Market Condition Evaluation based on standard indicators in Metatrader 5 - page 90

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.05 09:41

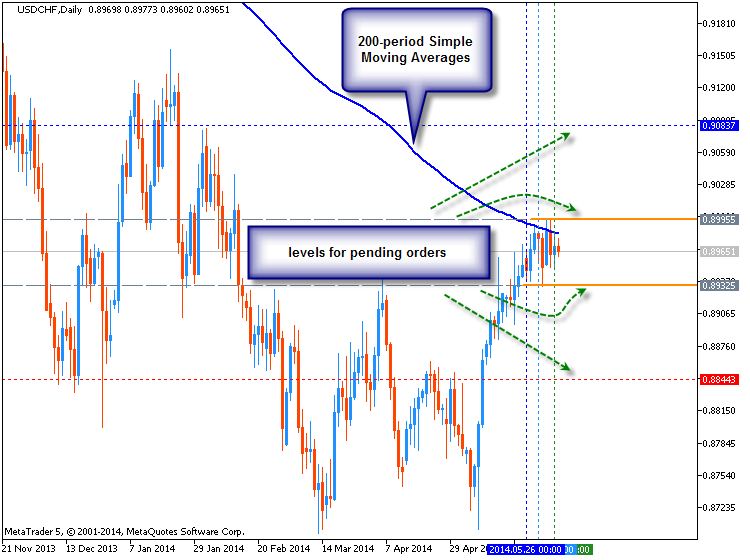

USDCHF Breakout Hindered by 200-Day Moving Average (adapted from dailyfx article)

The 200-Day Simple Moving Average

The 200-Day Simple Moving Average is one of the most popular indicators in the world. When price breaks through a 200 MA on a daily chart, it can often be seen as a topic of conversation on financial news stations, websites and newspapers.

It is primarily used to give traders and investors an overall sense of how strong or weak a currency pair is.

Typically, when a currency pair’s price falls below the 200 Day MA, it is a sign of weakness with a potential for further price decline. And when a currency pair’s price breaks above the 200 Day MA, it is a sign of strength with a potential for further price increases.

The chart above shows the recent price action surrounding the 200 Day MA. We see a large run up in price breaking through multiple resistance levels until it met this powerful MA line. We have had 6 consecutive days where price has temporarily broke through the 200 Day MA or price has come within 10 pips of the line before retreating lower. So this level is acting as strong resistance.

If price were to remain below the MA, it could propel it lower back into the pair’s price channel. However, a breakout to the upside could add yet another reason to buy the USDCHF. Until we witness a larger price move, we are in a state of limbo.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.05 13:33

2014-06-05 11:00 GMT (or 13:00 MQ MT5 time) | [GBP - Interest Rate]if actual > forecast = good for currency (for GBP in our case)

[GBP - Interest Rate] = Interest rate at which banks lend balances held at the BOE to other banks. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future.

==========

BoE Retains Key Rate At Historic Low; QE At GBP 375 Bln

As widely expected, the Bank of England on Thursday kept its interest rate at a historic-low and the size of quantitative easing at GBP 375 billion.

The Monetary Policy Committee governed by Mark Carney voted to leave the key bank rate unchanged at 0.50 percent. The rate has been at the current 0.50 percent since March 2009.

The panel also decided to maintain the asset purchase programme at GBP 375 billion. The previous change in asset purchases was in July 2012, when it was raised by GBP 50 billion.

The bank first launched quantitative easing in March 2009 with an initial value of GBP 75 billion.

In August 2013, the bank pledged not to hike the interest rate until the unemployment rate falls to 7 percent.

As the unemployment started falling faster than estimated to a level below the target, the BoE widened the scope of its forward guidance last February, and assured markets that interest rates will not be raised before the second quarter of 2015.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.06.05

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 17 pips price movement by GBP - Interest Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.10 11:34

2014-06-10 01:30 GMT (or 03:30 MQ MT5 time) | [GBP - Manufacturing Production]

if actual > forecast = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers. It's a leading indicator of economic health - production reacts quickly to ups and downs in the business cycle and is correlated with consumer conditions such as employment levels and earnings.

