquired, distribution of volume across intermediate fixations, restrictions on allowable losses per day, and minimum risk-reward per deal.

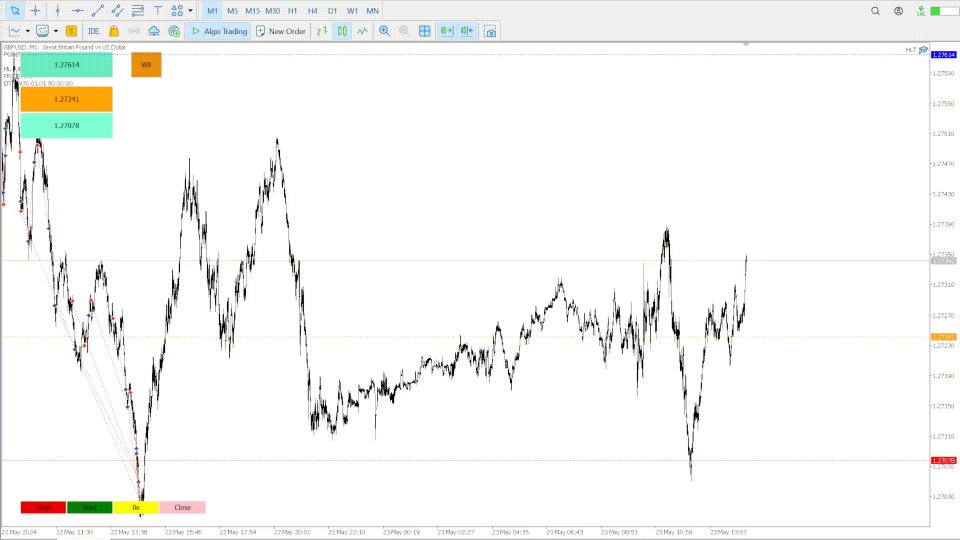

Timeframes for position seeking are limited to three combinations: AGGRESSIVE mode for working from M5-15-H1 interest zones (entry uses timeframes M5 and below, M15 in exceptional cases), NORMAL mode for working from H1-4 interest zones (entry uses M15-M5-H1), CONSERVATIVE mode for working from D1 interest zones (entry uses H1-M15-H4). Depending on the selected mode, the timeframes and their combinations for seeking entry models will change accordingly.

For a quick start of the algorithm, you only need to specify the price target up to which positions will be sought and acquired. Other levels are optional, and without specified information about them, the algorithm will operate within general restrictions.

Basic settings, available by default, are optimized for intraday trading from M5-M15-H1 interest zones for major Forex pairs such as EURUSD and GBPUSD, considering the specifics of working on a prop account. Tested on funded next and ftmo, there are no restrictions on trading using Lazy Trader with these companies. For other prop firms, it is recommended to contact their support directly before use. Additionally, before using, it is recommended to check typical spreads for your broker for each specific pair and add this value to the size of the minimum allowable stop loss, in ticks.

Settings for stop loss length have been fully automated since version 1.24. Manual adjustment remains possible. The length of stops in manual mode is specified in ticks (last digit after the decimal point) for any assets. For recommendations on a specific asset, contact the official Discord directly (*).

The number of trades simultaneously opened by HLT within a single trading idea is an adjustable parameter. If no restrictions are necessary, leave it at zero.

The translation of the stop to break even can be adjusted depending on the specified risk-reward level to which the price must reach.

The choice of trading time has been implemented since version 1.24. It is possible to set any number of trading time ranges to the second. Additionally, in 1.24, flexible settings were introduced for transitioning all positions to break even and for their forced closure according to the specified time.

Starting from version 1.26, a mechanism for aggressive trailing of positions has been implemented in three variations: by RR, by ticks and by dollars of price movement. Also, starting from 1.26, a session trading mechanism has been implemented.

