Market Condition Evaluation based on standard indicators in Metatrader 5 - page 152

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.23 16:16

EUR/USD Intra-Day Fundamentals: CB Consumer Confidence and 20 pips price movement

2016-02-23 15:00 GMT | [USD - CB Consumer Confidence]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CB Consumer Confidence] = Level of a composite index based on surveyed households.

==========

"The Conference Board Consumer Confidence Index®, which had increased moderately in January, declined in February. The Index now stands at 92.2 (1985=100), down from 97.8 in January. The Present Situation Index declined from 116.6 to 112.1, while the Expectations Index decreased from 85.3 to 78.9 in February.

The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was February 11."

“Consumer confidence decreased in February, after posting a modest gain in January,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions weakened, primarily due to a less favorable assessment of business conditions. Consumers’ short-term outlook grew more pessimistic, with consumers expressing greater apprehension about business conditions, their personal financial situation, and to a lesser degree, labor market prospects. Continued turmoil in the financial markets may be rattling consumers, but their assessment of current conditions suggests the economy will continue to expand at a moderate pace in the near-term.”

==========

EURUSD M5: 20 pips price movement by CB Consumer Confidence news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.24 08:02

Trading News Events: UK Gross Domestic Product (GDP) (based on the article)The U.K.’s Gross Domestic Product (GDP) report may heighten the bearish sentiment surround British Pound and fuel the near-term decline in GBP/USD should the data encourage the Bank of England (BoE) to further delay its normalization cycle.

What’s Expected:

Why Is This Event Important:

Even though BoE officials sees a ‘solid’ recovery in the U.K. and talk down bets for additional monetary support, the downside risk surrounding the economic outlook may prompt the Monetary Policy Committee (MPC) to retain its current policy throughout 2016 as the central bank struggles to achieve the 2% target for inflation.

Nevertheless, increased demand from home and abroad may encourage a stronger-than-expected GDP print, and an unexpected upward revision in the growth rate may spur a near-term rebound in GBP/USD as the fundamental outlook for the U.K. improves.

How To Trade This Event Risk

Bearish GBP Trade: U.K. Expands Annualized 1.9% or Less

- Need red, five-minute candle following the GDP report to consider a short British Pound trade.

- If market reaction favors bearish sterling trade, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: GDP Report Beats Market Expectations- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.25 11:30

GBPUSD M5: 37 pips range price movement by UK GDP news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.24 10:39

Technical Targets for EUR/USD by United Overseas Bank (based on the article)

EUR/USD: Ranging - Daily closing below 1.0989 would shift to bearish.

"EUR edged below 1.0990 (low of 1.0987) but closed higher at 1.1015. Only a daily closing below 1.0990 would indicate further EUR weakness towards the next support at 1.0850. Overall, this pair is expected to remain under pressure unless it can reclaim 1.1130 in the next few days."

As we see from the chart above - the daily price broke 200-day SMA for the primary bearish market condition with the ranging around 100-day SMA area. If the price breaks 1.0989 key support level on close daily bar so the primary bearish trend will be continuing, otherwise - the price will be ranging within 200-SMA/100-SMA levels waiting for direction.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.25 06:43

We expect gold prices to average $980 an ounce this year and $860 in 2017 - BNP Paribas (based on the article)

Harry Tchilinguirian, global head of commodity markets strategy at BNP Paribas:

As we see from the image - the XAU/USD weekly price is located between 200 period SMA and 100 period SMA for the ranging bearish market condition.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.25 14:46

EUR/USD Intra-Day Fundamentals: Durable Goods Orders and 22 pips price movement

2016-02-25 13:30 GMT | [USD - Durable Goods Orders]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods.