==========

U.K. Industrial Production Growth Improves In April

U.K. industrial production expanded at a faster pace in April, the Office for National Statistics said Tuesday.

Industrial output gained 0.4 percent in April from March, when it grew by revised 0.1 percent. The rate matched economists' expectations.

The increase in total production reflected increase of 0.4 percent in manufacturing, the fifth consecutive increase since November 2013. Manufacturing output growth also came in line with expectations.

On a yearly basis, industrial production grew 3 percent versus 2.5 percent in March. This was the eighth consecutive increase since August 2013. At the same time, manufacturing output advanced 4.4 percent.

Economists had forecast industrial output to rise 2.8 percent and manufacturing to grow 4 percent.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.06.10

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 25 pips price movement by GBP - Manufacturing Production news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.11 08:59

Trading the News: U.K. Jobless Claims Change (based on dailyfx article)

Another decline in U.K. Jobless Claims may prompt a near-term advance in the GBP/USD as it puts increased pressure on the Bank of England (BoE) to normalize monetary policy sooner rather than later.

What’s Expected:

Why Is This Event Important:

Indeed, the BoE Minutes due out on June 18 may highlight a growing dissent within the Monetary Policy Committee (MPC) as the central bank continues to see a stronger recovery in 2014, and the bullish sentiment surrounding the British Pound may gather pace in the second-half of the year should we see a growing number of BoE officials adopt a more hawkish tone for monetary policy.

The ongoing expansion in private sector consumption along with the rise in business outputs may generate a larger-than-expected decline in unemployment, and an upbeat labor report may pave the way for a higher-high in the GBP/USD as it raises the fundamental outlook for the U.K. economy.

However, sticky inflation paired with the slowdown in private lending may drag on hiring, and a dismal jobless claims report may spur a larger correction in the GBP/USD as it drags on interest rate expectations.

How To Trade This Event Risk

Bullish GBP Trade: U.K. Jobless Claims Contract 25.0K or Greater

- Need green, five-minute candle following a hawkish statement to favor a long British Pound trade

- If reaction favors buying British Pound, long GBP/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; need at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bearish GBP Trade: Labor Data Disappoints, Dragging on Rate Expectations- Need red, five-minute candle to consider a short GBP/USD trade

- Implement same setup as the bullish British Pound trade, just in the opposite direction

Potential Price Targets For The ReleaseGBP/USD Daily

Impact that the U.K Jobless Claims report has had on GBP during the last release

(1 Hour post event )

(End of Day post event)

April 2014 U.K. Jobless Claims Change

GBPUSD M5 : 41 pips price movement by GBP - Unemployment Rate news event:

U.K. Jobless Claims fell another 25.1K in April following the 30.6K contraction the month prior, while the ILO rate narrowed to an annualized 6.8% from 6.9% to mark the lowest reading since February 2009. Nevertheless, the GBP/USD traded lower as the print missed market expectations, and the British Pound weakened further throughout the day as the Bank of England Inflation report dampened bets of seeing the central bank normalize monetary policy ahead of schedule.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.06.11

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 36 pips price movement by GBP - Unemployment Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.13 07:01

