Contrarian Forex Options MT4

- Experts

- Tshepo Ignitius Mogorosi

- Versione: 1.2

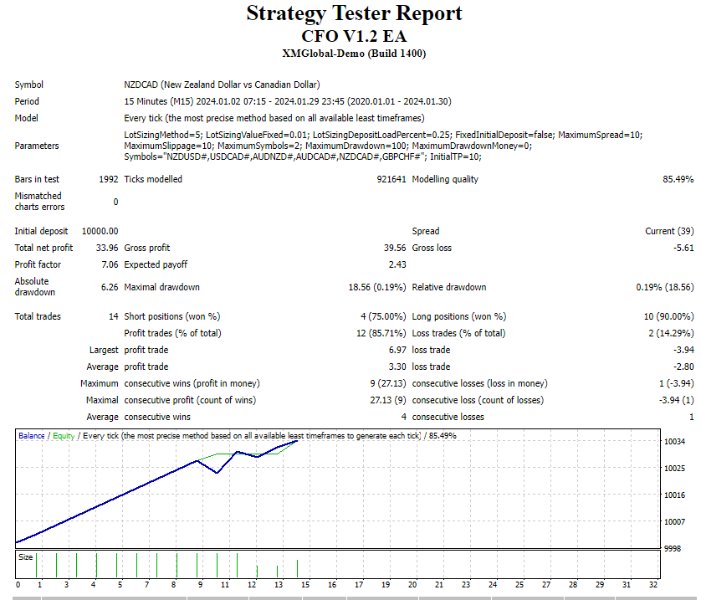

Robot CFO1.2EA is an innovative financial management system designed to optimize portfolio performance through the integration of contrarian, hedging, and grid techniques. Leveraging cutting-edge artificial intelligence algorithms, it provides sophisticated risk management and investment strategies tailored to meet the unique needs of your financial portfolio.

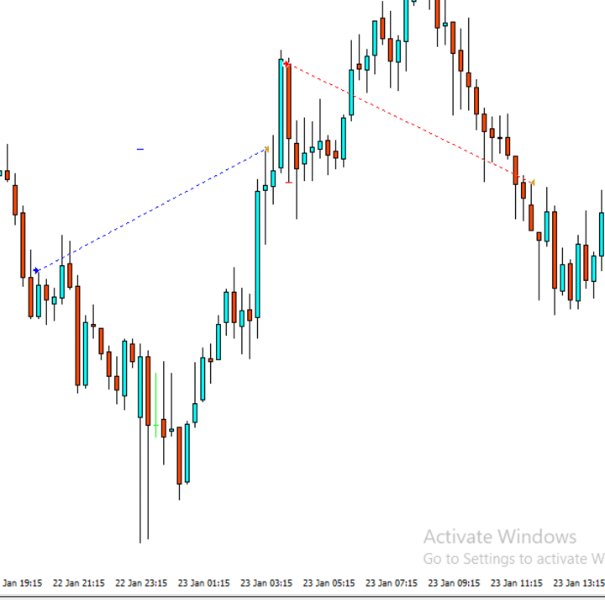

- Robot CFO1.2EA employs a contrarian investment approach, capitalizing on market inefficiencies and deviations from the norm. It identifies opportunities where market sentiment diverges from fundamental value, allowing it to strategically position portfolios for potential reversals.

- Through comprehensive data analysis and sentiment tracking, the system identifies overbought and oversold conditions, enabling it to execute timely buy or sell orders to exploit market mispricing.

- Hedging is a central component of Robot CFO1.2EA's risk management strategy. It utilizes various hedging instruments such as options, futures, and derivatives to mitigate downside risk and preserve capital in volatile market environments.

- By strategically allocating assets across correlated and uncorrelated investments, the system aims to offset potential losses and enhance portfolio stability, ensuring resilience against adverse market movements.

- Robot CFO1.2EA implements grid techniques to diversify portfolio exposure across multiple asset classes, sectors, and geographies. By spreading investments across a grid-like structure, it minimizes concentration risk and enhances overall risk-adjusted returns.

- The system dynamically rebalances the grid based on market conditions and asset performance, optimizing allocation to capitalize on emerging opportunities while maintaining prudent risk management principles.

- Utilizing advanced predictive modeling algorithms, Robot CFO1.2EA forecasts market trends, volatility, and asset correlations with high accuracy. This enables proactive decision-making and timely adjustments to portfolio allocations.

- By analyzing vast amounts of historical and real-time data, the system identifies patterns and signals that inform investment strategies, ensuring alignment with long-term financial objectives.

- Robot CFO1.2EA conducts comprehensive scenario analysis and stress testing to evaluate portfolio resilience under various market conditions. It simulates adverse scenarios, such as market crashes or economic downturns, to assess potential impacts on portfolio performance.

- Through stress testing, the system identifies vulnerabilities and implements preemptive measures to safeguard against systemic risks, preserving capital and optimizing risk-adjusted returns.

- The system allows users to customize investment strategies based on individual preferences, risk tolerance, and investment objectives. Whether seeking aggressive growth, capital preservation, or income generation, Robot CFO1.2EA tailors strategies to align with specific goals.

- Users can adjust parameters, such as asset allocation weights, risk limits, and hedging strategies, to optimize portfolio performance and adapt to changing market dynamics.