Awesome Price Action Movement Indicator APAMI Pro

- Indicatori

- Joshua Graham

- Versione: 3.52

- Attivazioni: 5

Intro to APAMI, PROfessional edition

Trace exactly how far prices trend between two price levels with fractional pip precision, while qualifying price movement between the same price levels.

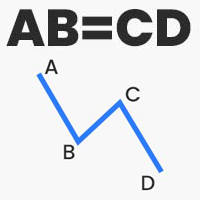

- Completely automate when trends change direction and volatility, without any lag. This is possible because the Accurate Price Action Measurement Indicator (APAMI) actually does what no other indicator can: measure price distance between two points and simultaneously qualify the price action that occurs between those 2 points with geometric pass/fail criteria.

- If prices pullback too much before continuing in the same direction, then that trend/volatility can be disqualified and a new trend can be measured (in the same or opposite direction). By limiting the measurement to only price movements in this way, you can actually measure volatility, trend direction, and momentum all at once, in real-time (coincidentally). I argue that no other known indicator can do this the way APAMI can.

- Up and down trends (movements) are independently measured. So you never have to worry about whether you are missing out on a new emerging trend.

- You can hide some pending lines if you want to reduce chart clutter and run it concurrently with other indicators. Although in my humble opinion you will likely end up removing most of those other [silly] indicators so that there is no “indicator overload” or “chart exhaustion”.

- So if you think about the typical use of a ruler or straight edge in real life for carpentry (or masonry for you conspiracy buffs) as a precision tool measure the exact length of something to draw, then you will begin to understand the true power of APAMI for trend measuring purposes. Especially when you consider objectively measuring or qualifying price movement between or within the trend for pass/fail criteria….or export for further analysis.

-

Alerts: Email/SMS*, push notification**, popup window, or any combination of these 3.

(*SMS via email-to-SMS gateway supported, if your mobile carrier support it | **requires mt4 app installed on target mobile device(s)

Quick comparison chart: Free / Pro / Pro + Plus + / Pro Plus Enterprise

| APAMI Indicator Version | ||||

|---|---|---|---|---|

| Features | Free | PRO | Pro Plus | Pro Plus Enterprise |

| Trends detected by measuring distance/direction across ticks in real time ("moves") | ✅ | ✅ | ✅ | ✅ |

| Determine momentum using retracement qualifier | ✅ | ✅ | ✅ | ✅ |

| Adjust looseness for initial qualification of moves | ✅ | ✅ | ✅ | ✅ |

| measure uptrends and downtrends simultaneously | ✅ | ✅ | ✅ | ✅ |

| Flag unusual ticks and gaps from datafeed | ✅ | ✅ | ✅ | ✅ |

| Can be backtested/simulated | ✅ | ✅ | ✅ | |

| Turn on/off HUD labels | ✅ | ✅ | ✅ | |

| Use hotkey to switch between HUD labels | ✅ | ✅ | ✅ | |

| Keep completed moves on chart when removing indicator from chart | ✅ | ✅ | ✅ | |

| Email/Popup/Push alerts when target length is achieved (moveComplete) | ✅ | ✅ | ✅ | |

| Features | Free | PRO | Pro Plus | Pro Plus Enterprise |

| Change font colors or size of label | ✅ | ✅ | ✅ | |

| Measure volatility avg change across individual moves | ✅ | ✅ | ||

| Record volatility stats of individual moves to txt file | ✅ | ✅ | ||

| Measure volatility stats across all incoming ticks for multiple consecutive tick lengths | ✅ | ✅ | ||

| record volatility stats across all ticks to text file | ✅ | ✅ | ||

| Record volatility stats across all ticks and display as HUD | ✅ | ✅ | ||

| Auto-adjust moveComplete length based on volatility | ✅ | ✅ | ||

| News-based Custom trend measurement (import news calendar; single source) | ✅ | |||

| triple-sourced news custom trend | | ✅ | ||

| 6-sources news custom trends | ✅ | |||

| Features | Free | PRO | Pro Plus | Pro Plus Enterprise |

So how do I trade with APAMI?

It's actually completely up to you. There is no one way to use a ruler or straightedge. It follows that there is no one correct way to trade with APAMI. It was originally developed as part of a larger professional trading strategy in which grid/averaging was part of the ordering process. The focus was on counter-trend analysis, but that does not mean that it can only be used with averaging/counter-trending strategies.

Nevertheless, many traders still want some idea of how to use it in real world trading. Here is a short summary:

- Scalping: Scalpers could easily clip pips on pullbacks. More risky without fundamental analysis, but hey.

- News trading: Could also analyze the typical price moves across various news categories and then enter the markets after a certain amount of movement has occurred during that news cycle.

- Swing trading: Cut out some of the swing movement. Or better identify pivot points of the swing.