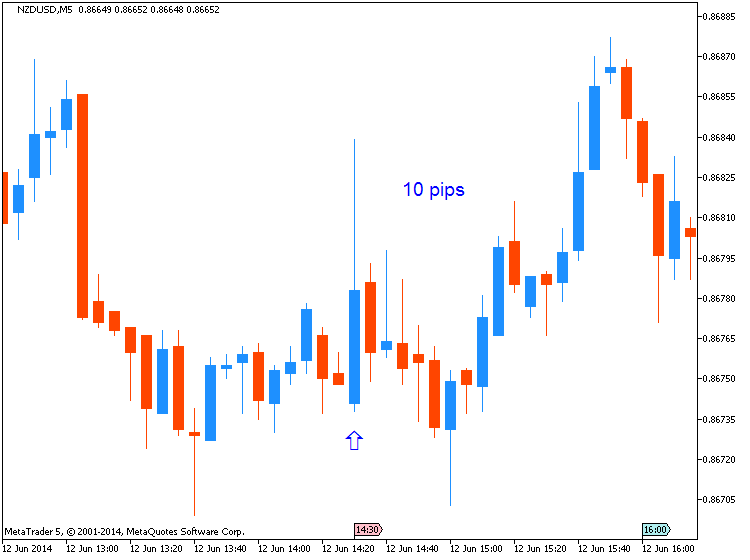

2014-06-12 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Retail Sales]

---

U.S. Retail Sales in May Grow Slower than Estimated

The US Commerce Department reported on Thursday that retail sales in May rose 0.3 percent, much lower than analysts’ estimate of 0.6 percent gain and April’s revised 0.5 percent growth.

“The continued gains during the first two months of the second quarter suggests that consumers are continuing to hold their side of the bargain, building on the strong momentum at the end of the last quarter,” Millan Mulraine, a New York-based deputy chief economist at TD Securities, told Reuters.

Separately, the Labor Department announced that initial applications for unemployment insurance rose 4,000 to 317,000 in the week through June 7. Nonetheless, recent data shows that the US labor market continues to improve steadily.

Employers in the country absorbed 217,000 new workers in May, marking the fourth straight month that the figure has stayed above 200,000. This has seen all the 8.7 million jobs that were shed in the financial recession recouped back.

Most analysts expect the economic growth in the second quarter to range from 3 percent to 4 percent, riding on the back of the resurgent services and manufacturing sectors. The economy posted a 1 percent decline in the first quarter owing to the harsh winter weather.

Another data released by the Commerce Department on Wednesday showed that business inventories grew the most in the six months through April.

The core retail sales, which are adjusted for food, gasoline, automobiles and building materials, remained unchanged in May. The figures in April were readjusted to show an increase of 0.2 percent as opposed to the earlier estimate of a 0.1 percent decline.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.17 07:44

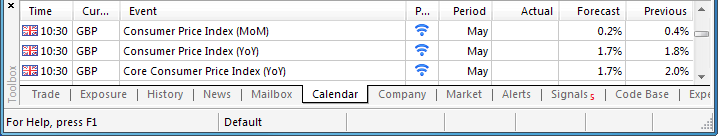

Trading the News: U.K. Consumer Price Index (based on dailyfx article)

A marked slowdown in the U.K.’s Consumer Price Index (CPI) may generate a larger pullback in the GBP/USD as it limits Bank of England (BoE) scope to normalize monetary policy sooner rather than later.

What’s Expected:

Why Is This Event Important:

Nevertheless, the BoE Minutes due out later this week may reveal a growing dissent within the Monetary Policy Committee (MPC) as U.K. officials see a stronger recovery in 2014, and the market reaction to the U.K. CPI print could be short-lived should we see a growing number of central bank officials adopt a more hawkish tone for monetary policy.

U.K. firms may offer discounted prices amid weak wage growth paired with the slowdown in private sector credit, and a weak inflation print may undermine the near-term outlook for the GBP/USD as it drags on interest rate expectations.

Nevertheless, the resilience in private sector consumption along with the ongoing improvement in the labor market may limit the downside risk for price growth, and a stronger-than-expected CPI print may heighten the bullish sentiment surrounding the sterling as it fuels bets for a rate hike.