The maximum allowable risk is stated in dollars and applies to the entire deposit and all open chart windows cumulatively, if stated as more than 10. Values up to 10 are considered as a percentage of the deposit. The risk is common for the day regardless of who opened the trade—algo or manually. If you want to limit this amount to a certain percentage of the deposit, calculate the desired number in dollars and specify it in the settings. For example, specifying the value of maximum allowable drawdown as $500, new positions will be opened as long as within the day, considering potential losses on already open positions, such value is not reached that the opening of another position could potentially lead to losses totaling more than $500. For instance, if you have already recorded a loss of $200 today, and there is another open position whose stop loss activation would increase the loss by another $200, then the maximum allowable risk for a transaction that may be opened is no more than $99. If the risk values specified in the settings, when recalculated in dollars, exceed this amount, the transaction will be skipped. However, if an open transaction closes in profit/break even/a small loss, for example, if it is partially fixed at the moment, and thus the maximum loss that can be incurred on the remainder of this position will amount to $50, then in that case the algorithm can open a transaction with a maximum theoretical loss of $249 (500-200-50-1).

There are no restrictions on the number of trading ideas in operation at the same time; to launch several simultaneously on one asset, open a new chart for each and use Lazy Trader in each window with unique settings. General restrictions, such as the size of permissible losses per day, will be calculated based on all trading operations on the account that day across all instruments/pairs/deals.

It is NOT recommended to leave it on overnight or any other extremely low volatility period especially in an aggressive mode of position seeking. Before high volatility news, such as inflation news, characterized by unreasonable spreads and low broker responsiveness, it is recommended to pause position seeking, and already open positions should be secured or manually closed completely.

------

Starting from version 2.0:

Additional operating modes have been introduced.

A semi-automatic mode is available, allowing for directional selection without specifying exact targets.

A fully automatic mode is available for trading assets within the BIASMACHINE research.

For BIASMACHINE research assets, a news rule with automatic identification of high-impact events is available. Based on Investing.com's version, there are certain limitations.

Displays are available for session liquidity pools, the NYM level, and several important levels according to BIASMACHINE’s analysis.

For any questions, complaints, suggestions, and in any unclear situation, for a prompt response, contact the Discord (*)

(*) Discord community for users, product discussion, update news, and first line of support

(*) This version of HINN Lazy Trader completely lacks a server part. This means that the algorithm works only as long as your computer (or VPS) is turned on, the MetaTrader 5 terminal is running, and the computer is in an active state (not sleeping). If the computer goes to sleep or turns off, so does the advisor, meaning positions will neither be opened nor partially fixed. The product does not send your data anywhere, does not perform any hidden operations based on your actions.

(*) Due to the peculiarities of the emulator built into the MacOs-based version of MetaTrader for MAC series M processors, delays are observed when using it. In some cases, this can affect the correctness of certain mechanisms. For owners of this technology, it is highly recommended to use VPS services or run MetaTrader with Lazy Trader on computers with x86 architecture (usually installed with Windows "out of the box").

Settings:

- MODE -- operating mode

- RISK PER TRADE -- risk per opened position

- DAILY LOSSES -- maximum allowable drawdowns on the deposit per day

- ACTIVE TRADES -- maximum number of simultaneously opened trades per trading idea

- STOP LOSS MIN-MAX -- minimum and maximum stop loss length

- MIN RR -- minimum risk-reward per deal

- PARTITIALS -- distribution of volume across intermediate fixations

- TP1 -- RR to the first intermediate take

- TP2 -- RR to the second intermediate take

- BE -- RR to move to break even

- TIME BE -- mode of moving to break even by time

- TIME CLOSE -- mode of closing positions at specified time

- TEST MODE -- for strategy tester purposes ONLY - https://youtu.be/2NE8COr9-Bk

входил в число бета-тестеров, без ошибок и багов удалось поработать на релизном продукте (или около него) трое суток. Работа была в тупую: один актив, евро. В Лонг и в шорт без указания пои, просто видишь формацию - открываешь сделку, что меня удивило, что в результате 13 сделок за трое суток софт отторговал в +1.5% к депозиту, при том, что торговля была от балды и цена только один раз дошла до таргета, весь плюс был на частичных фиксах. Софт хорошо считывает формации и использует модели входа и контроль рисков с частичной фиксацией, со своей задачей справляется на ура Спустя неделю торгов на демо взял проп, не могу теперь представить свою торговлю без ХЛТ) Огонь, Георг - жму руку)