Average Cross System

- Indicatori

- Muhammed Emin Ugur

- Versione: 1.0

The Average Cross System indicator is a versatile tool designed for traders using the MetaTrader 4 (MT4) platform. This indicator provides a straightforward yet effective way to identify potential buy and sell signals based on moving average crossovers, a widely used technical analysis strategy.

Key Features:

-

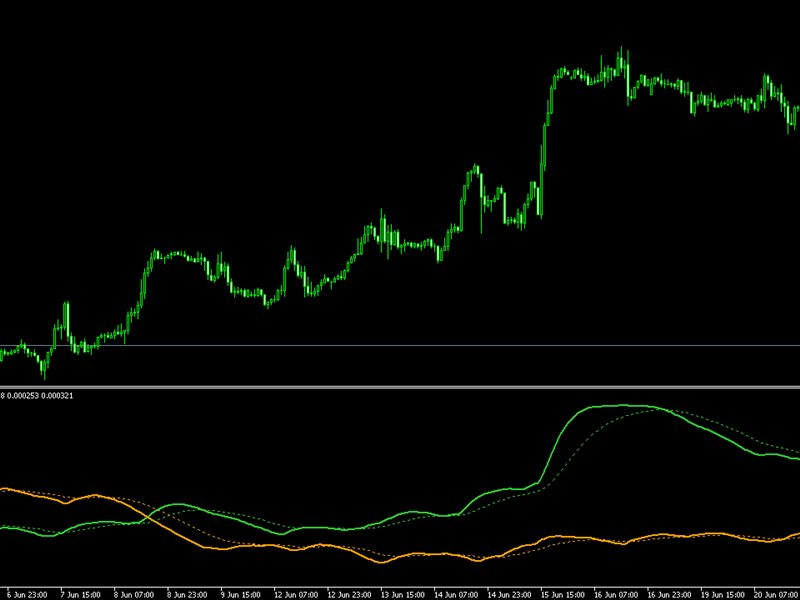

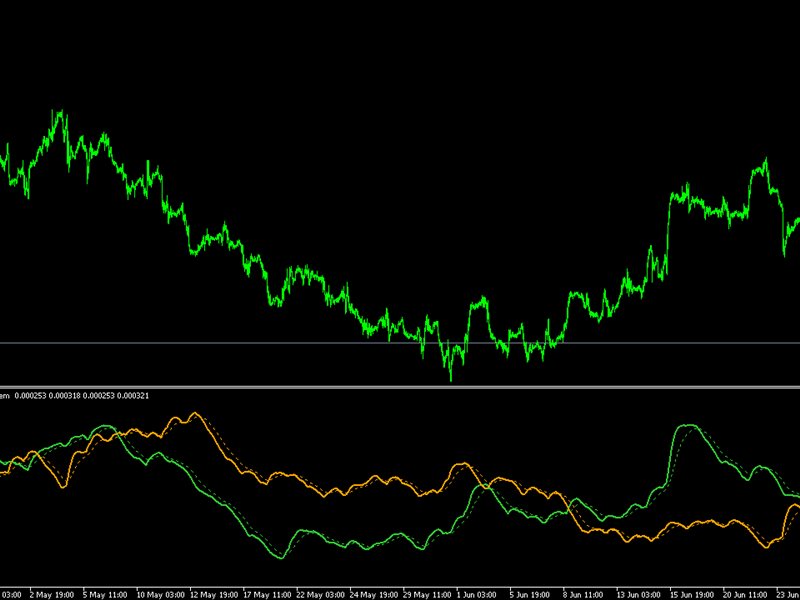

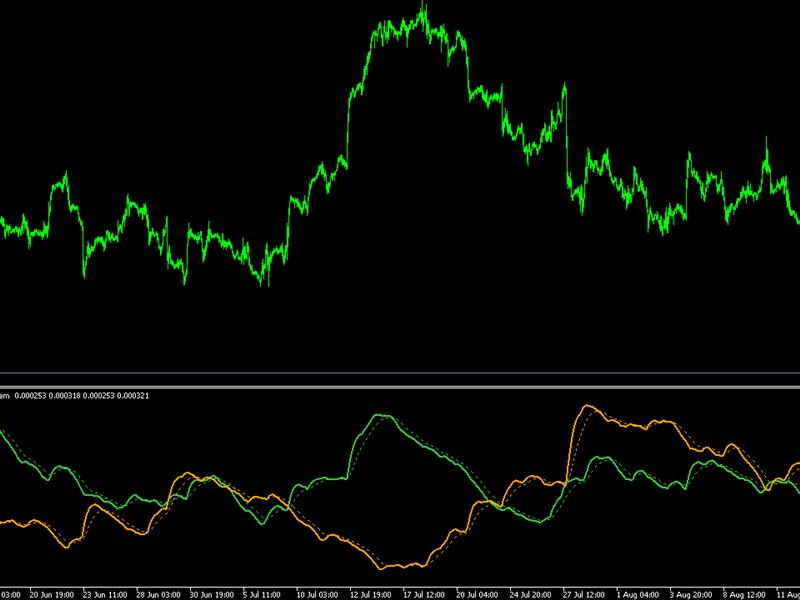

Moving Average Crossovers: The heart of the Average Cross System is the detection of moving average crossovers. It automatically identifies when a shorter-term moving average crosses above or below a longer-term moving average.

-

Customizable Averages: Tailor the indicator to your trading preferences by selecting your preferred types of moving averages (e.g., simple, exponential, smoothed) and adjusting their periods.

-

Buy and Sell Signals: The indicator generates clear buy and sell signals on your chart, making it easy for traders to understand potential entry and exit points.

-

User-Friendly Interface: The indicator is designed to be user-friendly, making it suitable for traders of all skill levels, from beginners to experienced professionals.

How to Use the Average Cross System:

-

Installation: Easily install the indicator in your MetaTrader 4 platform using the provided instructions.

-

Customize Settings: Select the types of moving averages (e.g., SMA, EMA) and their periods that best suit your trading strategy.

-

Trading Strategy: Watch for buy signals (when the shorter-term average crosses above the longer-term average) and sell signals (when the shorter-term average crosses below the longer-term average) to inform your trading decisions.

The Average Cross System indicator simplifies the process of identifying potential trend reversals and entry points in the market. By using moving average crossovers, you can enhance your trading strategies and make more informed trading decisions.

Remember that trading involves risk, and it's important to use this indicator in conjunction with other technical and fundamental analysis tools to make well-informed trading decisions.