How To Trade This Event Risk

Bearish GBP Trade: U.K. CPI Slips to 1.7% or Lower

- Need red, five-minute candle following the release to consider a short British Pound trade

- If market reaction favors selling sterling, short GBP/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish GBP Trade: Headline Reading for Inflation Exceeds Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade

- Implement same setup as the bearish British Pound trade, just in reverse

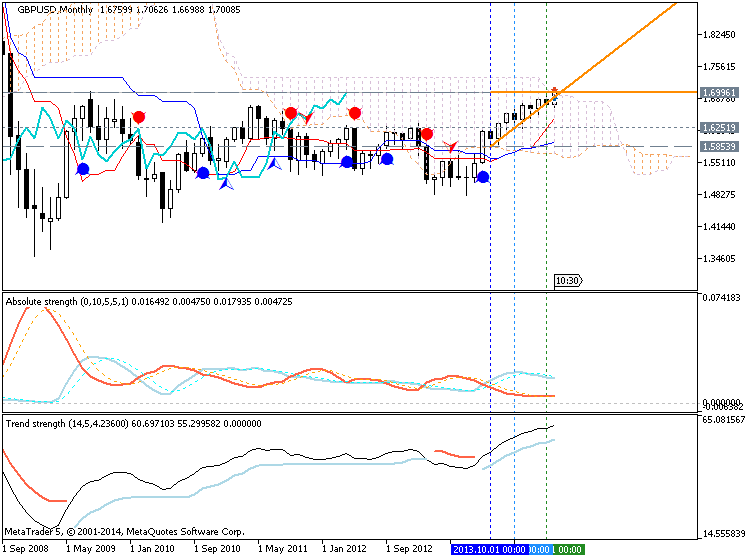

Potential Price Targets For The ReleaseGBP/USD Daily

- Carves Series of Higher-Lows in June; Higher-High in Place?

- Interim Resistance: 1.7000 Pivot to 1.7030 (100.0% expansion)

- Interim Support: 1.6720 (61.8% expansion) to 1.6730 (50.0% retracement)

Impact that the U.K. CPI report has had on GBP during the last release(1 Hour post event )

(End of Day post event)

April 2014 U.K. Consumer Price Index

GBPUSD M5 : 34 pips price movement by GBPUSD - CPI news event:

U.K. consumer prices increased an annualized 1.8% in April after expanding 1.6% the month prior, while the core rate of inflation climbed 2.0% to mark the fastest pace of growth since September. Despite the stronger-than-expected CPI print, the GBP/USD slipped below the 1.6825 region following the release, but the British Pound pared the decline during the North American trade to close at 1.6836.

MetaTrader Trading Platform Screenshots

GBPUSD, M5, 2014.06.17

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD M5 : 38 pips price movement by GBP - CPI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.21 08:08

USD/JPY nearing important break (based on dailyfx article)

- USD/JPY is in consolidation mode above the 101.55 61.8% retracement of the May/June range

- Our broader bias is negative in the rate while below 102.80

- A close under 101.55 should signal a resumption of the broader decline

- The end of the month is the next turn window of significnance for the rate

- Only strength over 102.80 will turn us positve on USD/JPY

Weekly USD/JPY Strategy: We like tactical short positions in USD/JPY while below 102.80.Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.21 08:17

End of month important for Gold (based on dailyfx article)

- XAU/USD broke above key Gann resistance at 1286 this week

- Our broader trend bias is now higher in the metal

- A resistance cluster at 1321 needd to be overcome to prompt the next push higher

- The end of the month looks to be the next turn window of importance

- A daily close under 1286 would turn us negative on Gold again

Weekly XAU/USD Strategy: Like buying on weakness against 1286.I am trying to prepare myself to make a technical analysis for the next week on the same way as I am doing it in every weekend ... so -

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.23 06:41

2014-06-23 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

if actual > forecast = good for currency (for CNY in our case)

[CNY - HSBC Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

Acro Expand : The Hongkong and Shanghai Banking Corporation (HSBC), Purchasing Managers' Index (PMI).

==========

HSBC flash manufacturing PMI tops 50 for first time this year

CHINA’S factory sector appears to be doing well, with the HSBC flash manufacturing Purchasing Managers’ Index rising to a seven-month high of 50.8 in June, from May’s 49.4.

It’s the first time the index has topped 50 — the dividing line between expansion and contraction — so far this year (although a competing, official PMI has been stronger). That suggests a combination of government spending and improving exports may be arresting the downward slide the economy has seen so far this year — though a weak housing market remains a major concern.

