The DAX Morning Scalp

- Experts

- Lasse Najbjerg Jensen

- Versione: 2.31

- Aggiornato: 2 aprile 2024

- Attivazioni: 7

NEW 2024 set file can be downloaded by clicking here. (All set files can be found in the comment section)

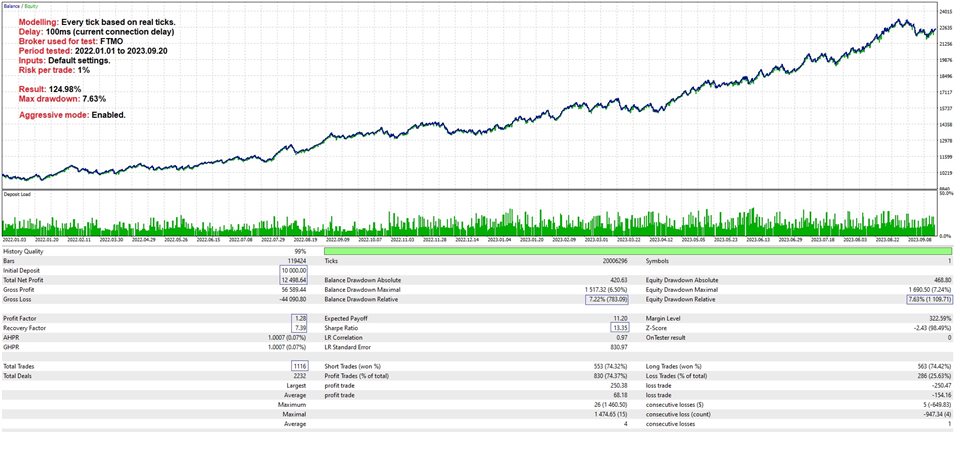

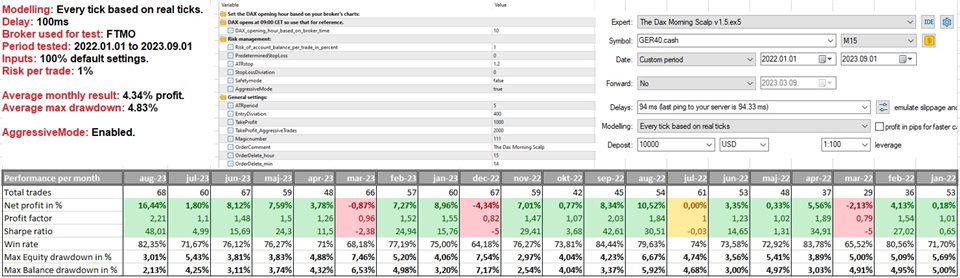

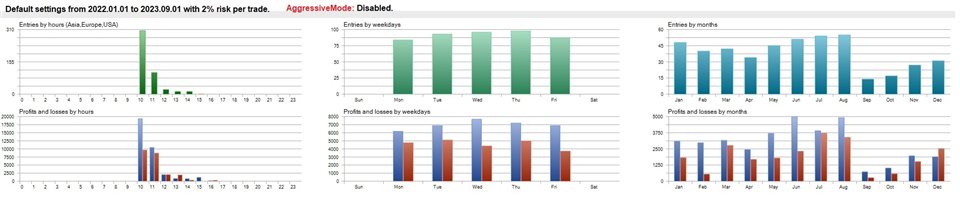

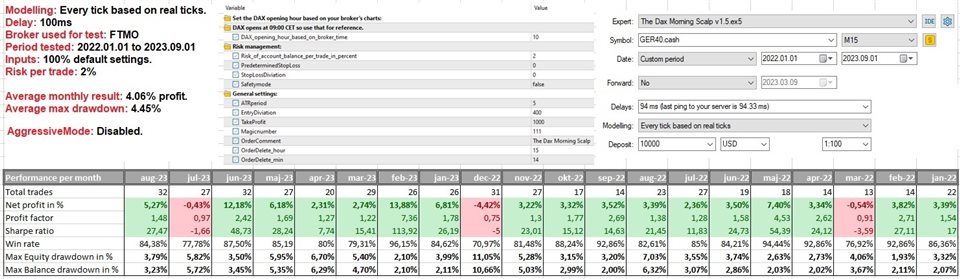

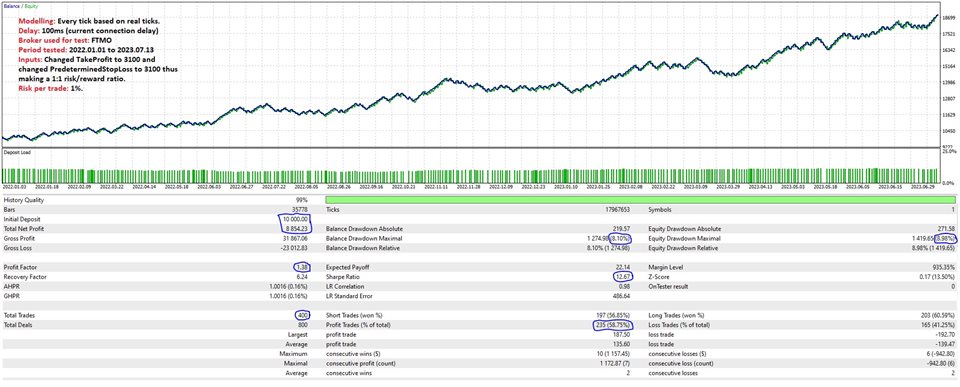

The Dax Morning Scalp is a real daytrading strategy that does NOT use risky money management tactics like martingale systems, grid systems or hedging of any kind! It is a fully automated breakout scalping strategy designed specifically for the German Dax index (aka DE40 or GER40). The strategy uses current volatility conditions to determine the stop loss size and whether to trade at all. If volatility is too low the conditions are not favorable for a breakout strategy and if volatility is too high something might be wrong, which can cause more irrational moves. I’ve traded the strategy manually for a year and a half now and it has been extremely consistent and reliable, so I finally decided to automate it and share it with the community at a low enough price for everyone to benefit from!

If you have any questions please contact me on mql5: https://www.mql5.com/en/users/njtrading

IMPORTANT recommendations:

- Testing: You should ALWAYS download the demo and do some testing on your own broker before buying ANY EA on the MQL5 market. You can watch the video below for information on how to test the EA correctly or contact me on here if you have any questions.

- Set files: Different types of set files can be found in the comment section and through the links above. Always go to the bottom comment for the newest set files. If you have any questions about the set files please send me a message on here.

- Risk: If you're using the default settings I'd recommend anything from 0.5% to 6% risk per trade. Depending on how aggressive you want to trade.

- Market: Designed to be used on the Dax index (usually called GER40, GER30, DE40 or DE30, depending on the broker).

- Timeframe: The strategy uses the 15 min timeframe, but it will still work just as well if you have your chart set to another timeframe.

- Minimum deposit: $200.

