USDCAD Technical Analysis 2016, 06.11 - 13.11: intra-day ranging; daily bullish, weekly bullish reversal

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.05 10:42

Weekly Outlook: 2016, November 06 - November 13 (based on the article)

US Presidential Election, Crude Oil Inventories, Unemployment Claims, Prelim UoM Consumer Sentiment, Rate decision in New Zealand. These are the main highlights of this week.

- US Presidential Election: Tuesday. US Presidential election attracts worldwide attention offering many surprises and uncertainties. The question is how the election would impact the economy and the markets. History suggests that the markets respond better to predictable outcomes than to uncertainties. The fact that Obama isn’t running may create a void badly affecting financial markets. Investors are not familiar with the candidates’ ability to “run the show”. Furthermore the party affiliation does not offer easy clues about which candidates might help or hurt investments. However, markets are expected to respond well to proposals from a front-runner to reduce U.S. corporate tax rates, which at the current 39% are the highest in the developed world. Moreover, analysts may look forward to a possible haven in 2017, after a new president takes over.

- US Crude Oil Inventories: Wednesday, 15:30. Analysts do not expect imports will remain strong in the coming weeks.

- NZ rate decision: Wednesday, 20:00.

- US Unemployment Claims: Thursday, 13:30. The number of new claims are expected to register a 267,000 gain.

- US Prelim UoM Consumer Sentiment: Friday, 15:00. U.S. consumer confidence is expected to rise to 87.4 this time.

- Stephen Poloz speaks: Friday 15:00. BOC Governor Stephen Poloz will speak in Santiago. In a recent talk, Poloz said risks from household debt and the housing market will be better addressed by macroprudential policies than by adjusting interest rates.

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2016.11.10 08:58

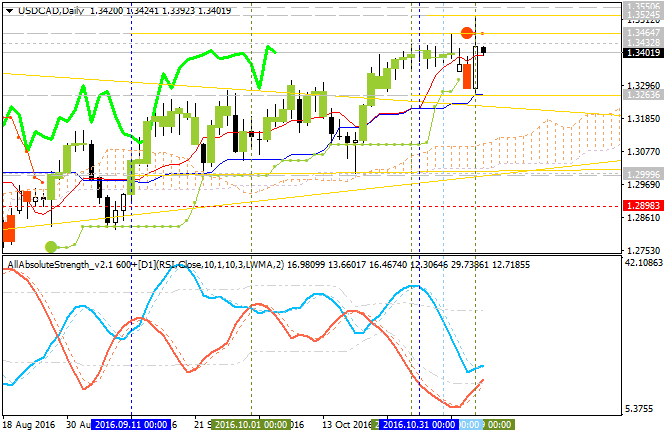

USD/CAD Technical Analysis: bullish reanging for the bullish continuation or to the correction to be started (based on the article)

The daily price is located above Ichimoku cloud in the bullish area of the chart: price is on ranging within 1.3464 resistance level for the bullish trend to be resumed and 1.3263 support level for the secondary correction to be started.

- "On Monday, Donald Trump said that voters in the U.S. would deliver “Brexit plus, plus, plus.” Now, traders are looking at that statement to understand what the implications of the statement mean, and how trade partners could be affected by President-Elect Trump’s new policies. The implications of new trade policies that are likely to be redrawn under the Trump Presidency was most clearly seen against the Mexican Peso that fell by nearly ~12% early on Wednesday as the votes were tallied to the point to declare Trump as the President-Elect."

- "Many traders have looked at yields post-Election as an indication of what is expected from Central Banks. Yields have moved higher however the spreads of sovereign debt against the U.S. 2-year, which can be seen as a proxy of the Federal Reserve’s policy rate path has widened on the day after the election. Longer on the curve, the US 10-Yr yield has an intraday move of 23 bps that would be a record intraday move, and the current open-close range would be the largest move since 2011."

If D1 price breaks 1.3263 support level on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

If D1 price breaks 1.2999 support level on close bar so we may see the reversal of the price movement from the ranging bullish to the primary bearish market condition.

If D1 price breaks 1.3464 resistance level on close bar from below to above so the primary bullish trend will be resumed with 1.3524 nearest bullish target.

If not so the price will be on bullish ranging within the levels.

- Recommendation for long: watch close D1 price to break 1.3464 for close bar for possible buy trade

- Recommendation to go short: watch D1 price to break 1.3263 support level on close daily bar for possible sell trade

- Trading Summary: ranging

| Resistance | Support |

|---|---|

| 1.3464 | 1.3263 |

| 1.3524 | 1.2999 |

SUMMARY: ranging

TREND: bullish

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Daily price is located above Ichimoku cloud in the bullish area of the chart: price is on testing 1.3433 resistance level to above for the bullish trend to be continuing.

Ascending triangle pattern was formed by the price to be crossed to above for the bullish continuation, Trend Strength indicator is estimating the trend as a primary bullish, and Absolute Strength indicator together with Chinkou Span line of Ichimoku are evaluating the trend as ranging bullish.

Anyway, Tenkan Sen line (moving average of the highest high and lowest low over the last 9 trading days. (Highest high + Lowest low) / 2 over the last 9 trading days) is already crossed with Kijun Sen line (moving average of the highest high and lowest low over the last 26 trading days. (Highest high + Lowest low) / 2 over the last 26 trading days) for the bullish trend to be continuing in the future.

If D1 price breaks 1.3277 support level on close bar so the local downtrend as the secondary correction within the primary bullish trend will be started.

If D1 price breaks 1.3005 support level on close bar so we may see the reversal of the price movement from the ranging bullish to the primary bearish market condition.

If D1 price breaks 1.3433 resistance level on close bar from below to above so the primary bullish trend will be continuing.

If not so the price will be on bullish ranging within the levels.

SUMMARY: rimary bullish market condition

TREND: bullish