MACD Divergence and TFR for MT4

- Indicatori

- Krzysztof Janusz Stankiewic

- Versione: 1.0

- Attivazioni: 5

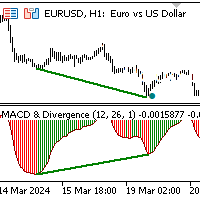

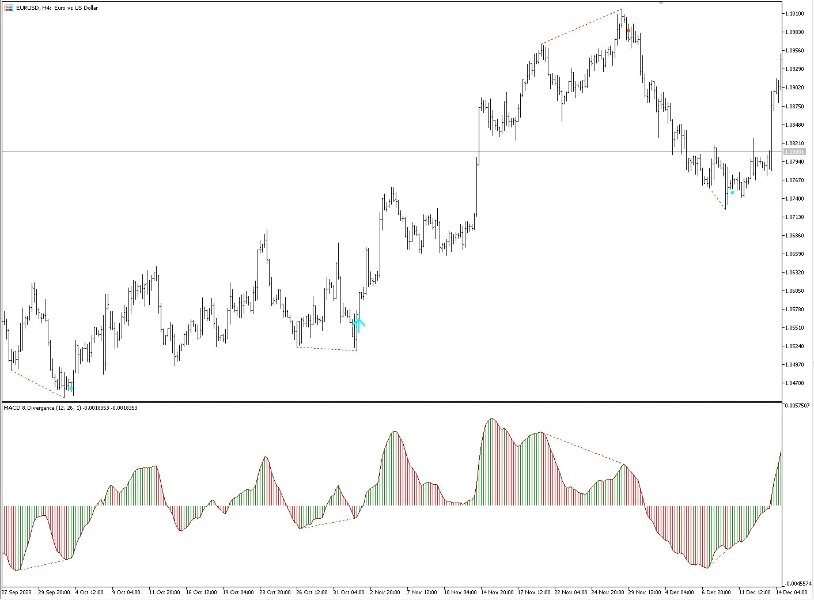

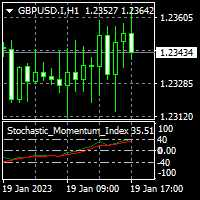

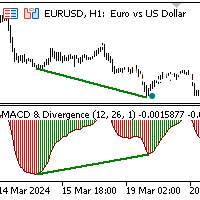

The indicator identifies divergence by analyzing the slopes of lines connecting price and MACD histogram peaks or troughs.

-

Bullish Divergence (Convergence): Occurs when the lines connecting MACD troughs and corresponding price troughs have opposite slopes and are converging.

-

Bearish Divergence: Occurs when the lines connecting MACD peaks and corresponding price peaks have opposite slopes and are diverging.

When a divergence signal is detected, the indicator marks the chart with dots at the price level and time corresponding to the signal.

Additional Features:

The indicator integrates signals from Darek Dargo’s trading system, known as TFR (The First Red). If a divergence coincides with a TFR signal, directional arrows are displayed on the chart, highlighting the enhanced signal.

MACD Histogram:

-

The histogram is color-coded for clarity:

-

Red bars indicate a higher value compared to the previous bar.

-

Green bars indicate a lower value compared to the previous bar.

-

-

A color change from red to green below the zero line suggests a potential buying opportunity. Conversely, a color change from green to red above the zero line indicates a potential selling opportunity.

-

Divergence and TFR signals act as filters, adding confirmation to these moments.

Technical Details:

The MACD histogram is calculated as the difference between a 12-period and 26-period exponential moving average. The signal line is not included in the divergence pattern, ensuring the focus remains on histogram dynamics.