SmartInvest MT5

- Experts

- MASTERBROK NEXUS SRL

- Versione: 1.3

- Aggiornato: 2 dicembre 2024

- Attivazioni: 15

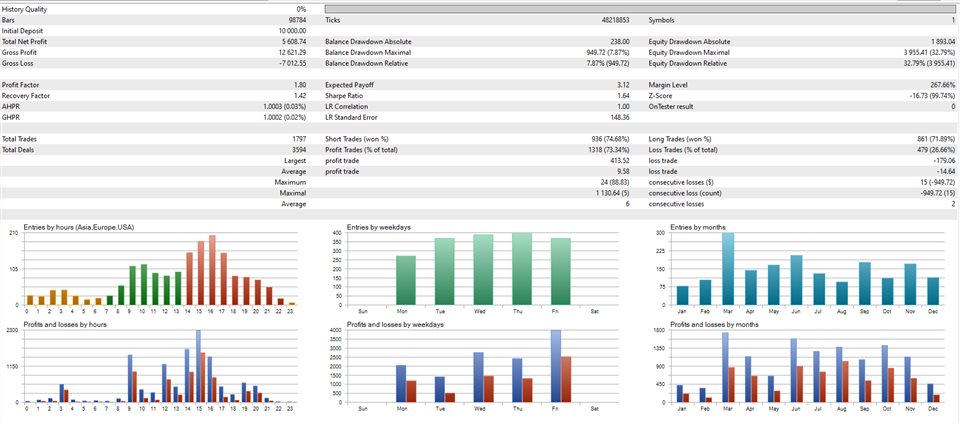

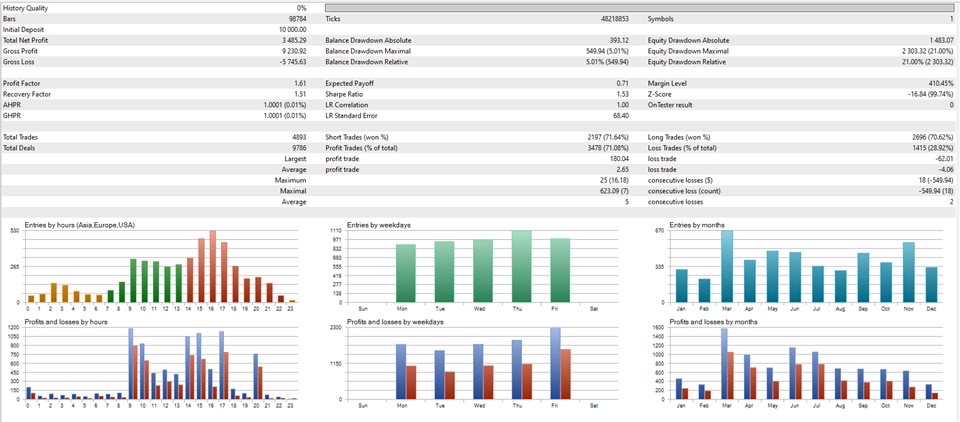

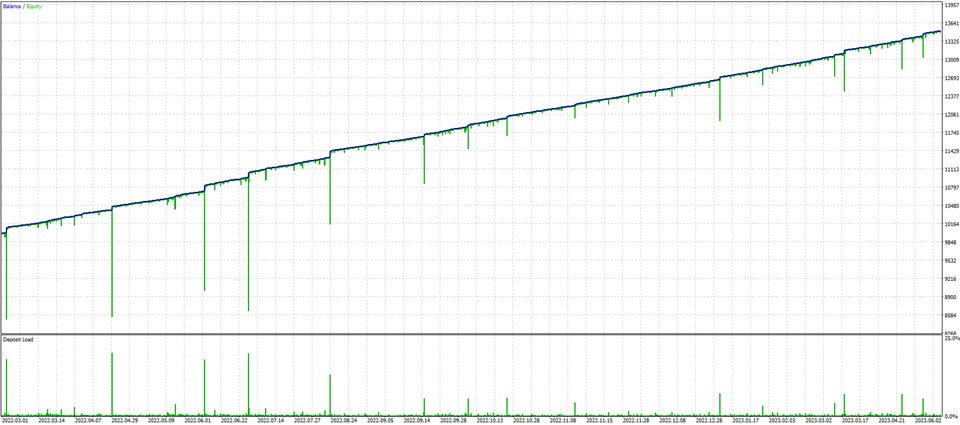

Smart Invest Basic (EA) employs an averaging strategy designed for long-term profitability with low risk. It operates by initiating trades and setting take profit levels. If the market quickly reaches the take profit point, it opens another trade upon the next candle's opening. Conversely, if the market moves against the trade, it employs an averaging technique to secure more favorable prices. The EA's primary approach involves using smaller lots to prevent significant drawdown during averaging, adopting a conservative stance. While higher volumes can be used for potentially greater returns, it's essential to recognize that higher ROI comes with increased risk. Users can adapt this strategy to their individual account preferences.

