Market Condition Evaluation based on standard indicators in Metatrader 5 - page 150

You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.16 08:09

Technical Intra-day Targets for EUR/USD by United Overseas Bank (based on the article)EUR/USD. Correction.

"The current down-move from the high is likely part of a corrective pull-back which could extend lower to 1.1060. The major support is nearer to 1.0990 and a move below this level is not expected for now. Overall, this pair is expected to remain under pressure in the coming days unless it can reclaim the 1.1375 peak."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.16 12:09

EUR/USD Intra-Day Fundamentals: German ZEW Economic Sentiment and 15 pips price movement

2016-02-16 10:00 GMT | [EUR - German ZEW Economic Sentiment]

if actual > forecast (or previous one) = good for currency (for EUR in our case)

[EUR - German ZEW Economic Sentiment] = Level of a diffusion index based on surveyed German institutional investors and analysts.

==========

"The ZEW Indicator of Economic Sentiment for Germany has declined for the second consecutive time in February 2016. The index has decreased by 9.2 points compared to the previous month, now standing at 1.0 points (long-term average: 24.6 points)."

==========

EURUSD M5: 15 pips price movement by German ZEW Economic Sentiment news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.16 14:44

EUR/USD Intra-Day Fundamentals: New York Manufacturing Index and 13 pips price movement

2016-02-16 13:30 GMT | [USD - Empire Manufacturing]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Empire Manufacturing] = Level of a diffusion index based on surveyed manufacturers in New York state.

==========

"The February 2016 Empire State Manufacturing Survey indicates that business activity continued to decline for New York manufacturers. The headline general business conditions index edged up three points, but remained firmly in negative territory at -16.6. The new orders and shipments indexes indicated an ongoing decline in both orders and shipments. Price indexes suggested a slight increase in input prices and a small drop in selling prices. Employment levels steadied, while the average workweek index pointed to a decrease in hours worked. The six-month outlook remained weak, with the index for future general business conditions up only slightly from last month’s multi-year low."

==========

EURUSD M5: 13 pips price movement by Empire State Manufacturing Index news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.17 08:05

Trading the News: Claimant Count Change (based on the article)Despite forecasts for another 3.0K decline in U.K. Jobless Claims, a further slowdown in Average Weekly Earnings may weigh on the sterling and spark a bearish reaction in GBP/USD as it provides the Bank of England (BoE) with greater scope to retain its current policy throughout 2016.

What’s Expected:

Why Is This Event Important:

Following the unanimous vote to retain the current policy, signs of slower wage growth may encourage the BoE to endorse a wait-and-see approach at the next meeting on March 17 as Governor Mark Carney & Co. reduce their economic projections and turn increasing cautious towards the U.K. economy.

Nevertheless, improved confidence paired with the ongoing expansion in private-sector lending may generate a stronger-than-expected job/wage report, and a positive development may foster a near-term rebound in GBP/USD as it puts increase pressure on the BoE to remove the record-low interest rate in 2016.

How To Trade This Event Risk

Bearish GBP Trade: Jobless Claims, Average Hourly Earnings Disappoint

- Need red, five-minute candle following the print to consider a short GBP/USD trade.

- If market reaction favors selling sterling, short GBP/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit, set reasonable limit.

Bullish GBP Trade: U.K. Job/Wage Growth Exceed Market Forecast- Need green, five-minute candle to favor a long GBP/USD trade.

- Implement same setup as the bearish British Pound trade, just in reverse.

Potential Price Targets For The ReleaseGBPUSD Daily

GBPUSD M5: 32 pips price movement by Claimant Count Change news event :

Forum on trading, automated trading systems and testing trading strategies

Forecast for Q1'16 - levels for EUR/USD

Sergey Golubev, 2016.02.17 13:57

EURUSD Intra-Day Technical Analysis - ranging for direction

H4 price is on ranging market condition located inside Ichimoku cloud waiting for direction.

