Weekly Options CME

- Utilità

- Viktor Glovluk

- Versione: 1.1

- Aggiornato: 18 novembre 2021

- Attivazioni: 5

The script draws levels based on the weekly options reports published on the ftp server of CME Group ftp://ftp.cmegroup.com/bulletin/. On the server, select the report for the day preceding the one you want to draw the levels on (to draw levels on 02.10.2015 download a report of 01.10.2015, most reports are published at 10:00 Moscow time the day after the reporting date, this is exactly what we need). Select the required option from the downloaded ZIP file, for example for EURUSD you need Section39_Euro_FX_And_Cme$Index_Options.pdf.

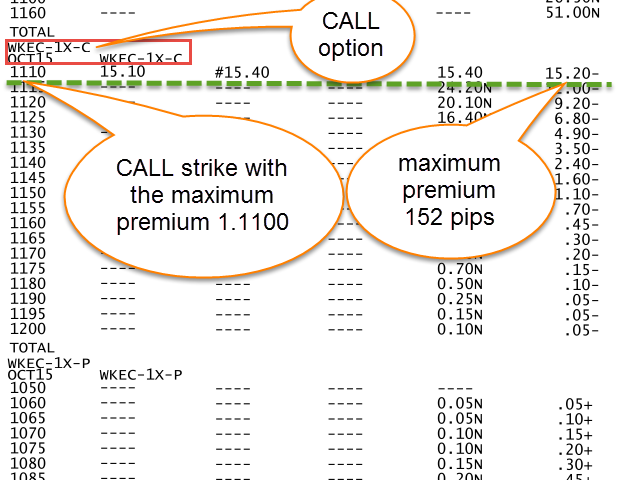

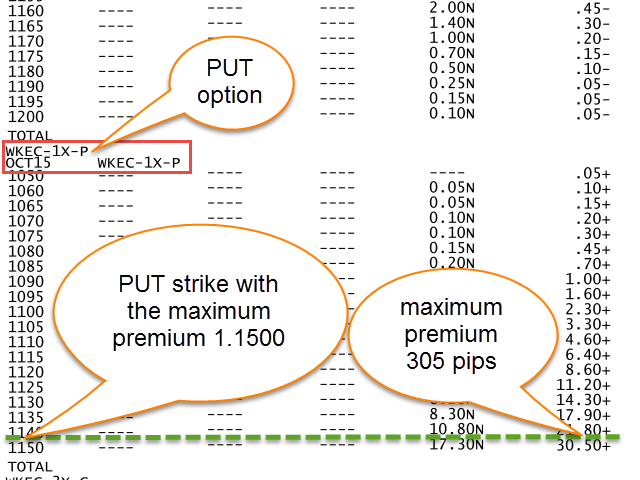

On the first page of the report, in the first column, find weekly options (WKEC-1X-C, WKEC-2X-C, WKEC-3X-C, WKEC-4X-C) with the date of expiry (columns 2 and 3) 20 to 5 days to the date of the day, where you want to draw the levels. Expiration of more than 20 days produces very broad levels, expiration of less than 5 days gives very narrow levels.

Weekly options are on the last pages of the report. In the selected option fined strike prices with the highest premium and enter the strikes with the premium values in points the script parameters.

As you know, when you buy an option you must pay a premium to the seller (originally it's the Clearing House). The premium is specified in the report published at 10:00 Moscow time the next morning following the reporting day, i.e. report for 01.10.2015 is published at 10:00 Moscow time 02.10.2015. Buying 1 EUR of an option we pay the premium, say, 10 points * $12,5 (price of 1 point can be found on the official site of CME Group) = $125, and we will start profiting only when the price makes 10 points in the right direction.

Who will pay us in case of profit? Naturally, the option seller (Clearing House)! How come such a powerful financial institution has no access to insider information about the price movement? And what prevents them from setting a premium so that the price will hardly go our way enough to allow us earn?

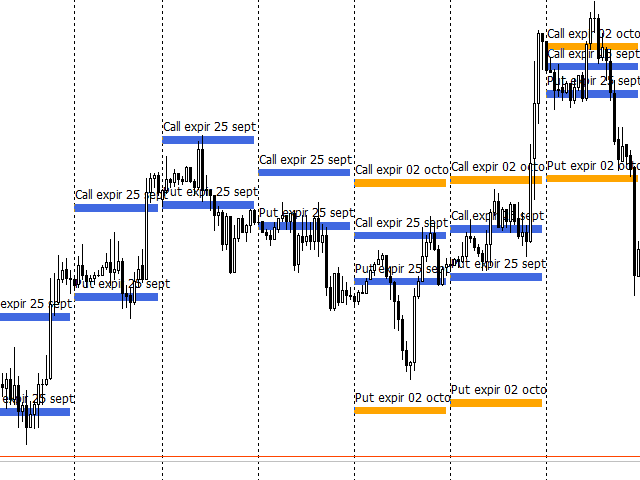

By analyzing the information from the report, correctly processing it and calculating the yesterday premium levels, today you can draw the levels that will most probably restrain the price.

Script Parameters

- Option settings : option configuration block;

- Call strike: CALL strike with the highest premium;

- Call premium (in pips): the highest premium in points;

- Put strike: PUT strike with the highest premium;

- Put premium (in pips): the highest premium in points;

- Drawing settings: drawing setup block;

- Comment: a comment on the levels;

- Drawing metod: level drawing method;

- Level width (in pips): the width of the levels in points;

- Color: the color of the levels;

- Line thickness: the thickness of the lines forming the levels (if no filling is used);

- Line style: the stile of the lines forming the levels (if no filling is used);

- Fill zone: fill levels;

- Draw balance: draw an average line;

- Balance color: the color of the average line;

- Balance style: the style of the average line;

- Balance thickness: the width of the average line.

Example of Inputs

See screenshots 4 and 5.

- Call strike: 1.11;

- Call premium (in pips): 152;

- Put strike: 1.15;

- Put premium (in pips): 305.