The reading came in well above forecasts. A survey of analysts by Bloomberg tipped a slight rise in the survey to 49.7. The flash index is published ahead of final PMI data and is usually based on 85 per cent to 90 per cent of total survey responses each month.

HSBC’s chief China economist Hongbin Qu said the improvement in the PMI was broadbased, with both domestic orders and external demand subindices in expansionary territory.

“This month’s improvement is consistent with data suggesting that the authorities’ mini-stimulus are filtering through to the real economy,” he said.

“Over the next few months, infrastructure investments and related sectors will continue to support the recovery. We expect policy makers to continue their current path of accommodative policy stance until the recovery is sustained.”

Here’s what the major economists said:

- The June HSBC flash PMI came as a big upside surprise, jumping to 50.8 from 49.4 in May (versus a market forecast of 49.7). This rebound reflects the initial impact of Beijing’s mini-stimulus programs. As Beijing is determined to deliver stable growth with a slew of mini-stimulus measures, including central bank relending (QE in China) and targeted reserve requirement ratio cuts (a total of RMB200bn), we observed a bounce-back of confidence in the economy which will help bolster demand. -- Ting Lu and Xiaojia Zhi, Bank of America Merrill Lynch

- Today’s PMI reading is the latest sign that, in some sectors at least, downwards pressure on growth has largely eased. The continued recovery of both manufacturing PMIs in recent months, despite further weakness in the property sector, suggests that the government’s targeted approach to shoring up growth is working. The rebound in infrastructure investment since the end of Q1, along with more recent measures to boost lending to small firms, appears to have eased downwards pressure on manufacturing and industrial output. -- Julian Evans-Pritchard, Capital Economics

- Domestic demand is picking up, given the government’s supportive policies. On the monetary policy side, the central bank recently lowered the reserve requirement ratio for selected banks to support small and medium-sized enterprises and rural-related sectors. This will improve small business financial conditions in the coming months as banks will have more money available to pump into the economy ... But given the difficulties from the removal of excess capacity and the downturn in the property market, the pace of recovery will be mild. -- Fan Zhang, CIMB

- Over the last few months the Chinese government has rolled out quite a lot of easing plans, but the pick-up is still quite mild. It’s too early to say the economy has bottomed out. What the government can do now is buy time to allow the impact of reforms to kick in. We are still quite worried about the property sector, but there’s a chance we could see the economy improve based on more fiscal spending. -- Xie Dongming, OCBC

- It seems the selective easing is working, with the help of exports, although I wouldn’t say so soon that everything’s well. The housing downturn could continue to deepen, so the downside risk is still there. The drag from the housing sector will remain, so we’re unlikely to see a very strong rebound like we saw in the third quarter last year. Growth will probably flatline — that’s the best scenario in my view. -- Wei Yao, Société Générale

MetaTrader Trading Platform Screenshots

AUDUSD, M5, 2014.06.23

MetaQuotes Software Corp., MetaTrader 5, Demo

AUDUSD M5 : 40 pips price movement by CNY - HSBC Manufacturing PMI news event

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.23 15:32

GBP/USD holds near 6-year highs

The GBP/USD remains near 6-year highs, having managed to close last week above the 1.7000 mark and underpinned by solid manufacturing data from China.

The greenback trades a tad softer across the board amid better sentiment after China’s HSBC PMI came in at a 7-month high of 50.8, first time above the 50 mark this year. The dollar also continues to suffer after a FOMC meeting last week, which offered little indication the Fed will hike rates anytime soon, contrasting BoE's recent comments.

The GBP/USD rose to a daily high of 1.7048 and it is currently trading at the 1.7040 zone, 0.18% above its opening price.

GBP/USD levels to watch

Immediate resistance levels for the Cable line up at 1.7062 (2014 high Jun 19), 1.7100 (psychological level) and 1.7180 (Oct 10 2008 high). On the flip side, supports are now seen at 1.7000 (psychological level), 1.6947 (10-day SMA) and 1.6920 (Jun 18 low).