If H4 price will break 1.1086 support level on close H4 bar so the primary bearish will be continuing without secondary ranging.

If H4 price will break 1.1247 resistance level so we may see the reversal to the primary bullish market condition.

If not so the price will be ranging within the levels.

SUMMARY : ranging

TREND : waiting for direction of the trendForum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.17 14:43

EUR/USD Intra-Day Fundamentals: US Producer Price Index and 14 pips price movement

2016-02-17 13:30 GMT | [USD - Core PPI]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Core PPI] = Change in the price of finished goods and services sold by producers, excluding food and energy.

==========

"The Producer Price Index for final demand advanced 0.1 percent in January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices decreased 0.2 percent in December and advanced 0.4 percent in November. On an unadjusted basis, the final demand index declined 0.2 percent for the 12 months ended in January."

"The increase in the final demand index for January can be traced to a 0.5-percent advance in prices for final demand services. In contrast, the index for final demand goods moved down 0.7 percent."

"In January, the index for final demand less foods, energy, and trade services advanced 0.2 percent for the second consecutive month. For the 12 months ended in January, prices for final demand less foods, energy, and trade services climbed 0.8 percent."

==========

EURUSD M5: 14 pips price movement by Producer Price Index news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.18 06:58

EUR/USD Intra-Day Fundamentals: China CPI and 13 pips price movement

2016-02-18 01:30 GMT | [CNY - CPI]

if actual > forecast (or previous one) = good for currency (for CNY in our case)

[CNY - CPI] = Change in the price of goods and services purchased by consumers.

==========

"In January of 2016, the consumer price index (CPI) went up by 1.8 percent year-on-year. Producer Price Index (PPI) for manufactured goods decreased 5.3 percent year-on-year, and decreased 0.5 percent month-on-month."

==========

EURUSD M5: 13 pips price movement by China CPI news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.18 07:40

AUD/USD Intra-Day Fundamentals: Australian Jobless Rate and 41 pips price movement

2016-02-18 00:30 GMT | [AUD - Unemployment Rate]

if actual < forecast (or previous one) = good for currency (for AUD in our case)

[AUD - Unemployment Rate] = Percentage of the total work force that is unemployed and actively seeking employment during the previous month.

==========

==========

AUDUSD M5: 41 pips price movement by Australian Jobless Rate news event :

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.19 08:56

Gold Rallies On More Bargain Hunting, Technical Buying (based on the article)

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.02.19 09:29

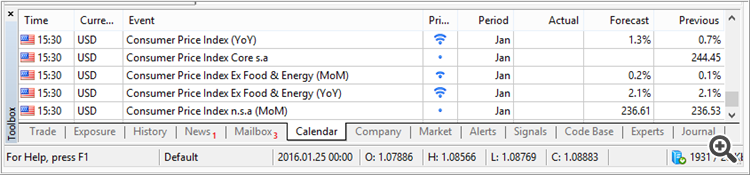

Trading News Events: U.S. Consumer Price Index (based on the article)

A marked pickup in the U.S. Consumer Price Index (CPI) may heighten the appeal of the dollar and spark a further decline in EUR/USD as it puts increased pressure on the Federal Open Market Committee (FOMC) to implement higher borrowing-costs in 2016.

What’s Expected:

Why Is This Event Important:

Signs of stronger price growth may encourage the Fed to further normalize monetary policy over the coming months especially as the U.S. economy approaches ‘full-employment,’ while Chair Janet remains confident in achieving the 2% inflation target over the policy horizon.

Nevertheless, waning confidence paired with the slowdown in private-sector activity may drag on price growth, and a dismal development may produce near-term headwinds for the greenback as market participants push out bets for the next Fed rate-hike.

How To Trade This Event Risk

Bullish USD Trade: CPI Climbs to 1.3% or Higher, Core Inflation Remains Sticky

- Need to see red, five-minute candle following the release to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bullish USD Trade: Inflation Report Fails to Meet Market Expectations- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The ReleaseEURUSD Daily