Market Condition Evaluation based on standard indicators in Metatrader 5 - page 151

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.19 11:18

GBP/USD Intra-Day Fundamentals: UK Retail Sales and 58 pips price movement

2016-02-19 09:30 GMT | [GBP - Retail Sales]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

Year-on-year estimates of the quantity bought in the retail industry showed growth for the 33rd consecutive month in January 2016, increasing by 5.2% compared with January 2015.

The underlying pattern in the data, as suggested by the 3 month on 3 month movement in the quantity bought, showed growth for the 26th consecutive month, increasing by 1.4%.

Compared with December 2015, the quantity bought in the retail industry is estimated to have increased by 2.3%.

Average store prices (including petrol stations) fell by 2.6% in January 2016 compared with January 2015, the 19th consecutive month of year-on-year price falls.

The amount spent in the retail industry increased by 2.4% in January 2016 compared with January 2015 and increased by 2.3% compared with December 2015.

The value of online sales increased by 10.4% in January 2016 compared with January 2015 and increased by 2.7% compared with December 2015

==========

GBPUSD M5: 58 pips price movement by UK Retail Sales news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.19 14:42

EUR/USD Intra-Day Fundamentals: Consumer Price Index and 21 pips price movement

2016-02-19 13:30 GMT | [USD - CPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers.

==========

"The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in January on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.4 percent before seasonal adjustment.

An increase in the index for all items less food and energy offset a decline in the energy index to lead to the seasonally adjusted all items index being unchanged. The energy index fell 2.8 percent as all of its major component indexes declined. The index for all items less food and energy rose 0.3 percent in January. The increase was broad-based, with most of the major components rising, but increases in the indexes for shelter and medical care were the largest contributors."

==========

EURUSD M5: 21 pips price movement by Consumer Price Index news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.20 09:30

Week Ahead: High Volatility, limited GBP downside risk from the current levels - Crédit Agricole (based on the article)

What to watch:

USD - "Next week’s PCE data will be key. Only a considerably weaker than expected outcome may lower rate expectations further."

GBP - "Growth data should become a more important currency driver anew. Hence next week’s GDP data will be closely watched. We see limited GBP downside risk from the current levels."

JPY - "It remains to be seen if weaker inflation data will drive the JPY lower. This is due to increased uncertainty about the BoJ’s policy stance being efficient in bringing inflation back to target."Next Week Forecast: the most interesting pair you can make money with - CAD/JPY

CAD/JPY H4: bullish reversal. This pair is on ranging market condition located to be inside Ichimoku cloud within 82.55 resistance and 81.35 support levels waiting for direction. There are 3 simple scenarios for the price movement for the week:

Chinkou Span line is located below the price and directed us to the possible bearish reversal.

There are the following news events which will be affected on CAD/JPY price movement for the coming week:

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q1'16 - levels for EUR/USD

Sergey Golubev, 2016.02.21 16:09

Forecast for Tomorrow - levels for EUR/USD

EUR/USD: ranging within key primary levels for trend following direction. This pair for intra-day price is located above 200 period SMA and near 100 period SMA on the border between the primary bullish and ranging bullish market condition. The price is ranging within key reversal support/resistance levels, and descending triangle pattern was formed to be crossed for the possiuble intra-day bearish trend to be started.

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q1'16 - levels for USD/JPY

Sergey Golubev, 2016.02.22 10:22

Forecast for USD/JPY

USD/JPY: ranging bearish. The price for the pair is located below 100 period SMA and below 200 period SMA for the primary bearish market condition with the secondary ranging within key support/resistance levels.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.22 20:11

EUR/USD Intra-Day Fundamentals: ECB Sabine Lautenschläger Speech and 19 pips price movement

2016-02-22 18:00 GMT | [EUR - ECB Sabine Lautenschläger Speech]

[EUR - ECB Sabine Lautenschläger Speech] = Sabine Lautenschläger is a member of the European Central Bank's Executive Board since January 2014.

==========

"Rede von Sabine Lautenschläger, Mitglied des Direktoriums der EZB und stellvertretende Vorsitzende des Aufsichtsgremiums des einheitlichen Aufsichtsmechanismus, Bankenabend der Hauptverwaltung in Baden-Württemberg der Deutschen Bundesbank, Stuttgart, 22. Februar 2016."

==========

EURUSD M5: 19 pips price movement by ECB Sabine Lautenschläger Speech news event :

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q1'16 - levels for EUR/USD

Sergey Golubev, 2016.02.23 07:37

EUR/USD Intra-Day Technical Analysis - ranging within key reversal levels

M5 price is located above 200 period SMA (200 SMA) and near 100 period SMA (100 SMA) for the primary bullish market condition with the secondary ranging. The price is rabnging within the following key reversal support/resistance levels: 1.1049 bullish reversal resistance and 1.1020 bearish reversal support levels.

SUMMARY : ranging

TREND : bullishForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.23 10:35

EUR/USD Intra-Day Fundamentals: German Ifo Business Climate and 38 pips price movement

2016-02-23 09:00 GMT | [EUR - German Ifo Business Climate]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German Ifo Business Climate] = Level of a composite index based on surveyed manufacturers, builders, wholesalers, and retailers.

==========

"Sentiment among German businesses continued to weaken in February. The Ifo Business Climate Index for German industry and trade fell to 105.7 points this month from 107.3 points in January, marking its third consecutive decrease. The majority of companies were pessimistic about their business outlook for the first time in over six months. Assessments of the current business situation, by contrast, were slightly better than last month. German businesses expressed growing concern, especially in manufacturing."

==========

EURUSD M5: 38 pips price movement by German Ifo Business Climate news event :

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q1'16 - levels for GBP/USD

Sergey Golubev, 2016.02.23 13:30

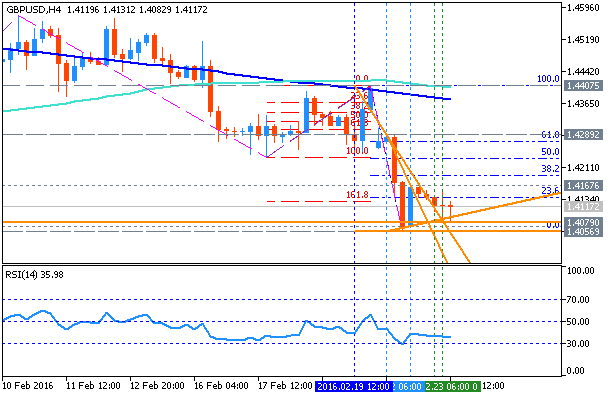

Technical Targets for GBP/USD - United Overseas Bank (adapted from the article)

GBP/USD: Bearish: Take profit at 1.3930.

"While we have been bearish GBP since last Wednesday, the pace of the down-move took us by surprise. The major support at 1.4080 was easily breached with a low of 1.4057. The outlook is still clearly bearish and the next support below 1.4055/60 is near 1.3930."

Daily price

UOB is considering the bearish market condition for GBPUSD with the key support level at 1.4080 (1.4079 in case of Metatrader 5). If the price breaks this 1.4080 support so the next bearish target will be 1.3930:

Descending triangle pattern was formed by the price to be broken for the bearish trend to be continuing, and RSI indicator is estimating the ranging bearish condition in the near future.

The most likely scenario for the daily price of this pair is bearish breakdown.

Intra-day price (H4)

This is very similar situation for H4 timerframe: possible bearish breakdown in case the price breaks 1.4080 support level to below with 1.4056 as the next nearest bearish target to re-enter.