- Position/”Trend” traders: Similar to swing trading mixed with news trading. You could potentially ‘cut out’ part of the trend, but with longer chart timeframes Could be used for longer trends also.

- Momentum Traders: similar to position traders.

The MT4 terminal should be left on continuously to maximize trend measurements, including the measurment accuracy. You could use the lookback feature (pro editions), but this is technically simulated. Real-time moves should have live, continuous connection.

- With weekend market breaks, APAMI will just continue when the market reopens. Do not close the terminal unless necessary. Any pending moves not covered by lookback period may be lost.

Which Chart Timeframe(s) (TF) should I use?

While APAMI is timeframe-agnostic (20 pips price movement is 20 pips regardless of the timeframe), it is best to attach the indicator to 1m or 5 min timeframe chart in most cases. If the trend length (MoveComplete) is larger (100-200+ pips), then 15-60m might be more appropriate. This also depends on the pair and how many pips the typical daily range is.

Also chart timeframe is heavily dependent on how long you will hold trade for. If it is daytrading or swing trades that avg <1 week, then 1/5 min chart is best. Hold time is 1-4 weeks long, then 5-30 min chart is better. >4 weeks would use 15-60min. Note that these recommendations are mainly to keep the chart organized with moderate zoom. There are only so many bars you can have on chart, even fully zoomed in.

- I recommend to add Apami on 2-4 separate charts with different timeframes. Then observe which one works best for your trading setup.

What APAMI is NOT

Comparing APAMI coincident trend indicator with other indicator categories: -

Not a zig-zag indicator: From one point to the next, how do you determine whether a price has actually reached an endpoint of a zag? You cant know the endpoint of the previous zag until the zig occurs in the opposite direction...so it still lags. APAMI calculates up and down trends independently. So you can sometimes see both UP and DOWN pending moves being drawn at the same time (as a current larger trend in one direction has not yet failed, but a new countertrend is possibly beginning).

Also there is no lookback* for legitimate trends. You must draw them in real time (terminal with indicator must constantly run) and then record them. Only then could a previous trend be re-copied onto a chart. Therefore, APAMI would likely replace any existing zig-zag indicator you have.

*[you can have a lookback in pro plus versions, but it is technically simulated for the part of the move that is in lookback period]

-

Not a Repainting indicator: APAMI cannot repaint older moves by design. APAMI is only useful in real time and to see historical APAMI moves already drawn previously by Apami. Since all calculations are drawn coincidently, there is never a need to repaint anything. Indicators that repaint are actually fake indicators because they are changing signals or their drawings after the fact with the benefit of hindsight.

-

Not a Moving Average: The only thing that moves on a price chart is the current bid/ask price (or the "last" price). But how far they move (length), how fast they move (speed, slope sharpness), and the activity that happens in between (retracement, volatility, tick length) can be objectively measured. Averaging stale prices (simple, weighted, exponential, smoothed, et al) will always result in some lag.

-

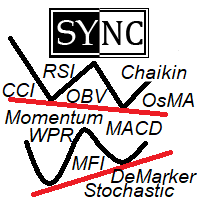

Oscillator: One of the worst types of lagging indicators, because you have multiple averaging and smoothing of prices. With all this said, APAMI Pro Plus/Enterprise versions could show you distance across ticks and allow you to measure volatility across different moves.

-

Momentum: Price rate of change (PROC) of prices over x periods ago can be a less laggy way to measure price action, depending on how momentum is calculated. The lagging way you are thinking (RSI, MACD, ROC/PROC). Actually, APAMI Free/Pro could be used to measure momentum when you consider slope or length of bars used.

APAMI Pro PLUS/Enterprise has the ability to incorporate tick-based volatility into recalculating the length of the trend in real time. And you can also keep track of the tick lengths across several ticks on GUI and also in a log, which you could import or study for further analysis.

-

Volatility: The speed/quantity of the momentum of price change over a period of time. Usually volatility would be compared with quantity of price changes over 2 or more different sections of identical time periods to study relative volatility. How fast/often prices moved in one period of time compared to the same amount of time.

-

Leading indicator: While I can make the argument that APAMI performs leading calculations (especially the Pro Plus/Enterprise versions), the term “leading” is inaccurate. Because the term leading implies that the indicator can see into the future. But that is just an illusion. All the averaging, smoothing, and other wizardry applied to make the indicator look fashionable ultimately confuses the user. Consider instead: Precise, coincident indication tools is the best anyone can get in real life use.

The world’s ONLY coincident method to objectively track how prices trend without using any averaging, smoothing, or other guesswork (true zero-lag).

Momentum is the rough equivalent of velocity in physics, as it has both direction and movement of prices.

APAMI Pro PLUS/Enterprise has the ability to measure differences in price movements across ticks and manipulate the length of the trend move. Volatility could also be considered acceleration in physics.