- Account type: Preferably ECN, raw or Razor with low spreads.

- Leverage: 1:20 is fine for the NormalMode but if you want to use both the NormalMode AND the AggressiveMode then I would recommend at least 1:50.

- Brokers: I’d recommend ICMarkets, Pepperstone or any other reputable broker that offers low spreads and good executions.

- MT5 account type: Doesn’t matter, both Hedge and Netting account types are fine.

Detailed explanation of strategy inputs:

"Auto-detect DAX opening hour" = If you switch this input to "true" the EA will automatically detect the opening hour for the DAX based on your broker's timezone. Beware that this setting does not work in strategy tester so you can't use it for testing purposes. It does however work for real trading. I would recommend enabling the "Show DAX opening time on Chart" setting as well if you plan on enabling this feature.

"DAX opening hour for current broker" = This input lets the user manually adjust the opening hour of the DAX. This is an important setting as broker's use different timezones and Charts are based on the broker's server time.

"Start minute for AggressiveMode orders" = This input lets the user manually adjust the minute of the opening hour at which the EA will open the AggressiveMode orders.

"Start minute for NormalMode orders" = This input lets the user manually adjust the minute of the opening hour at which the EA will open the NormalMode orders.

"ATR period" = The ATR indicator is used to help with the volatility calculations so here you can change the ATR length if you want to.

"Entry Diviation" = This input decides how much the market must go above/below the breakout point in order to trigger the pending order.

"Enable NormalMode" = This input is set to "true" by default but you can switch it to "false" if you only want the EA to use the AgressiveMode strategy. This input needs to be set to "true" for the UltraSafetyMode to work.

"Enable AggressiveMode" = This input is set to "true" by default but you can switch it to "false" if you want the EA to take less trades. The AggressiveMode enables the EA to take even more breakout trades in the morning and it will increase the average number of daily trades to around 3-4. I recommend testing the EA with AggressiveMode enabled and disabled so you can see the difference yourself.