==========

EURUSD M5: 22 pips price movement by Durable Goods Orders news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.26 10:11

Intra-Day Fundamentals: CNY Swift Global Payments CNY and 72 pips price movement for majors

2016-02-26 01:00 GMT | [CNY - Swift Global Payments]

==========

EURUSD M5: 19 pips price movement by Swift Global Payments CNY news event :

USDJPY M5: 33 pips price movement by Swift Global Payments CNY news event :

GBPUSD M5: 11 pips price movement by Swift Global Payments CNY news event :

USDCHF M5: 9 pips price movement by Swift Global Payments CNY news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.26 10:58

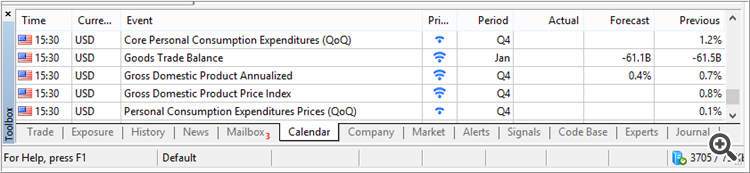

Trading News Events: USD Gross Domestic Product (based on the article)

The preliminary U.S. 4Q Gross Domestic Product (GDP) report may produce headwinds for the greenback and spark a near-term a rebound in EUR/USD should the report highlight a slowing recovery in the world’s largest economy.

What’s Expected:

Why Is This Event Important:

Even though the U.S. approaches ‘full-employment,’ a marked downward revision in the growth rate may undermine Fed expectations for a ‘consumer-led’ recovery, and the central bank may largely endorse a wait-and-see approach throughout 2016 in an effort to mitigate the downside risks surrounding the region.

Nevertheless, the pickup in private-sector consumption may generate a better-than-expected GDP print as it remains one of the leading drivers of growth, and signs of a more meaningful recovery may boost the appeal of the greenback as it puts increased pressure on the Fed to implement higher borrowing-costs over the coming months.

How To Trade This Event Risk

Bearish USD Trade: 4Q GDP Slows to Annualized 0.4% or Lower

- Need to see green, five-minute candle following the GDP report to consider a long trade on EURUSD.

- If market reaction favors a short dollar trade, buy EURUSD with two separate position.

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Growth, Inflation Top Market Expectations- Need red, five-minute candle to favor a short EURUSD trade.

- Implement same setup as the bearish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2014.01.06 18:38

What is the Pip Cost for Gold and Silver?The pip cost for 1 ounce of Gold (minimum trade size) is $0.01 per pip.

The pip cost for 50 ounces of Silver (minimum trade size) is $0.50 per pip

Monthly price is on breakdown with possible bearish reversal: the price is breaking Ichimoku cloud together with symmetric triangle pattern for the reversal of the price movement from the primary bullish to the primary bearish market condition.

The price is ranging within the following key support/resistance lines:

Chinkou Span line crossed the price to below for the good breakdown, and Absolute Strange indicator is evaluating the ranging market condition to be started in for the near future.

If monthly price will break 71.28 support level on close bar so the reversal of the price movement from the primary bullish to the primary bearish condition will be started.

If monthly price will break 83.36 resistance level on close bar from below to above so the bullish trend will be continuing

If not so the price will be on ranging within the levels.

SUMMARY : bearish breakdown

TREND : rangingForum on trading, automated trading systems and testing trading strategies

Forecast for Q1'16 - levels for EUR/USD

Sergey Golubev, 2016.02.28 11:10

EURUSD Technical Analysis 2016, 28.02 - 06.03: the secondary correction with the possible bearish reversal

Daily price is on primary bullish market condition with the secondary correction to be started in the middle of February this year: the price broke key support level for the local downtrend and stopped near Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart.

Chinkou Span line is located above the price to be ready to crossed to from above for the good possible breakdown, and Absolute Strange indicator is evaluating the price movement as the secondary correction with possible bearish reversal.

If D1 price will break 1.0777 support level on close bar so the reversal of the price movement from the primary bullish to the primary bearish market condition will be started.

If D1 price will break 1.1192 resistance level on close bar from below to above so the bullish trend will be continuing.

If not so the price will be on ranging within the levels.

SUMMARY : correction

TREND : correction to the bearish reversal