This EA excels in ranging markets, efficiently opening and closing positions without substantial drawdown.

To enhance safety, several risk management features have been integrated. Users have the option to implement a martingale strategy, enabling larger volumes at more advantageous prices (this is optional).

Additionally, users can set a "Late Start," activating the martingale strategy after a series of trades has commenced.

The inclusion of a "Max Lot" parameter ensures that the EA never opens a position larger than the specified Max Lot value, further minimizing risk.

The "Max Trades" parameter sets a limit on the number of trades within a batch, prompting the EA to cease trading once this threshold is reached.

A virtual Stop Loss feature has also been incorporated. This mechanism automatically closes all open positions when a specified drawdown level is attained, effectively mitigating potential larger risks. These risk management measures collectively contribute to a safer trading experience with your EA.

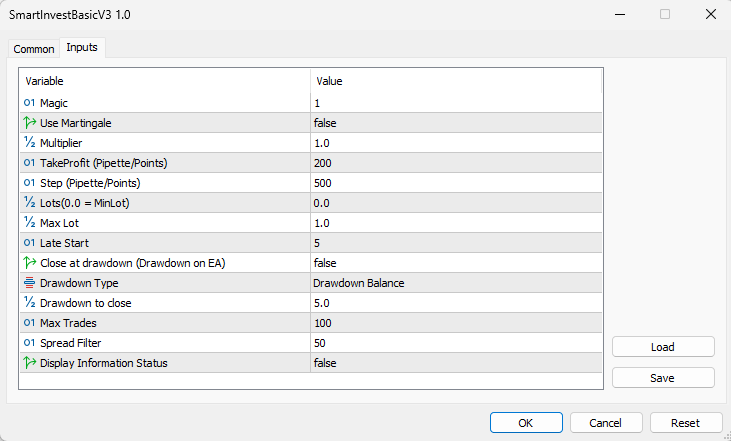

Input parameters

-

Magic Number: A unique identifier for the EA, ensuring distinctiveness.

-

Use Martingale: When set to 'true', activates the Martingale strategy; set to 'false' to disable it.

-

Multiplier: Determines the multiplication factor if Martingale strategy is employed.

-

Take Profit (Points): The targeted profit for the batch of transactions, calculated in points, considering each instrument's specific volatility.

-

Step (Points): The minimum distance between two consecutive transactions within the batch, measured in points, adjusted for the instrument's volatility.

-

Lots: Denotes the initial lot size of the transaction batch.

-

Max Lots: Specifies the maximum permissible lot size; trades will not exceed this value.

-

Late Start: Sets the threshold at which the Martingale strategy becomes active (only applicable if Martingale is enabled). For the initial "Late Start" trades, Martingale will not be applied.

-

Close at Drawdown: When set to 'true', enables the virtual Stop Loss feature, causing the EA to close all trades. Set to 'false' to allow trades to remain open regardless of drawdown.

-

Drawdown Type: Choose between ' Drawdown Cash' for a predefined drawdown in monetary value or 'Drawdown Balance' for a percentage of the account balance.

-

Drawdown to Close: Specifies the drawdown value at which the EA will close all trades. This value is either a fixed monetary amount or a percentage, depending on the selected 'Drawdown Type' ( Drawdown Cash or Drawdown Balance).

-

Max Trades: Sets the maximum number of simultaneous trades the EA will execute (modifiable during trading).

-

Display Information: When enabled, provides real-time updates on drawdown status, next trade volume, direction, and other pertinent information about the EA. Note that it's advisable to disable this feature during optimization and testing to ensure faster processing, particularly in "visual mode".

Tips and Tricks for Choosing the Right Instrument:

-

Opt for Assets (Instruments) with a historical tendency to exhibit more ranging behavior than trending. Pairs with aligned monetary policies, such as (EURCHF), (USDCAD), and (AUDNZD), often demonstrate this characteristic.

-

Examine the largest average moves a pair has undergone in the past. Adjust parameters like "Step," "Take Profit," and "Lot" to ensure that these moves don't lead to a larger drawdown than anticipated. Experiment with different parameter values to gauge drawdown levels in worst-case scenarios and be prepared accordingly.

-

Consider employing a more aggressive martingale strategy and a larger initial volume if you're using a greater "late start" and a smaller "Max Volume." This approach encourages the EA to generate more profit on smaller batches, which are more likely to occur, while minimizing drawdown on larger batches and significant market moves. However, it's crucial to conduct thorough testing based on your risk tolerance.

-

During periods of market uncertainty and exceptionally high volatility, it's advisable to either halt the EA on specific Assets and shift it to more ranging markets or temporarily suspend it until market conditions stabilize. For instance, during the heightened volatility of the Covid-19 market, it would have been prudent to pause the EA for a month or two until the markets regained stability. This precaution ensures lower risk and potentially higher profitability.

L'utente non ha lasciato alcun commento sulla valutazione.