"Enable ReversalMode" = You can switch this input to "true" if you want the EA to trade range reversal through limit orders. This has worked particularly well since September 2023 where breakouts started underperforming in the morning market of the DAX.

"Enable Safetymode" = You can switch this input to “true” if you want to play it safe. This will make the EA only take the first trade of the day which usually has a higher win rate but you will lose out on some profit in the long run as the second trade is also profitable.

"Enable UltraSafetyMode" = You can switch this input to "true" if you want to play it REALLY safe. This will drastically reduce the number of trades the EA takes but it will also increase the win rate. Basically improves quality while reducing quantity.

Risk Management:

"Percentage of Balance risked per trade" = Here you decide how many percent of your account balance you’re willing to risk on every trade.

"Enable Manual Lot Size" = This input is used to turn the manual lot size on and off. If the input is set to "true" the manual lot size is on and if the input is set to "false" the manual lot size is turned off and the EA will use the percentage based risk input instead.

"Manual Lot Size" = This input determines the lot size of every order the EA opens if the manual lot size option is enabled.

Exit Settings:

"Predetermined Stop Loss for NormalMode" = In case you don’t want to use the built-in volatility-based stop loss you can use this input to set a specific stop loss.

"Predetermined Stop Loss for AggressiveMode" = In case you don't want to use the built-in price action based stop loss you can use this input to set a specific stop loss value.

"ATR Stop Loss" = The multiplier used for volatility based stop loss. (1.2 means 1.2 x the ATR value)

"Stop Loss Diviation" = You can use this input to fine-tune the stop loss a bit if you want to.

"Take Profit for NormalMode orders" = This input determines the amount of points used for the take profit target. I use 1000 as the default value but you can change it if you want a specific risk/reward ratio for example.

"Take Profit for AggressiveMode orders" = This input determines the amount of points used for the take profit target of the AggressiveMode trades. I use 2000 as the default value but you can change it if you want a specific risk/reward ratio for example.

"Take Profit for UltraSafetyMode orders" = This input determines the amount of points used for the take profit target of the UltraSafetyMode trades. I use 1000 as the default value but you can change it if you want a specific risk/reward ratio for example.

Trailing Stop Loss Settings:

"Enable Trailing Stop Loss" = This input enables the Trailing Stop feature. The input is set to "false" by default which means it is disabled. If you want to enable the feature you need to change the input to "true".

"BreakEvenStop" = This input overrides the Trailing Stop so that the EA only moves the stop loss to the entry point, when the trigger and distance criterias are met. The Trailing Stop Loss input above needs to be set to true for this BreakEven option to work.

"Trailing Stop Loss trigger" = This input determines how far the market needs to move in the direction of the position before the Trailing Stop Loss feature starts working. This input requires the Trailing Stop Loss input above to be enabled.

"ATR based Trailing Distance" = This input lets the user decide the Trailing Stop Loss distance in terms of the ATR value of the last 15min bar.

"Point based Trailing Distance" = This input lets the user decide the Trailing Stop Loss distance in points.

General Settings:

"Show DAX opening time on Chart" = You can enable this feature by switching the input setting to "true" which will make the EA show the opening time of the DAX based on your broker's server time. Beware that the feature does not work correctly in the strategy tester as the strategy tester doesn't support GMT time.

"Magic Number for the EA" = This is just an EA identification number, but you should make sure that this number is unique.

"Comment for the trades taken by the EA" = A unique comment for the EA so you can easily identify the trades taken by the EA.

"Delete orders at this hour" = This input is for selecting the hour of the day where the EA should delete the pending orders. The default setting is 15.

"Delete orders at this minute" = This input is for selecting the minute of the hour where the EA should delete the pending orders. The default setting is 14. So together with the input above it determines that the EA should delete the pending orders at 15:14.

"Enable Buy orders" = If this input is set to true the EA will open Buy orders but if the input is changed to false the EA will stop opening Buy orders.

"Enable Sell orders" = If this input is set to true the EA will open Sell orders but if the input is changed to false the EA will stop opening Sell orders.

After purchasing this EA I back tested it and got great results. I played with the settings and spoke to the developer about changes. He is very quick to reply and very helpful. I have since put it on a live account and receive the same great results. The very first trade made my money back and more. Factory settings are great. Depending on your trading style you may want to change some of the settings. However it appears to be a very reliable set and forget EA. 100% recommend to purchase this EA.