Apami Pro Indicator Properties

Inputs description| APAMI PRO inputs list | Description | Notes |

| /---- Primary Settings ----- | ||

| MOVE_MoveComplete | Desired length of the trend, in pips. 17.5 = 17.5 pips. Length is measured from start level to end level and remains fixed, unless using ProPlus version with dynamic MoveComplete enabled. | Passing move will complete on chart in Yellow/Red solid lines. Pending lines are thinner, dashed lines with same color. Failed moves are purple, thin dashed lines. But even failed moves can give you information about price inertia. Tiny moves < 3.0 need to have higher RetraceQual. |

| MOVE_RetracementQualifier | The % pip distance from the Start level current price must move in opposite direction (pullback) for MOVE to fail. 38.5 = 38.5%; Abbr: RetraceQual | RetraceQual pip length will be auto-calculated and shown on pending lines. Lower % = looser qual; more trends, but weaker momentum/inertia required to pass. Higher % = stricter qual; less trends, but stronger momentum/inertia required to pass) Tiny MoveComplete < 3.0 need to have higher RetraceQual (>30% |

| MOVE_IgnoreDistance | pip distance from potential start level that RetraceQual is ignored. | Once you see pending lines, Ignored distance has already been considered. 1.0 is good in 95% of cases. MoveComplete must be > IgnoreDistance |

| ShiftDownMovesForSpread | Shifts downward moves based on current spread once MoveComplete (reaches end level) | Moves are calculated on same prices chart bars/candlesticks are drawn (bid prices). Shifting move considers the Ask price. |

| PendingLineDataDisplay | draws the Move start line, end line, RetraceQual line, and diagonal line from start point to highest end point achieved. Includes failed moves lines. | False = only completed Moves are drawn on chart. No pending lines, EXCEPT for purple failed moves will still be drawn. |

| DrawLines | draws the Move start line, end line, RetraceQual line, and diagonal line from start point to highest end point achieved. | False = only completed Moves are drawn on chart. No pending lines, INCLUDING no failed moves. |

| APAMI PRO inputs list | Description | Notes |

| /--- Secondary Settings --- | ||

| EA_ID | allows to assign a unique number for running multiple instances in the same terminal | Differentiate multiple instances of indicator on the same symbol (including different charts). Not critical for indicator-only internal operations. |

| AlertUp | Enable alerts for Completed Moves; UP moves only | Choose between: Popup window, Email, Push Notification, or any combination (or 'no alerts') |

| AlertDown | Enable alerts for Completed Moves; DOWN moves only | Choose between: Popup window, Email, Push Notification, or any combination (or 'no alerts') |

| DisplayHUD | Heads-Up Display (HUD) of indicator information | Choose between: None, Mini HUD and Full HUD. |

| HUDFont_Size | Customize HUD font size | |

| HUDRowColorEven | customize color of HUD Even row | make sure colors are different |

| HUDRowColorOdd | customize color of HUD Odd row | make sure colors are different |

| MOVE_LookBack | How many previous chart bars from current bar to consider when first adding indicator to chart. | 0 is best for freshest moves and least errors. > 0 is useful if you do not leave terminal on continuously, especially for larger trends. > 300, try increasing chart timeframe instead |

| MaxMoveCompleteLineCount | How many completed moves will remain on chart. | Object control. Increase if you want more historical moves. |

| HotKeyHUD | Use keyboard to change/remove HUD | "Ctrl + J". You may have to wait a few ticks (seconds) between each attempt. |

| MOVE_Up | true = Evaluate only UP moves | Disable if you don't want any UP moves |

| MOVE_Down | true = Evaluate only DOWN moves | Disable if you don't want any DOWN moves |

| KeepObjectsAtExit | true = Keep completed moves on chart if indicator is removed | false = remove all objects from chart when removed |

| APAMI PRO inputs list | Description | Notes |

| /------ Log Settings | ||

| AlertMissingData | true = popup alert when missing datastream is detected that can affect pending moves | default = false |

| PrintMissingData | true = expert log when missing datastream is detected that can affect pending moves | default = true; may disable if you see pending moves are mostly unaffected. |

| DebugMode | not used | only if developer requests this. |

Make sure to attach empirical evidence so that we can understand the context of the bug

-

Screen video where you reproduce the error or demonstrate .

- use continuous recording tools like Bandicam, Thundersoft Screen Recorder, Snagit. Web-based VideoCandy is also ok and does not require installation. Mobile/tablet users may search for A-to-Z screen recorder.

- try to keep the video to under 4 minutes.

-

Expert logs + journal logs generated from the terminal.

If you are having errors attaching large files to the message, just use cloud file sharing service like google drive, dropbox, etc.

Tags: pure price action

I am not trying to give negative feedback on the indicator but there is no info in any form like a pdf or a video to even understand how to use this product. The author has been supportive and would like to address the issues